Why American Airlines Stock Flew Higher This Week

Key Points

A peer's troubles could lead to a reduction in capacity, and that's good news for the rest of the industry.

The airline industry is cyclical, and ticket pricing is highly sensitive to the demand/capacity equation.

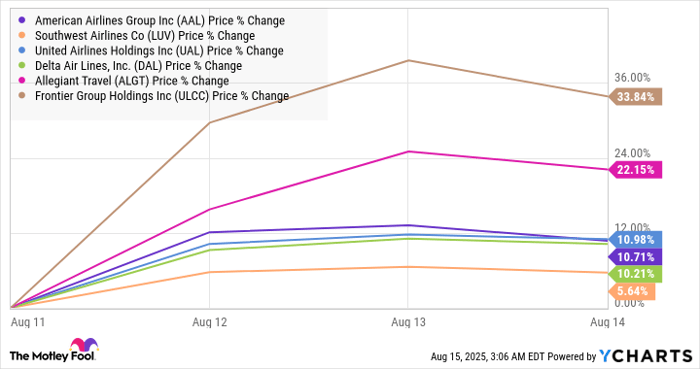

Shares in American Airlines (NASDAQ: AAL) flew higher by more than 10% in the week to Friday morning. The circumstances behind the move are unusual outside the airline industry. Here's why.

Why American Airlines' stock took off

Usually, when a company issues an SEC filing warning that it has doubts over its ability to continue as a going concern, its peers sell off in sympathy. There's a logical sense to this because it indicates weak end-market conditions that all industry participants will suffer from.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

However, when Spirit Airlines did just that earlier in the week, some of its peers, including American Airlines soared.

The reason is that the market is pricing in a removal of capacity in the marketplace, which should enable more pricing power, notably for the budget airlines that Spirit competes directly, and also with network carriers like American Airlines whose ticket prices are also pulled down by competition from budget carriers on specific domestic routes.

Where next for American Airlines

The issue of capacity matching demand is a constant stress point in a cyclical industry like airlines. Overcapacity can lead to slashed ticket prices and profit margins; undercapacity leads to the opposite. Given the reduction in demand caused by the tariff conflict, airlines are reducing capacity. That's why the Spirit news is taken as a positive.

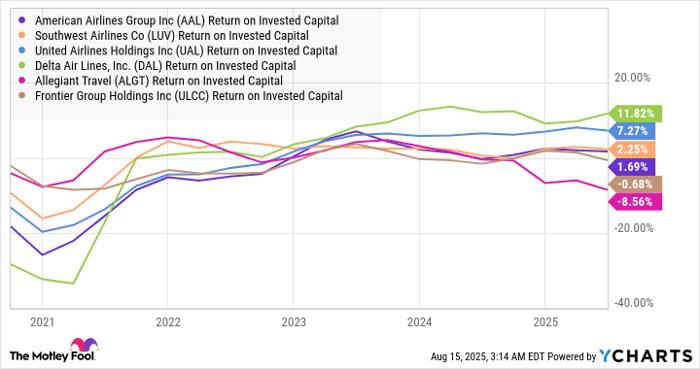

That said, it makes more sense to buy best-in-class stocks like Delta Air Lines and United Airlines.

AAL Return on Invested Capital data by YCharts

Or at least it does until American Airlines can demonstrate an ability to improve its return on invested capital sufficient to cover its cost of capital consistently. Until then, Delta and United are the most attractive stocks in the sector.

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends Allegiant Travel, Delta Air Lines, and Southwest Airlines. The Motley Fool has a disclosure policy.

Wall Street Journal

Wall Street Journal