The Bull Case For Bristow Group (VTOL) Could Change Following Multi-Year Revenue Guidance Update and Latest Results

- Bristow Group Inc. recently updated its earnings guidance for 2025 and 2026, projecting total revenues between US$1.46 billion and US$1.74 billion, and reported half-year financial results with sales of US$376.43 million and net income of US$31.75 million.

- The combination of forward-looking revenue guidance and profit figures provides a clearer view of Bristow's expected financial trajectory and near-term business momentum.

- We'll explore how Bristow Group's updated multi-year revenue guidance shapes its investment narrative and future outlook.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Bristow Group Investment Narrative Recap

To have conviction as a Bristow Group shareholder, you must believe in steady, long-term demand for vertical flight services from both energy and government customers, and Bristow’s ability to secure recurring contracts and deploy aircraft efficiently. The recent upward revision of revenue guidance confirms near-term momentum, but does not materially shift the key short-term catalyst: successful ramp-up of new offshore and SAR contracts. The largest risk, persistent supply chain constraints and cost inflation, remains front and center, as these could delay fleet modernization or erode margin expansion even as revenues grow.

Of the recent announcements, the expanded partnership with Vertical Aerospace Ltd. stands out for its future impact, aligning with Bristow's focus on next-generation aircraft deployments and technological advancement. While this could eventually support higher operating efficiency and margin improvement, the short-term outlook still hinges more on execution in core operations and delivering on new contract wins, both of which are closely tied to the company’s ability to manage supply chain and cost headwinds.

Yet, it's important not to overlook how ongoing supply chain pressures could affect Bristow’s ability to upgrade and maintain its fleet, a risk every investor should understand before...

Read the full narrative on Bristow Group (it's free!)

Bristow Group's outlook anticipates $1.9 billion in revenue and $129.4 million in earnings by 2028. This is based on a 9.0% annual revenue growth rate and a $10.3 million increase in earnings from the current $119.1 million.

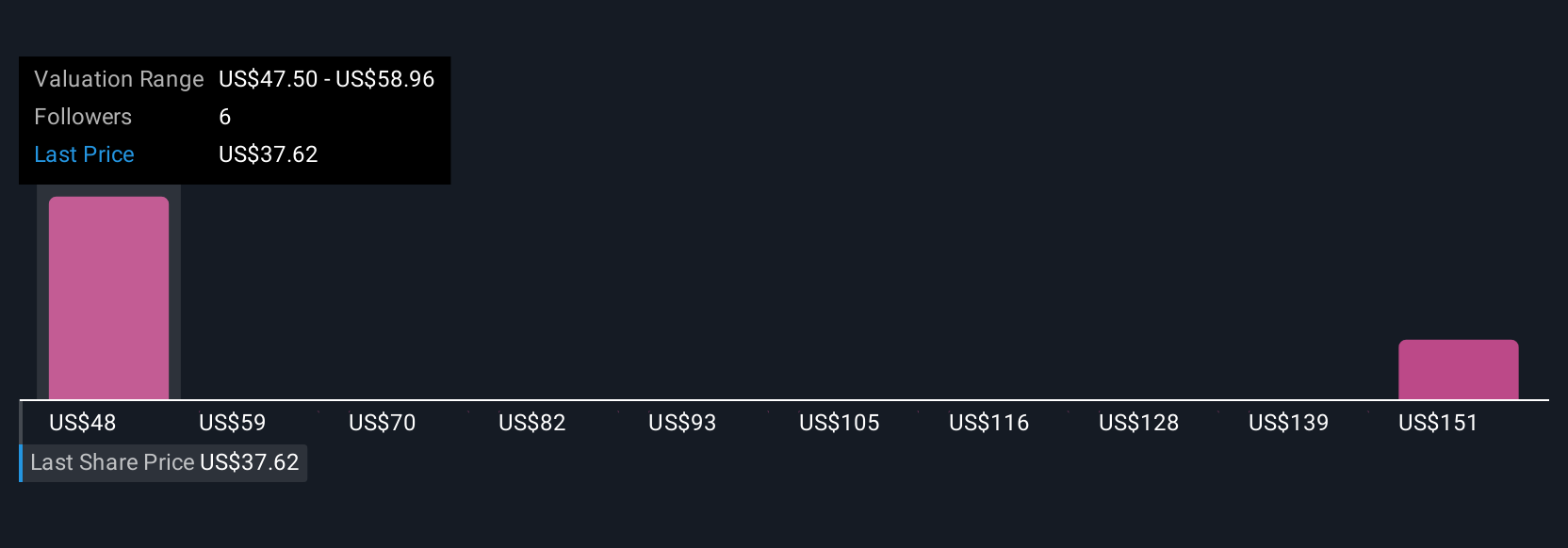

Uncover how Bristow Group's forecasts yield a $47.50 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$47.50 to US$161.71, reflecting two distinct viewpoints. Against this backdrop, any assessment of Bristow’s future hinges on how the company addresses aircraft delivery lead times and operational costs.

Explore 2 other fair value estimates on Bristow Group - why the stock might be worth over 4x more than the current price!

Build Your Own Bristow Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bristow Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bristow Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bristow Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal