Boralex (TSX:BLX) Valuation Spotlight: Executive Shakeup and Earnings Raise Fresh Questions for Investors

Boralex (TSX:BLX) has been in the spotlight this week with a double headline: the company is seeing a significant shakeup in its leadership and has just released its latest quarterly results. Investors learned that CFO Bruno Guilmette will be exiting, there is a new Chair of the Board stepping in, and the latest earnings report brought a mix of stronger revenue but a swing to a net loss. For shareholders, these changes introduce new questions about stability, continuity, and how the next phase of Boralex’s 2030 Strategy will unfold.

Looking at the stock, it has been a choppy ride. Over the past year, Boralex shares have dropped about 7%, erasing much of the gains from this spring, even though year-to-date the stock is up 5%. In the short term, the market’s reaction to management changes and an underwhelming quarterly profit print suggests some caution is emerging. However, the annual revenue growth of 11% still points to underlying operational momentum. As Boralex moves through executive transitions and updates its strategy, the market appears to be weighing new risks against growth potential.

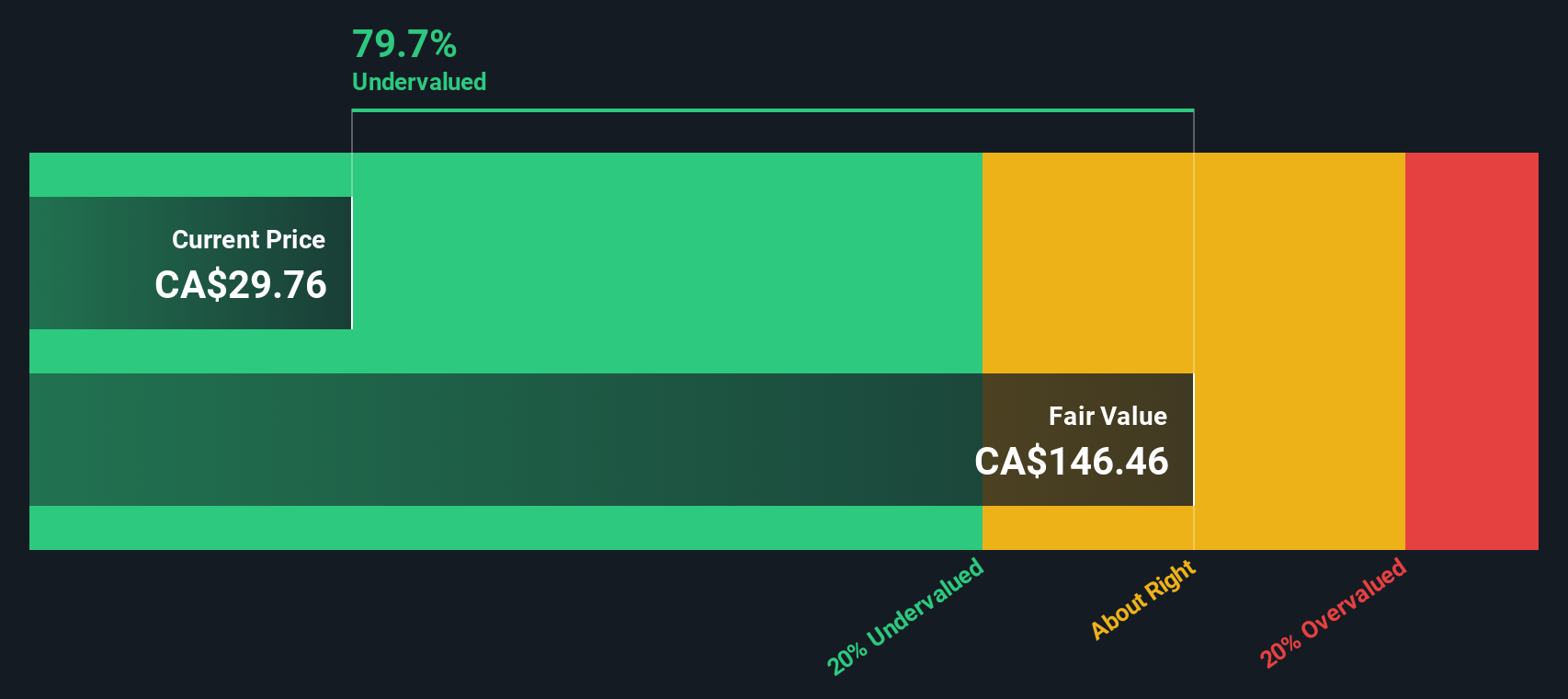

After these recent swings and significant changes at the top, is the current share price a bargain for investors with patience, or is the market looking ahead and fully reflecting everything Boralex has to offer?

Most Popular Narrative: 20% Undervalued

According to the community narrative, Boralex shares are currently trading below their fair value. This presents a potential opportunity for investors who are focused on upside from forecasted improvements in earnings and margins.

Advances in storage and hybrid projects (for example, ongoing battery storage developments in Ontario and the UK) will enable Boralex to better capitalize on grid modernization and flexible power needs. This could improve average realized prices and strengthen long-term net margins.

Is Boralex about to outgrow the pack? The analyst valuation narrative is grounded on bold financial assumptions. Analysts are considering the potential for transformative profit margins and accelerating revenue. These figures could reset how the market values this clean energy contender. Curious about which forward-looking projections are driving this target? Their underlying calculations might surprise you.

Result: Fair Value of $38.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, declining contract prices in France and rising debt levels could present challenges to Boralex’s growth story and put future margins under pressure if conditions worsen.

Find out about the key risks to this Boralex narrative.Another View: Our DCF Model’s Verdict

Looking at Boralex through the SWS DCF model offers a different perspective. This approach assesses the company’s future cash flows, and on this measure, Boralex looks notably undervalued. Could this method be missing something that the multiples reveal, or is it the other way around?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Boralex Narrative

If you want to dig deeper or you have your own ideas, you can explore the data and develop a unique investment angle of your own in just minutes. do it your way.

A great starting point for your Boralex research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Don’t just stop at Boralex. Some of the most promising stocks right now are hiding in plain sight. If you want to build a future-focused portfolio or find companies bucking the trends, use these powerful tools so you never risk missing a great opportunity:

- Capture market-beating yields by checking out companies offering dividend stocks with yields > 3% that deliver stable income even in volatile markets.

- Tap into healthcare’s transformation by spotting innovative healthcare AI stocks at the forefront of medical technology and intelligent diagnostics.

- Zero in on high potential opportunities by searching for stocks that are truly undervalued stocks based on cash flows according to cash flow analysis, helping you invest confidently in proven value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal