What Robinhood Markets (HOOD)'s $100 Billion Milestone and Bitstamp Deal Mean For Shareholders

- Robinhood Markets reported its July 2025 operating results on August 13, showcasing continued strength in revenue, deposits, and user engagement driven by robust growth in cryptocurrency and tokenization offerings, following the acquisition of Bitstamp.

- An interesting development is the company's achievement of a US$100 billion market capitalization milestone for the first time, indicating substantial investor confidence amid insider selling and ongoing efforts for S&P 500 inclusion.

- We'll examine how Robinhood's expanding crypto capabilities and acquisition of Bitstamp could reshape its investment narrative and growth prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Robinhood Markets Investment Narrative Recap

To be a shareholder in Robinhood Markets today, you must believe in the company's transformation from a pure stock trading platform into a diversified fintech driven by crypto and tokenization. The recent operating results, including rapid crypto-driven growth and the Bitstamp acquisition, have fueled optimism, but short-term momentum remains closely tied to achieving S&P 500 inclusion. Ongoing insider selling and high valuation levels are the biggest risks, though the new data does not materially alter these key concerns.

Among recent announcements, the Q2 2025 earnings release stands out for showing revenue and net income growth, supported by strong customer engagement and accelerated net deposits in July. This ties directly to the ongoing catalyst around scaling crypto products and expanding recurring revenues, but also underscores the importance of sustaining operational efficiency as the company grows.

However, while momentum remains strong, investors should also pay close attention to the impact of persistent insider selling and what it may signal about...

Read the full narrative on Robinhood Markets (it's free!)

Robinhood Markets is projected to reach $5.2 billion in revenue and $1.7 billion in earnings by 2028. This outlook assumes annual revenue growth of 13.6%, but earnings are expected to decrease by $0.1 billion from the current $1.8 billion.

Uncover how Robinhood Markets' forecasts yield a $109.09 fair value, a 4% downside to its current price.

Exploring Other Perspectives

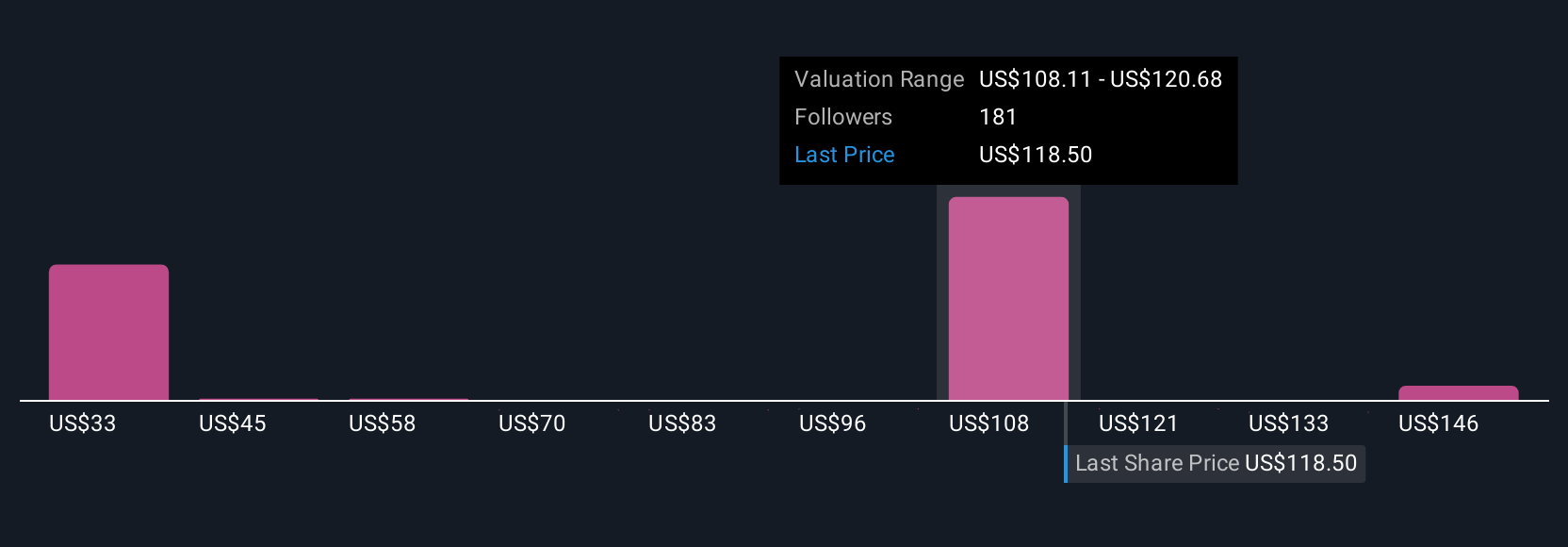

Simply Wall St Community members offered 36 fair value estimates for Robinhood, ranging from US$32.57 to US$130 per share. While community opinions diverge sharply, continued competition and regulatory uncertainty in crypto remain critical for the company’s outlook, consider examining these wide-ranging views before making your own assessment.

Explore 36 other fair value estimates on Robinhood Markets - why the stock might be worth less than half the current price!

Build Your Own Robinhood Markets Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Robinhood Markets research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Robinhood Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Robinhood Markets' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal