13F File Revealed: Hedge Funds Bought Tech Stocks in Q2! Hedge funds such as Buffett and Tepper take the lead in “sweeping goods” UnitedHealth (UNHUS)

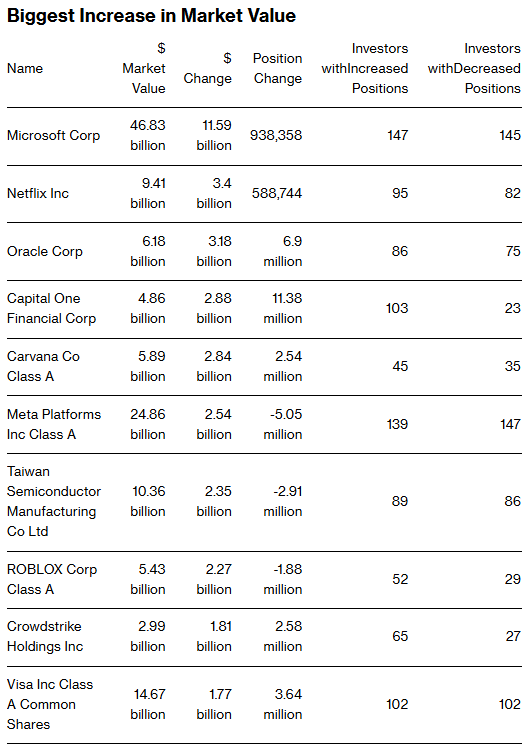

The Zhitong Finance App learned that hedge funds have recently released 13F position reports for the second quarter. Many of these institutions have increased their holdings of tech giants such as Microsoft (MSFT.US) and Netflix (NFLX.US). During this period, although Trump's trade policy caused market fluctuations for a while, in the end, major indices still recorded significant gains. Bloomberg's analysis of data from the 13F file shows that in the three months up to June 30, the market value of Microsoft shares held by hedge funds increased by 12 billion US dollars to 47 billion US dollars, the highest total market value of positions. This increase was due to net purchase operations and a sharp rise in the company's stock price.

As artificial intelligence ushered in an epoch-making development boom, Wall Street's large hedge funds, such as Qiaoshui Joint Fund, Tiger Global Management, and Discovery Capital, also increased their holdings in large technology stocks in the second quarter.

This position adjustment comes at a time when US stocks are experiencing a sharp reversal. Although Trump's announcement of additional tariffs in early April triggered an initial sell-off, the market rebounded rapidly thereafter due to multiple extension of policy deadlines and the resilience of the US economy. By the end of June, the S&P 500 index had risen about 25% from its April low, the best quarterly performance since December 2023; the Nasdaq 100 index, which mainly focuses on technology stocks, ushered in its best performance period in more than two years.

Bloomberg has now analyzed the 13F documents of 716 hedge funds. The total market value of the holdings of these funds reached US$726.54 billion, compared to US$622.94 billion three months ago.

Technology stocks accounted for the highest share of hedge fund holdings, reaching 23%; followed by financial stocks, accounting for 17%. The increase in market value of investment in the energy sector was the smallest of all industries.

Additionally, hedge funds reduced their holdings of backward stocks in the aerospace and defense, consumer and retail industries in Q2 as part of a comprehensive return to momentum investment strategy.

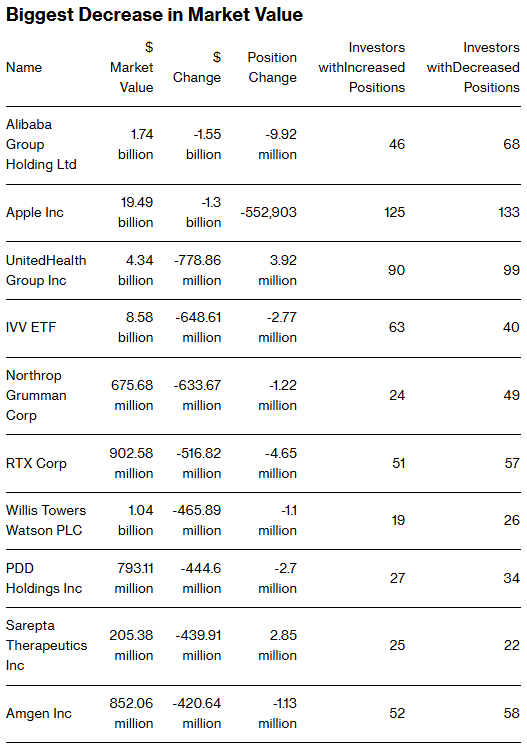

It is worth mentioning that when UnitedHealth Group (UNHUS) plummeted in the second quarter, many organizations chose to “cut the bottom”. The share price has fallen 46% this year, and the company is facing many problems such as rising costs, investigations by the US Department of Justice, cyber attacks, and the shooting of former executive Brian Thompson in December of last year.

Billionaire investors Warren Buffett and David Tepper bottomed out during the stock's Q2 crash of nearly 40%. Buffett's Berkshire Hathaway Q2 increased its holdings of UnitedHealth Group by 5.04 million shares, worth US$1.57 billion. “Wall Street Scavenger” David Tepper made a big increase in the stock, accounting for 11.85% of the portfolio, which surged 1300.00% from the number of positions held in the previous quarter.

Scion Asset Management, a prototype of “The Big Short” and managed by world-renowned hedge fund manager Michael Burry (Michael Burry), also disclosed its holdings in this insurance company. Among the top ten heavy-held stocks, UnitedHealth Bullish Options (UNHUS, CALL) ranked first. It is also an asset for the fund's new positions in the second quarter, with a market value of 190 million US dollars. In addition to this, the company also bought $6 million in individual shares of UnitedHealth.

Other hedge funds, such as Lone Pine (Lone Pine) and Discovery Capital, are also betting on UnitedHealth, while Soros Fund Management has increased its existing positions.

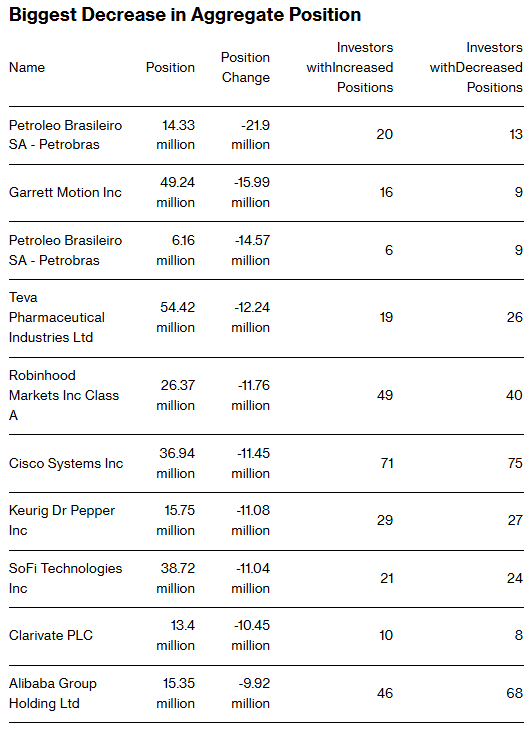

Furthermore, the market value of hedge fund holdings with Alibaba (BABA.US) decreased by US$1.55 billion, the biggest drop in market value of all holdings.

Additionally, other important position change reports:

- Qiaoshui reduced Alibaba's holdings by 5.66 million shares, the largest reduction in this investment group; Coatue Management LLC reduced its holdings by 2.93 million shares.

- Arrowstreet Capital LP (Arrowstreet Capital LP) reduced its holdings of Petroleo Brasileiro SA - Petrobras (Petrobras) by 21.2 million shares, the biggest reduction for this group; Oak Capital reduced its holdings by 2.66 million shares.

- Qiaoshui increased Microsoft's holdings by 905,622 shares, the largest increase; Walleye Capital LLC increased its holdings by 882,930 shares.

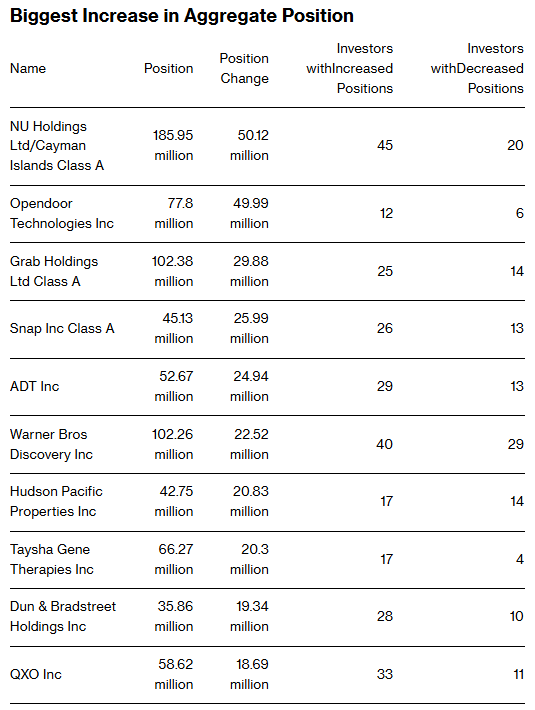

- D1 Capital Partners LP (D1 Capital Partners LP) increased its holdings of NU Holdings (NU.US) by 14.33 million shares, the largest increase; Renaissance Technologies LLC (Renaissance Technologies LLC) increased its holdings by 12.21 million shares.

- 147 investors reduced their holdings or cut Meta Platforms Class A shares, with the largest number of holdings reduced; 177 investors increased their holdings or bought new Amazon (AMZN.US), which increased their holdings the most.

- Microsoft remains the stock with the highest total market capitalization, at $46.83 billion.

Wall Street Journal

Wall Street Journal