Cardinal Health (CAH) Confirms US$0.51 Dividend Payout for October 2025

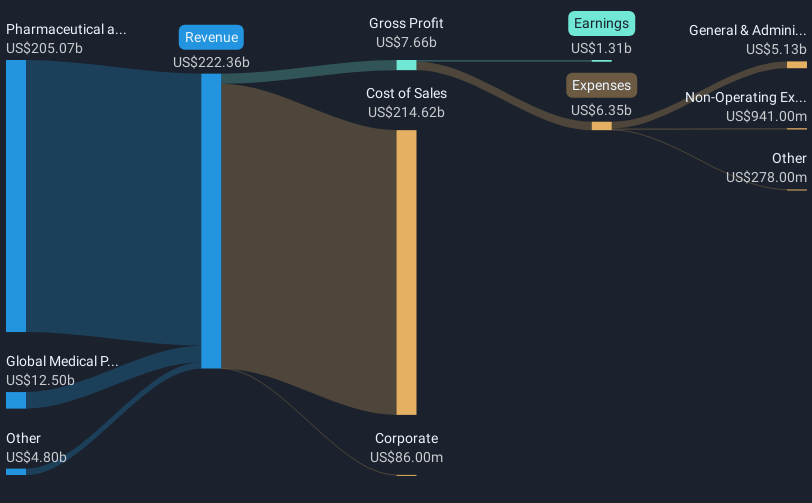

Cardinal Health (CAH) recently affirmed its quarterly dividend of $0.51 per share, set for mid-October 2025, underscoring its commitment to shareholder returns. However, the company's stock experienced a 3% decline over the past quarter, contrasting with the broader market which climbed 1% over the last week and 17% over the past year. Despite reporting an increase in net income and earnings per share for the year ending June 2025, Cardinal Health's share price movement was slightly out of step with broader market trends and may reflect mixed investor sentiment amid macroeconomic uncertainties.

The recent decision by Cardinal Health to affirm its quarterly dividend can be seen as a reassurance of its emphasis on shareholder returns, even amidst its recent 3% share price decline. Over the past five years, Cardinal Health's total shareholder return stands at a significant 243.32%, reflecting robust long-term performance despite short-term fluctuations. In the previous year, Cardinal Health's share performance exceeded the broader US market return of 17.4%, highlighting its resilience in a competitive environment.

The recent news does not seem to have affected analysts' revenue and earnings forecasts drastically. Revenue is projected to grow at 7.9% annually, while earnings are expected to demonstrate solid growth at 10.6% yearly, albeit slower than the US market's anticipated earnings growth of 15.1%. The share price movement, currently at US$149.61, appears to be significantly below the analyst consensus price target of US$180.46, suggesting a potential upside of approximately 20.6%. This places the stock in a position where it might be seen as undervalued relative to the consensus growth expectations and projected returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal