Should Social Media Buzz Without Foot Traffic Prompt a Rethink by American Eagle Outfitters (AEO) Investors?

- In recent weeks, American Eagle Outfitters launched a high-profile advertising campaign featuring Sydney Sweeney, which generated widespread online attention but coincided with a significant drop in in-store foot traffic and concerns about underwhelming sales impact.

- This event highlighted the disconnect between social media buzz and actual consumer engagement, as increased web interest failed to translate to higher physical store sales or market share.

- We’ll examine how this gap between digital interest and in-store performance could affect American Eagle Outfitters' investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

American Eagle Outfitters Investment Narrative Recap

To be a shareholder in American Eagle Outfitters right now, you need to believe that the company’s brand investment and omnichannel strategies will translate into revenue growth, despite headwinds from declining foot traffic and muted consumer spending. The recent Sydney Sweeney campaign captured online attention but did not appear to meaningfully offset concerns about softer store sales or short-term earnings outlooks, making consumer uncertainty the most pressing risk, while revenue acceleration is the key near-term catalyst.

The most relevant recent announcement is the launch of the “Sydney Sweeney Has Great Jeans” campaign, which used 3D billboards and AI-powered try-on technology to engage younger shoppers. However, the disconnect between viral marketing and actual traffic trends brings the campaign’s impact into question, especially as the company seeks to strengthen its digital offerings to offset in-store challenges.

In contrast to the hype, investors should remain mindful of the risk that consumer uncertainty...

Read the full narrative on American Eagle Outfitters (it's free!)

American Eagle Outfitters is projected to reach $5.3 billion in revenue and $166.2 million in earnings by 2028. This outlook is based on an annual revenue decrease of 0.3% and a $30.5 million decline in earnings from current earnings of $196.7 million.

Uncover how American Eagle Outfitters' forecasts yield a $11.44 fair value, a 12% downside to its current price.

Exploring Other Perspectives

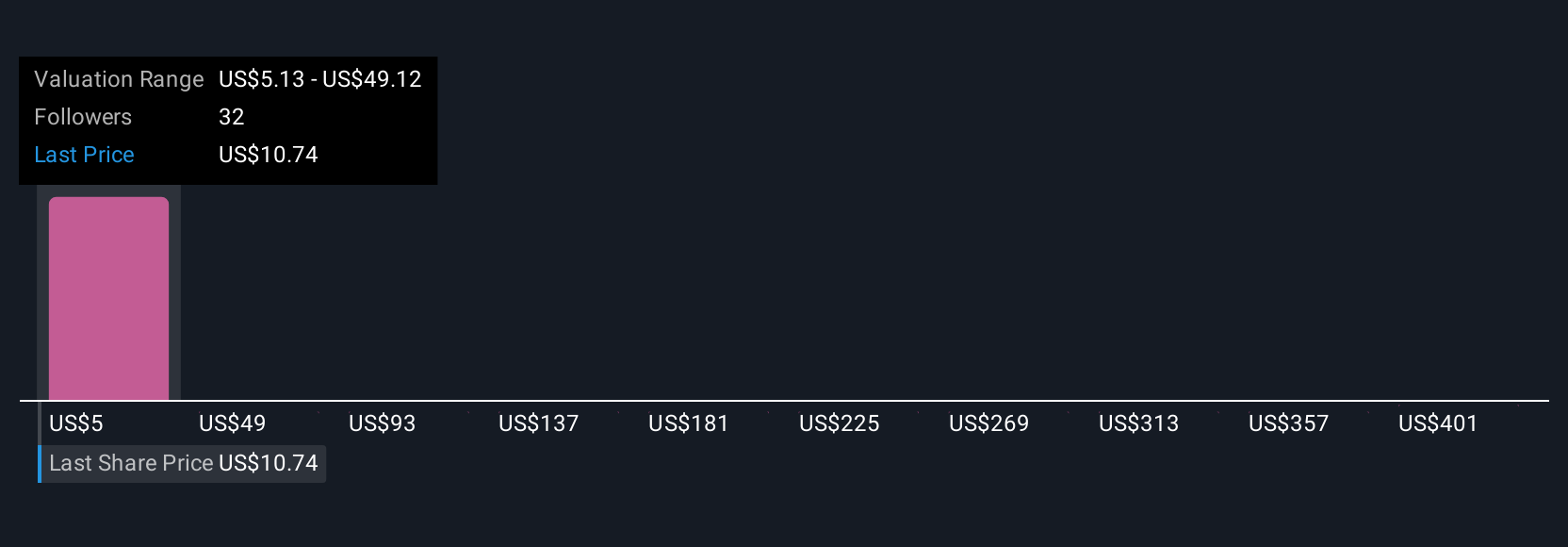

Seven members of the Simply Wall St Community offered fair value estimates for American Eagle ranging from US$5.13 to US$445.03 per share. Many believe that weaker in-store performance could shape future profitability and you can compare these differing views now.

Explore 7 other fair value estimates on American Eagle Outfitters - why the stock might be worth less than half the current price!

Build Your Own American Eagle Outfitters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Eagle Outfitters research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free American Eagle Outfitters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Eagle Outfitters' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal