Is P&G Set for Growth in 2025 After Strong Earnings Beat Expectations?

Approach 1: Procter & Gamble Cash Flows

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting future free cash flows and bringing them back to today’s value. The idea is simple: what will the business make in the future, and what is all that worth in today’s dollars?

For Procter & Gamble, the latest twelve-month Free Cash Flow stands at $14.4 billion. Looking ahead, analysts expect steady growth, with Free Cash Flow projected to reach approximately $21.7 billion by 2035. All these future cash flows are run through a two-stage Free Cash Flow to Equity model, which helps account for both near-term growth and a longer-term, stable outlook.

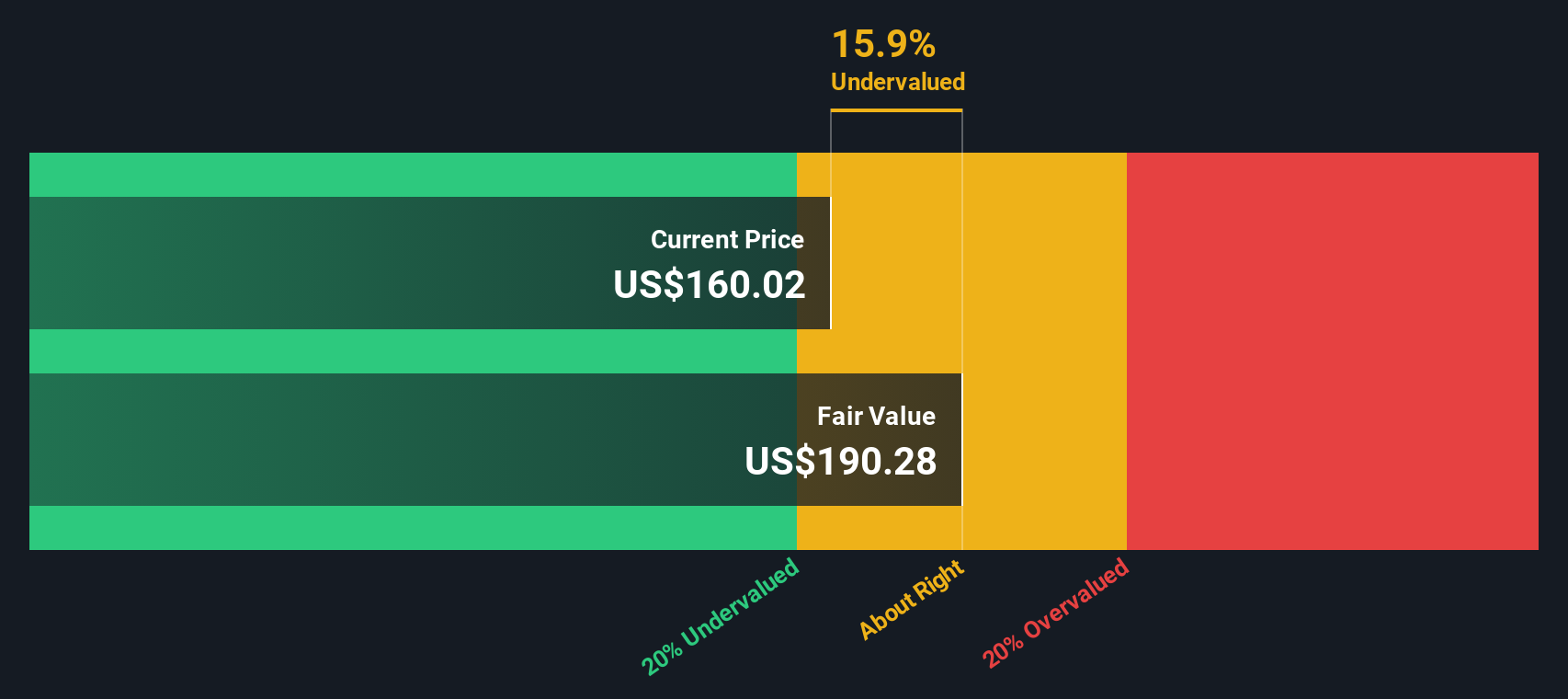

According to this DCF approach, the intrinsic value of the stock comes out to $190.12 per share. Comparing this number to the current stock price, the calculation shows that Procter & Gamble is trading at a 16.7% discount. In other words, it is 16.7% undervalued according to this model.

Result: UNDERVALUED

Approach 2: Procter & Gamble Price vs Earnings

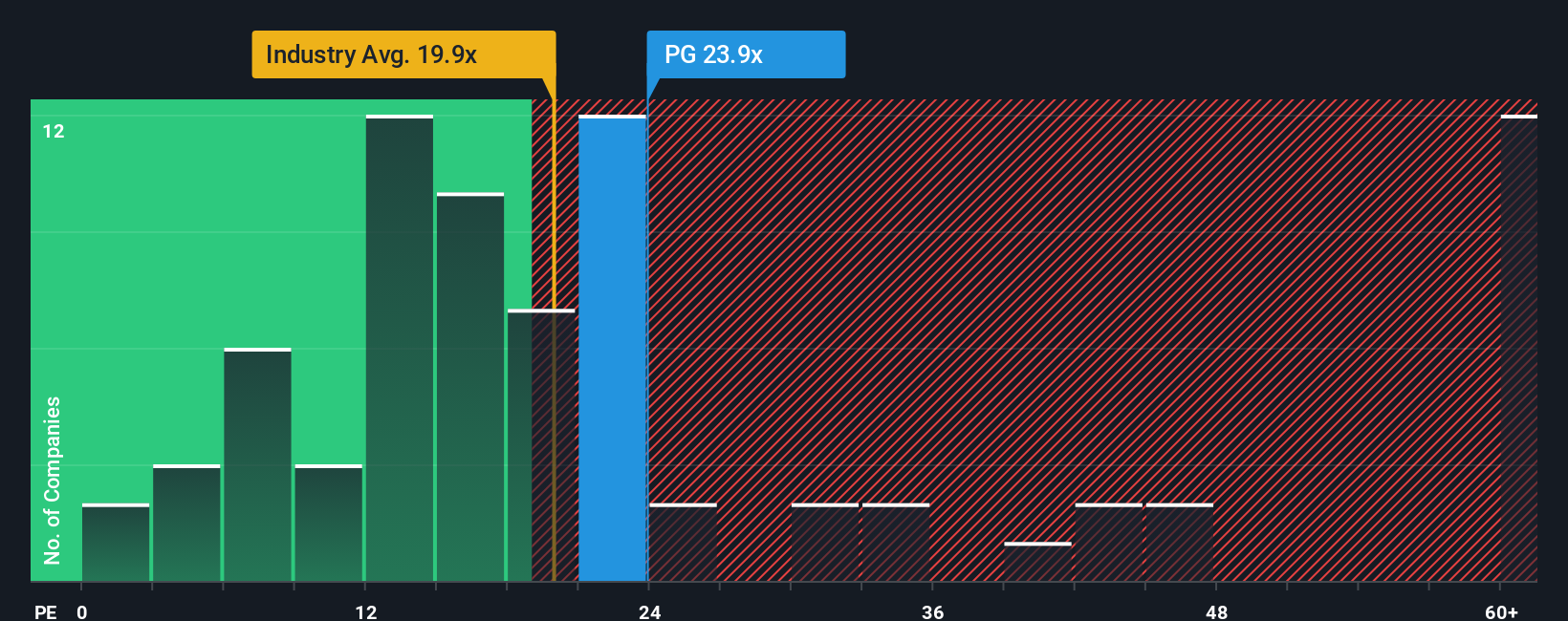

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics for established, profitable companies like Procter & Gamble. It helps investors gauge how much they are paying for each dollar of current earnings. This is especially relevant for businesses with consistent profit streams.

The "right" PE ratio is not set in stone. It typically reflects what the market expects for a company’s future growth and the risks associated with its business. Higher expected earnings growth or lower risk often justify higher PE ratios. In contrast, slow-growing or riskier firms are usually valued at lower multiples.

Currently, Procter & Gamble is trading at a PE of 23.7x. For context, this is below its peer group average of 25.9x but above the Household Products industry average of 18.1x. To help interpret these comparisons, Simply Wall St calculates a proprietary Fair Ratio that considers growth, margins, and risks specific to Procter & Gamble. The Fair Ratio is 29.1x, which suggests that the current market price is actually a little below what would be expected given the company’s fundamentals.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Procter & Gamble Narrative

Narratives are a simple but powerful tool: they are your way of adding a story, your own point of view and expectations, to the numbers behind any investment decision. Instead of just looking at past performance or generic forecasts, a Narrative directly connects Procter & Gamble’s business story—such as its outlook on growth, margins, or innovation—to a forward-looking forecast for revenue, earnings, and ultimately a fair value.

With Simply Wall St’s platform and community, millions of investors use Narratives to make sense of the numbers, easily adjust key assumptions, and see in real time whether the stock looks undervalued or overvalued compared to its current price. Narratives help answer the big decision: is now the time to buy, sell, or wait, based on your own beliefs and what the market is expecting?

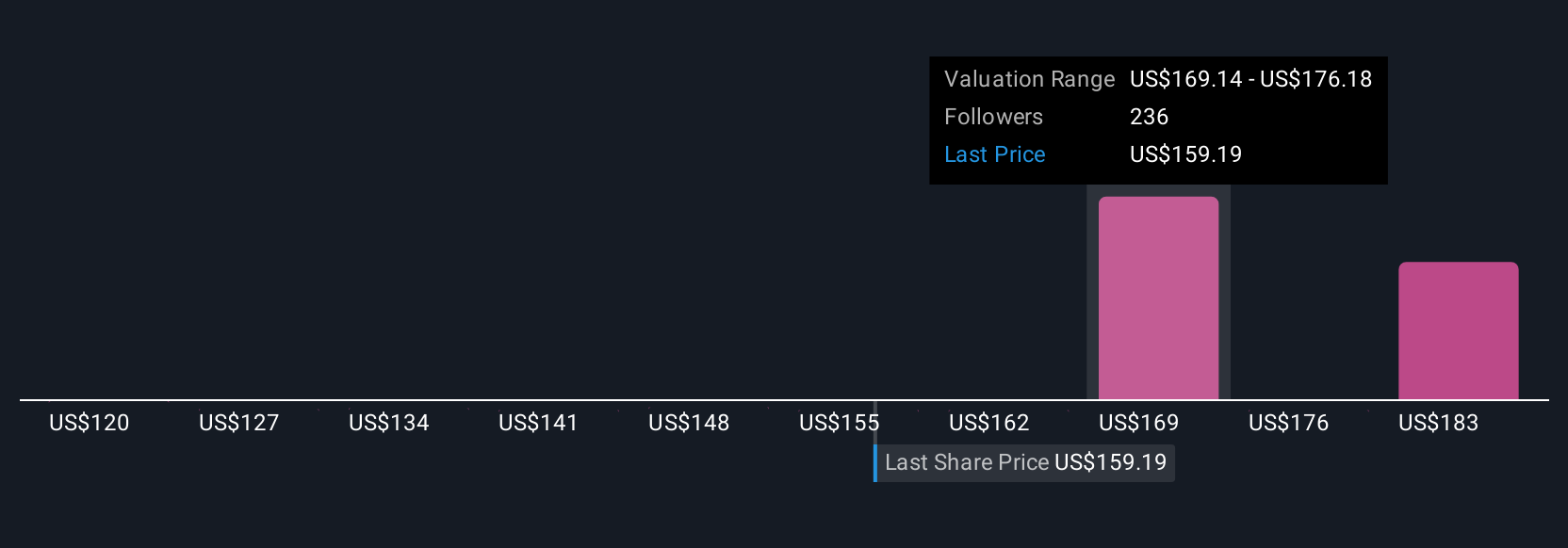

What makes Narratives especially useful is how they update dynamically when new information, such as fresh earnings reports or important news, arrives. Your estimates and fair value always reflect the latest facts. For example, one investor’s Narrative might see Procter & Gamble’s fair value near $119 based on mature growth and margin pressures. Another, focused on innovation and expanding product lines, might arrive at $170.

For Procter & Gamble, we’ll make it really easy for you with previews of two leading Procter & Gamble narratives: 🐂 Procter & Gamble Bull Case- Fair Value Estimate: $170.64

- Currently trading at 7.1% below fair value

- Revenue Growth Rate: 3.34%

- Innovation and investment in new products could fuel market share and revenue growth as consumer confidence rebounds.

- Productivity improvements and cost controls are expected to expand net margins even in a challenging economic environment.

- Analyst consensus price target is only modestly above the current share price, suggesting P&G is fairly valued unless the outlook improves further.

- Fair Value Estimate: $119.81

- Currently trading at 32.2% above fair value

- Revenue Growth Rate: 4.68%

- P&G’s growth is projected to be modest, in line with inflation and mature industry norms, which could result in limited long-term upside.

- Dividend strength remains a highlight, but slowing revenues and margin compression suggest future payouts may outpace growth.

- Blending multiple valuation models points to current prices being somewhat high, with only a premium justified by high quality and stability, not by accelerating growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal