Will Cal-Maine Foods’ (CALM) New Leadership Shape Its Long-Term Competitive Edge?

- Cal-Maine Foods recently appointed Melanie Boulden to its Board of Directors and named Keira Lombardo as its first Chief Strategy Officer, introducing new leadership roles effective August 11, 2025.

- These appointments bring decades of experience in global food, beverage, and agriculture to Cal-Maine, reflecting a concentrated effort to enhance innovation and align with evolving industry demands.

- We'll explore how the addition of a Chief Strategy Officer underscores Cal-Maine's push for operational excellence within its investment narrative.

Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

What Is Cal-Maine Foods' Investment Narrative?

Cal-Maine Foods’ recent leadership appointments suggest the company is prioritizing long-term transformation at a moment when its fundamentals are at a crossroads. The arrival of Keira Lombardo as Chief Strategy Officer and Melanie Boulden to the board injects substantial food and agriculture expertise, but the most immediate investor focus remains on whether operational improvements and strategic moves can cushion the impact of a forecast decline in earnings and revenue over the next three years. Current challenges, ranging from volatile egg prices, avian influenza risks, a history of unstable dividends, and recent index exclusion, haven’t been fundamentally altered by these new appointments, though their fresh perspectives could drive a sharper focus on operational discipline and stakeholder alignment. While recent financials show high quality earnings and strong returns, most analysts are forecasting a significant contraction in profitability, underscoring that leadership change alone may not alter the biggest near-term headwinds. For now, the news signals ambition and board renewal, but the catalysts and risks flagged by the market still warrant close attention heading into the next earnings cycle.

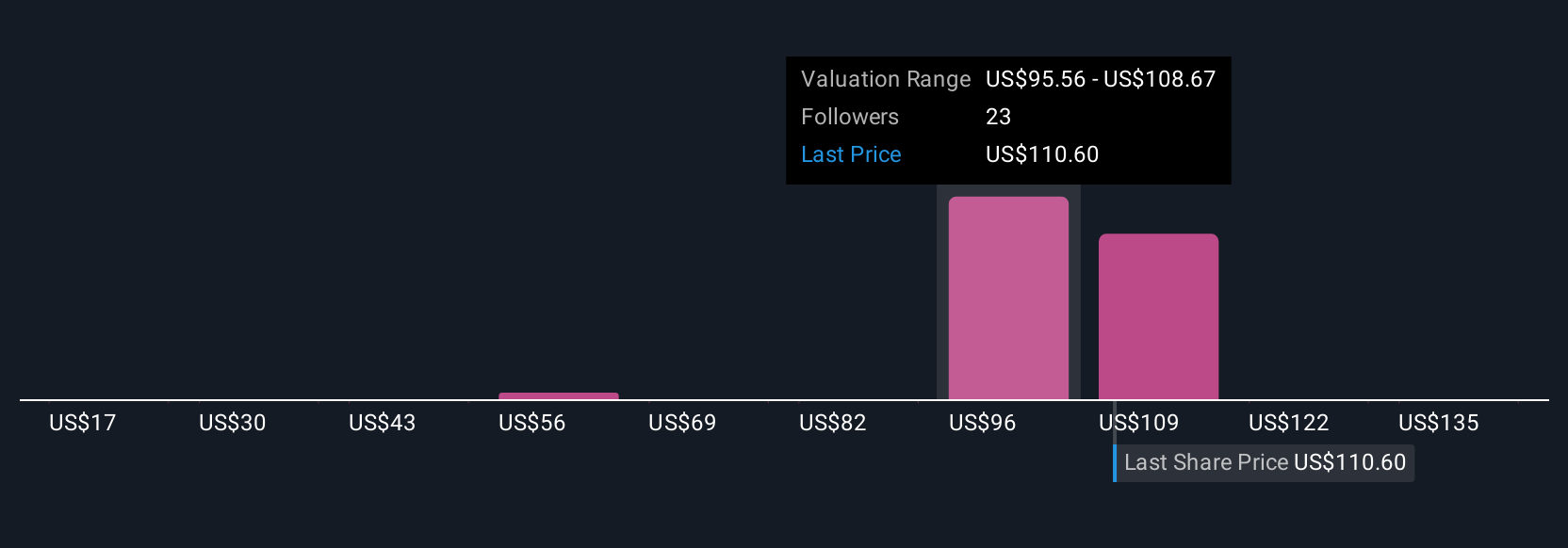

But the risk of declining profits still stands out for anyone tracking Cal-Maine’s outlook. Cal-Maine Foods' shares are on the way up, but they could be overextended by 6%. Uncover the fair value now.Exploring Other Perspectives

Explore 13 other fair value estimates on Cal-Maine Foods - why the stock might be worth less than half the current price!

Build Your Own Cal-Maine Foods Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cal-Maine Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cal-Maine Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cal-Maine Foods' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal