Could STARLUX Partnership Shift American Airlines (AAL) Strategy in Transpacific Expansion?

- Earlier this month, STARLUX Airlines announced a new partnership with American Airlines, enabling single-ticket booking and expanded network connectivity between North America and Taipei, coinciding with the launch of STARLUX’s nonstop Phoenix-Taipei service operated by Airbus A350 aircraft.

- This milestone collaboration broadens American Airlines' transpacific connections and offers travelers more convenient access to major U.S. cities, reflecting a growing focus on seamless international travel partnerships.

- We'll explore how this expanded international partnership could influence American Airlines Group's investment outlook and future competitive positioning.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

American Airlines Group Investment Narrative Recap

To be a shareholder in American Airlines Group today, you need to believe in the company’s ability to improve profitability amid competitive pressures and significant cost headwinds, particularly as it grows its international and premium route network. While the new STARLUX partnership broadens American’s transpacific reach and strengthens its global alliances, this expansion does not materially alter the main short-term catalyst, domestic market recovery, or the biggest risk: high labor and debt costs weighing on margins and flexibility.

Among recent announcements, the launch of a direct route from Quebec City to Dallas-Fort Worth stands out as strengthening American’s network, although its impact is secondary compared to developments in the international market. These network additions may incrementally support American’s strategy of recapturing pricing power, yet margin pressure from higher operating expenses remains an underlying concern.

However, even as American broadens access for travelers, investors should also keep in mind...

Read the full narrative on American Airlines Group (it's free!)

American Airlines Group is projected to reach $61.7 billion in revenue and $1.8 billion in earnings by 2028. This outlook assumes a 4.4% annual revenue growth rate and an earnings increase of $1.2 billion from current earnings of $567.0 million.

Uncover how American Airlines Group's forecasts yield a $13.31 fair value, in line with its current price.

Exploring Other Perspectives

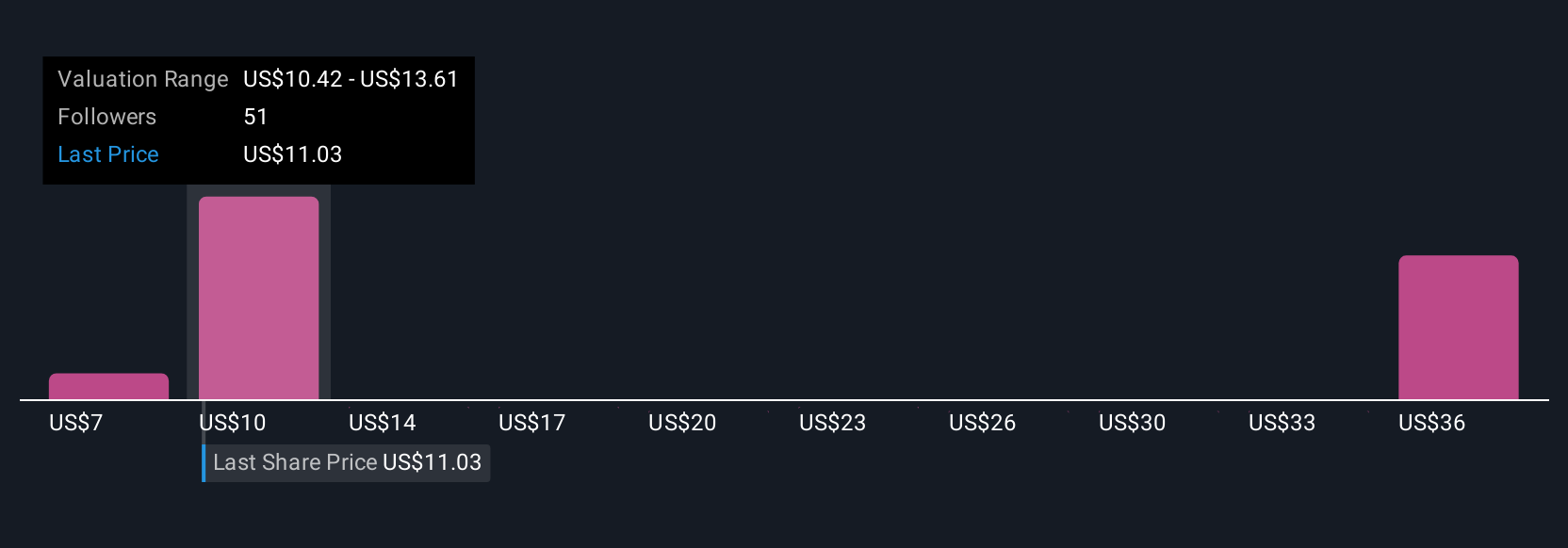

The Simply Wall St Community’s fair value estimates for American Airlines Group range from US$7.23 to US$35.36, across 12 unique perspectives. As optimism about international connectivity rises, the persistent challenge of elevated labor and debt costs might temper long-term profitability, highlighting the importance of reviewing these varied viewpoints for a fuller understanding.

Explore 12 other fair value estimates on American Airlines Group - why the stock might be worth 45% less than the current price!

Build Your Own American Airlines Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free American Airlines Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Airlines Group's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal