Trump Says Nancy Pelosi Traded On Inside Information—Her 2025 Portfolio Outperforms S&P 500 Thanks To These 4 Stocks

President Donald Trump has accused former House Speaker Nancy Pelosi of trading on “inside information” after her portfolio’s returns reportedly outperformed the S&P 500 in 2025.

Nancy Pelosi Clocks Higher Returns Than S&P 500 So Far In 2025

According to “Nancy Pelosi Stock Tracker” on X, Pelosi’s returns are up roughly 12% in 2025, while the S&P 500 index has risen 10.22% year-to-date.

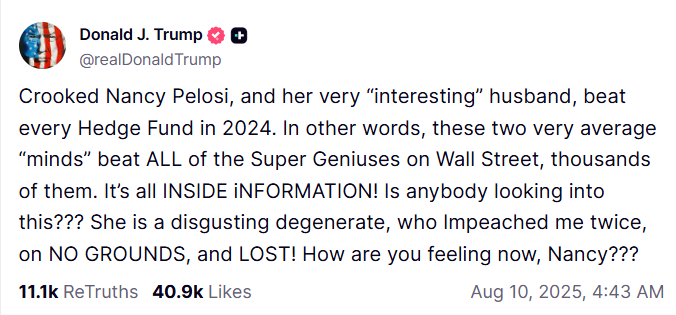

Trump Alleges Pelosi For Trading On Insider Information

Even as her portfolio has beaten the S&P 500 index thus far in 2025, in a Truth Social post on Aug. 10, Trump claimed that Pelosi and her husband “beat every Hedge Fund in 2024” and that their success was due to “INSIDE INFORMATION!”.

The tracker highlights four stocks, Tempus AI Inc. (NASDAQ:TEM), Nvidia Corp. (NASDAQ:NVDA), Broadcom Inc. (NASDAQ:AVGO), and Palo Alto Networks Inc. (NASDAQ:PANW) as key drivers of her performance.

This follows a 54% return in Pelsoi's portfolio in 2024, a figure based on her filings and underlying stock performance.

Benzinga's government trade tracker corroborates her strong performance, showing she has “gained 48.40% on average” over the past 12 months, outperforming the S&P 500.

Key Stocks Contributing To Pelosi’s Portfolio Returns

According to posts from the “Nancy Pelosi Stock Tracker” and supported by official financial disclosures and the Benzinga tracker, several key stock trades have contributed to her recent gains:

- Tempus AI: Pelosi’s portfolio saw a significant boost from her investment in Tempus AI. A Periodic Transaction Report from the U.S. House of Representatives confirms she purchased 50 call options for TEM on Jan. 14, 2025, with a value between $50,001 and $100,000. The stock tracker noted a 91% return on this position since she originally bought it.

- Nvidia: The tracker credits NVIDIA as the source for the majority of her 2024 gains, claiming she bought up to $5 million in call options on Nov. 22, 2023, and that the stock alone was up around 190% in 2024. Official records show that on Dec. 20, 2024, she exercised 500 call options for NVDA that were purchased on Nov. 22, 2023. The transaction was valued between $500,001 and $1,000,000. The Benzinga tracker lists a purchase of NVDA stock options for $1 million to $5 million on Dec. 20, 2024.

- Broadcom: Pelosi’s portfolio also benefited from her position in Broadcom. A House of Representatives Periodic Transaction Report shows she exercised 200 call options on June 20, 2025, which were originally purchased on June 24, 2024, for an amount between $1,000,001 and $5,000,000. According to the stock tracker, the stock rose approximately 40% from her purchase date through the end of 2024.

- Palo Alto Networks: The tracker also highlighted her trades in Palo Alto Networks, stating she first bought around $1 million in calls on Feb. 12, 2024, and then “doubled down” with another purchase of approximately $250,000 in calls on Feb. 21, 2025. The official disclosure, however, specifies that she exercised 140 call options on Dec. 20, 2024, that were purchased on both Feb. 12, 2024, and Feb. 21, 2024. The transaction was valued between $1,000,001 and $5,000,000. The tracker claims the first trade was flat while the second one had a 30% gain.

Price Action

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were trading mixed in premarket on Friday. The SPY was up 0.30% at $646.90, while the QQQ advanced 0.14% to $580.68, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Wall Street Journal

Wall Street Journal