Will Southwest (LUV) Route Expansion and Rewards Shift Boost Its Edge in Domestic Travel?

- Southwest Airlines recently announced the addition of new routes from Knoxville and San Diego, set to begin in March 2026, as well as enhancements to its Rapid Rewards program through co-branded credit card offers with Chase.

- This expansion not only broadens Southwest’s regional footprint but also directly targets customer loyalty and travel demand in both leisure and business markets.

- We’ll explore how the Knoxville and San Diego route expansions could influence Southwest Airlines’ growth outlook and competitive positioning in the U.S. airline industry.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

Southwest Airlines Investment Narrative Recap

To be a Southwest Airlines shareholder, you need to believe in the company’s ability to maintain resilient passenger demand and strengthen loyalty despite industry challenges. The recently announced Knoxville and San Diego route expansions could support this outlook by widening the customer base, but do not materially change the key short-term catalyst of implementing new pricing options, or the primary risk from ongoing macroeconomic pressures impacting travel demand.

Of all recent announcements, the rollout of assigned seating, now available for flights to St. Thomas, best aligns with the company’s efforts to diversify revenue streams and address the short-term catalyst of driving higher yields per passenger. Assigned seating may also impact customer satisfaction, as Southwest balances operational changes with its well-known service model.

However, investors should also be aware that in contrast, Southwest’s ongoing exposure to softened booking trends and macroeconomic uncertainty could weigh heavily on future results, especially if...

Read the full narrative on Southwest Airlines (it's free!)

Southwest Airlines' outlook anticipates $32.6 billion in revenue and $1.9 billion in earnings by 2028. This projection is based on a 5.9% annual revenue growth rate and a $1.51 billion increase in earnings from the current $392.0 million.

Uncover how Southwest Airlines' forecasts yield a $31.86 fair value, in line with its current price.

Exploring Other Perspectives

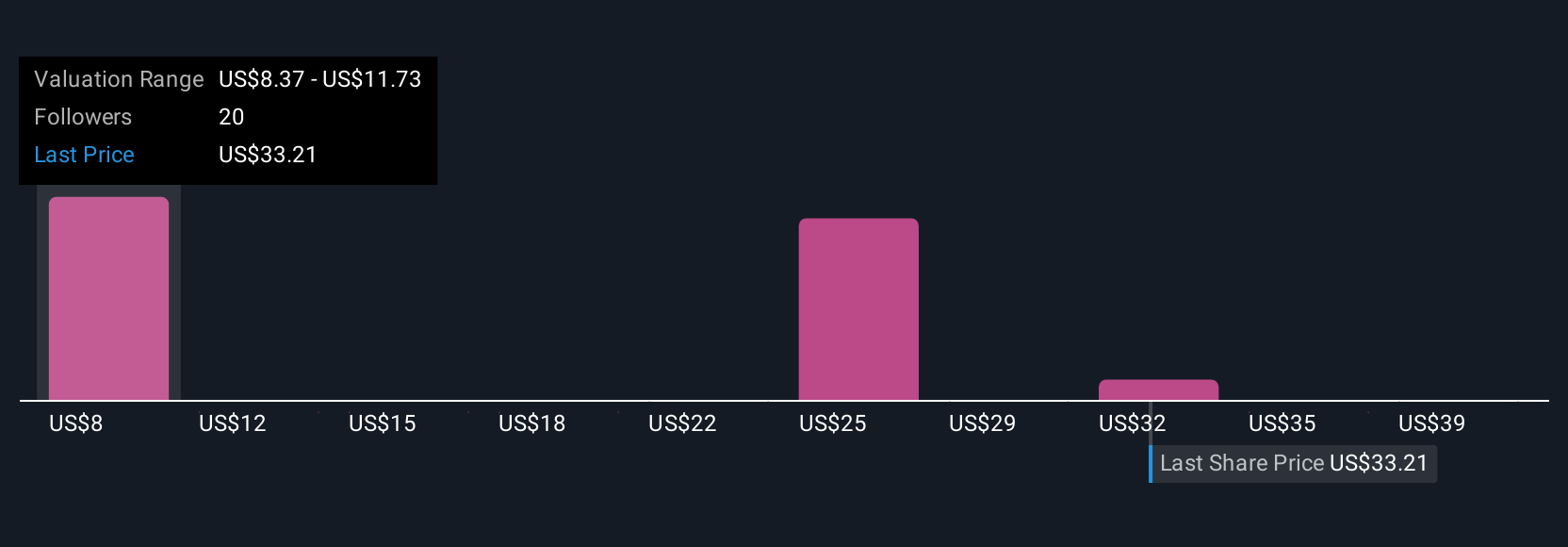

Eight fair value estimates from the Simply Wall St Community range from US$7.69 to US$46 per share. While these reflect varying growth outlooks, remember that ongoing changes to Southwest’s route network and loyalty program may shape future performance in ways that could surprise many observers, explore the full spectrum of community perspectives for additional insight.

Explore 8 other fair value estimates on Southwest Airlines - why the stock might be worth as much as 46% more than the current price!

Build Your Own Southwest Airlines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southwest Airlines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southwest Airlines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southwest Airlines' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal