Is Cal-Maine Foods' (CALM) Strategic Leadership Refresh a Sign of an Evolving Growth Narrative?

- Cal-Maine Foods recently announced the appointment of Melanie Boulden to its Board of Directors and Keira Lombardo as its first Chief Strategy Officer, both effective August 11, 2025.

- The addition of Boulden and Lombardo brings decades of leadership expertise from major food and beverage companies, expanding the company's governance and focus on long-term growth strategies.

- We'll explore how Lombardo's arrival as Chief Strategy Officer could shape Cal-Maine Foods' strategic priorities and overall investment narrative.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Cal-Maine Foods' Investment Narrative?

To believe in Cal-Maine Foods as a shareholder right now means seeing value in its leadership changes and large-scale operational efforts, even as the business faces a period of expected earnings and revenue decline. The arrival of Keira Lombardo as Chief Strategy Officer, along with Melanie Boulden joining the Board, positions the company to refresh strategic priorities and governance just as lingering risks, like production disruptions and index removals, continue to impact sentiment. Although these appointments bring impressive food industry experience, it's unlikely they will deliver an immediate boost to critical short-term catalysts such as dividend stability, buyback effects, or recovery from recent facility challenges. The market’s muted reaction so far suggests these leadership changes are being viewed as longer-term plays rather than game-changers for the next few quarters. Investors will want to keep a close eye on whether future moves from this new team shift the company’s risk profile meaningfully.

However, instability in the dividend track record is something investors should not overlook.

Exploring Other Perspectives

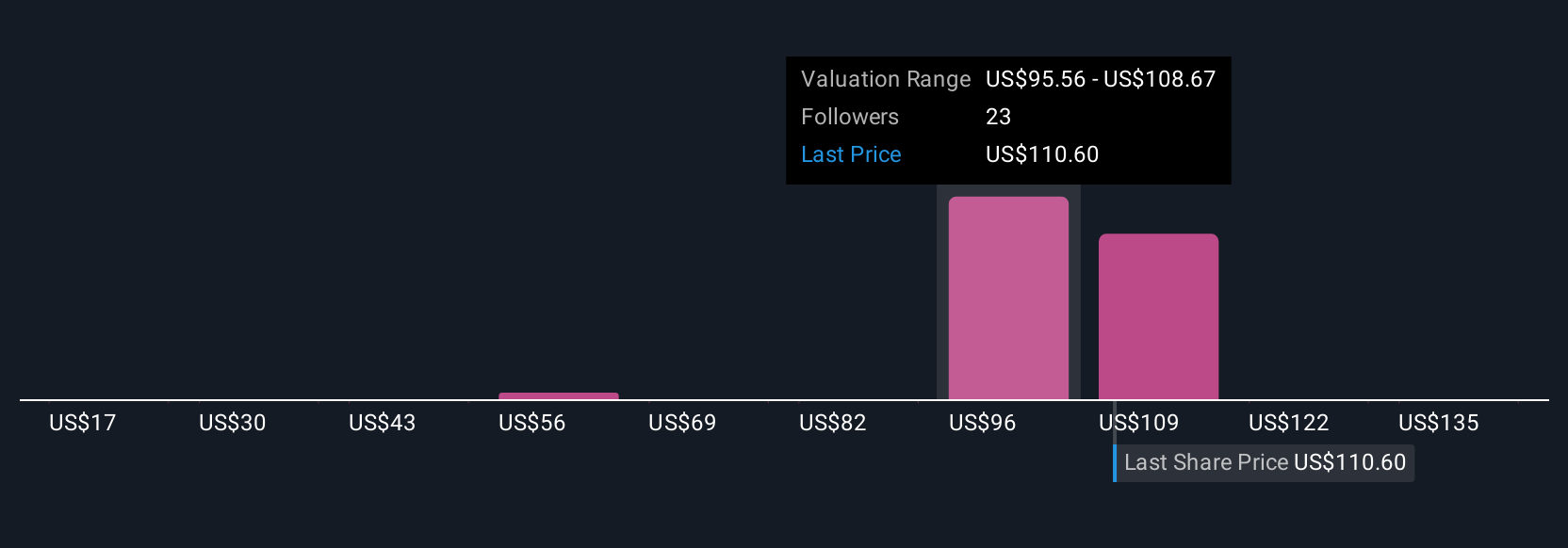

Explore 13 other fair value estimates on Cal-Maine Foods - why the stock might be worth as much as 34% more than the current price!

Build Your Own Cal-Maine Foods Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cal-Maine Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cal-Maine Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cal-Maine Foods' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal