Statutory Earnings May Not Be The Best Way To Understand Vasta Platform's (NASDAQ:VSTA) True Position

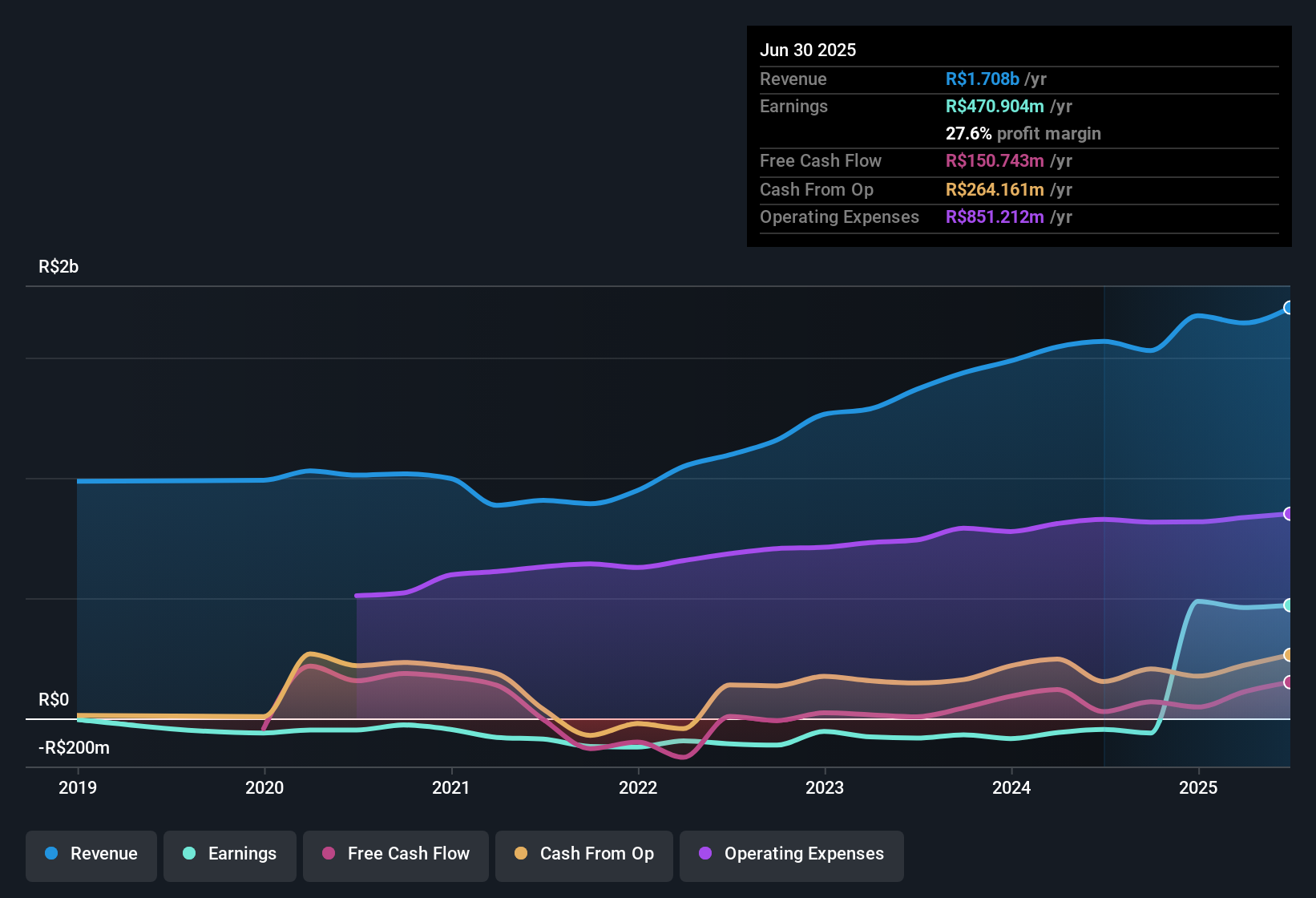

Even though Vasta Platform Limited (NASDAQ:VSTA) posted strong earnings recently, the stock hasn't reacted in a large way. We think that investors might be worried about the foundations the earnings are built on.

The Impact Of Unusual Items On Profit

For anyone who wants to understand Vasta Platform's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from R$97m worth of unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. Vasta Platform had a rather significant contribution from unusual items relative to its profit to June 2025. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

An Unusual Tax Situation

Having already discussed the impact of the unusual items, we should also note that Vasta Platform received a tax benefit of R$182m. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! Of course, prima facie it's great to receive a tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Vasta Platform's Profit Performance

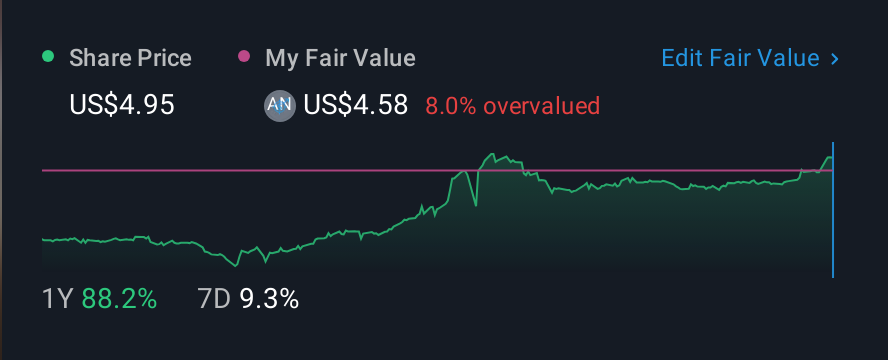

In the last year Vasta Platform received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. And on top of that, it also saw an unusual item boost its profit, suggesting that next year might see a lower profit number, if these events are not repeated. For all the reasons mentioned above, we think that, at a glance, Vasta Platform's statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. So while earnings quality is important, it's equally important to consider the risks facing Vasta Platform at this point in time. Be aware that Vasta Platform is showing 2 warning signs in our investment analysis and 1 of those is a bit unpleasant...

Our examination of Vasta Platform has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal