Should Rising Cocoa Costs and Price Hikes Lead Mondelez International (MDLZ) Investors to Reassess Risks?

- Mondelez International recently disclosed that CEO Dirk Van de Put and CFO Luca Zaramella will join a fireside chat at the Barclays Global Consumer Staples Conference on September 3, 2025, and announced new rounds of price increases to manage intense cocoa cost inflation in North America and emerging markets.

- This announcement highlights Mondelez's reliance on pricing power to offset rapidly rising input costs, as well as management’s focus on transparent investor engagement.

- We'll explore how ongoing cocoa cost pressures and Mondelez’s latest pricing initiatives may influence the company's investment story moving forward.

The latest GPUs need a type of rare earth metal called Terbium and there are only 27 companies in the world exploring or producing it. Find the list for free.

Mondelez International Investment Narrative Recap

To own Mondelez International, investors must have confidence in the company’s ability to sustain earnings through strong pricing power, even as it contends with steep cocoa inflation and supply chain volatility. The most recent news confirms that elevated cocoa costs remain the central near-term challenge and that the success of new price increases will be the critical catalyst to watch, while consumer elasticity and margin pressure continue to pose risk. For now, the overall story remains unchanged, though input cost trends and consumer behavior are still key variables.

Among the company’s latest announcements, the introduction of additional pricing actions in North America and emerging markets to offset cocoa cost inflation is highly relevant. This move reinforces the company’s near-term approach to protecting profitability and signals continued focus on managing margin risk through price adjustments during periods of volatile input costs.

However, investors should be aware that if cocoa prices do not ease as expected, pricing power alone may not be enough to...

Read the full narrative on Mondelez International (it's free!)

Mondelez International's narrative projects $42.7 billion revenue and $4.7 billion earnings by 2028. This requires 4.8% yearly revenue growth and an earnings increase of $1.1 billion from current earnings of $3.6 billion.

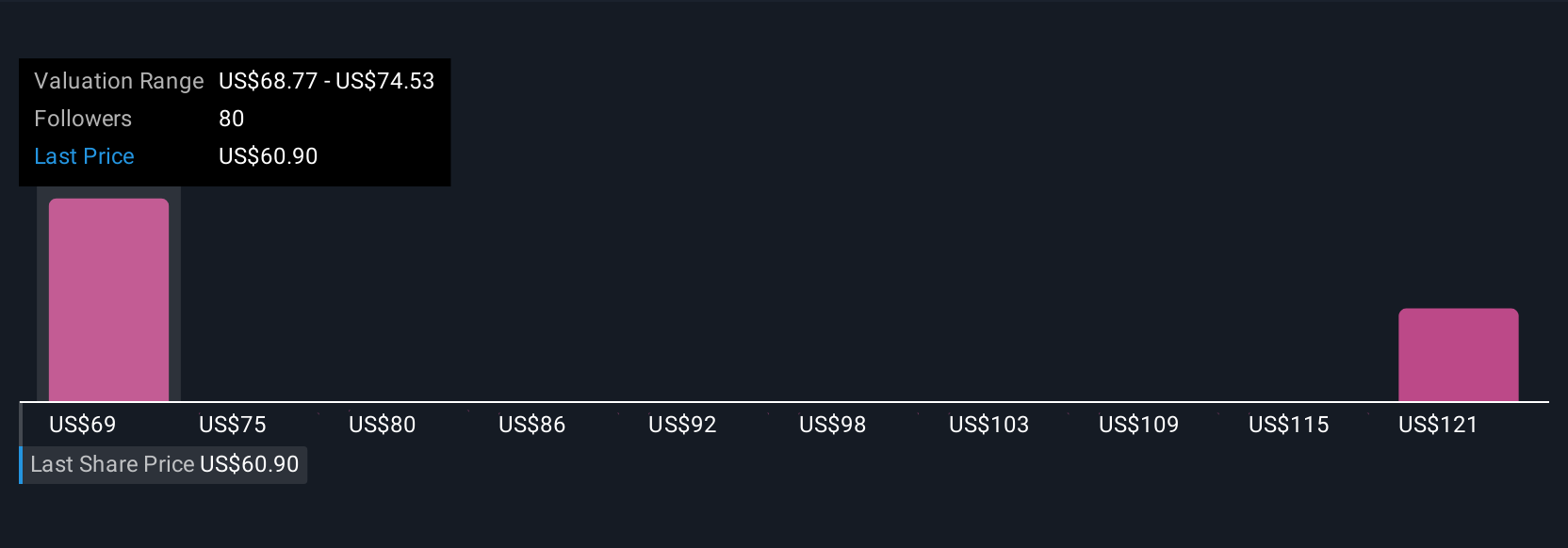

Uncover how Mondelez International's forecasts yield a $74.44 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered six different fair value estimates for Mondelez, ranging from US$61.73 to US$123.58 per share. With cocoa cost inflation challenging margins, these varied views remind you to consider multiple scenarios for future performance.

Explore 6 other fair value estimates on Mondelez International - why the stock might be worth just $61.73!

Build Your Own Mondelez International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mondelez International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mondelez International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mondelez International's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal