Will CBRE Group's (CBRE) Q2 Beat and Upward Estimates Shift Its Growth Narrative?

- Earlier this week, CBRE Group reported stronger-than-expected second-quarter results, with both revenue and core earnings per share surpassing analyst forecasts amid robust client activity in the face of macroeconomic uncertainties.

- An interesting insight is that, following upward revisions to earnings estimates and favorable analyst outlooks, CBRE’s projected earnings per share growth is anticipated to outpace the industry this year.

- We’ll explore how CBRE’s recent earnings outperformance and positive analyst sentiment could shape its investment narrative going forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

CBRE Group Investment Narrative Recap

Owning CBRE Group means believing in the company’s ability to deliver growth as a global leader in commercial real estate while managing through shifting economic and interest rate environments. The second-quarter earnings beat reinforces confidence in near-term performance, but the biggest risk remains the potential slowdown in capital markets activity if macroeconomic uncertainty or interest rate volatility causes corporates and investors to pause major projects, which could impact earnings momentum in coming quarters.

Among recent announcements, CBRE’s upgraded 2025 earnings guidance, issued alongside robust Q2 results, directly ties into the key catalyst for the stock: the company’s focus on growing recurring, resilient revenue streams and operational efficiencies. This guidance upgrade follows tangible revenue and earnings growth, highlighting management’s expectations for stronger profit growth and improved margins, which may bolster investor sentiment if targets are met.

However, despite the current optimism, it’s important to keep in mind that interest rate volatility and its impact on corporate spending decisions remain a critical risk investors should be aware of, especially if…

Read the full narrative on CBRE Group (it's free!)

CBRE Group's outlook anticipates $50.1 billion in revenue and $2.3 billion in earnings by 2028. This is based on annual revenue growth of 9.5% and an increase in earnings of $1.2 billion from the current level of $1.1 billion.

Uncover how CBRE Group's forecasts yield a $162.64 fair value, in line with its current price.

Exploring Other Perspectives

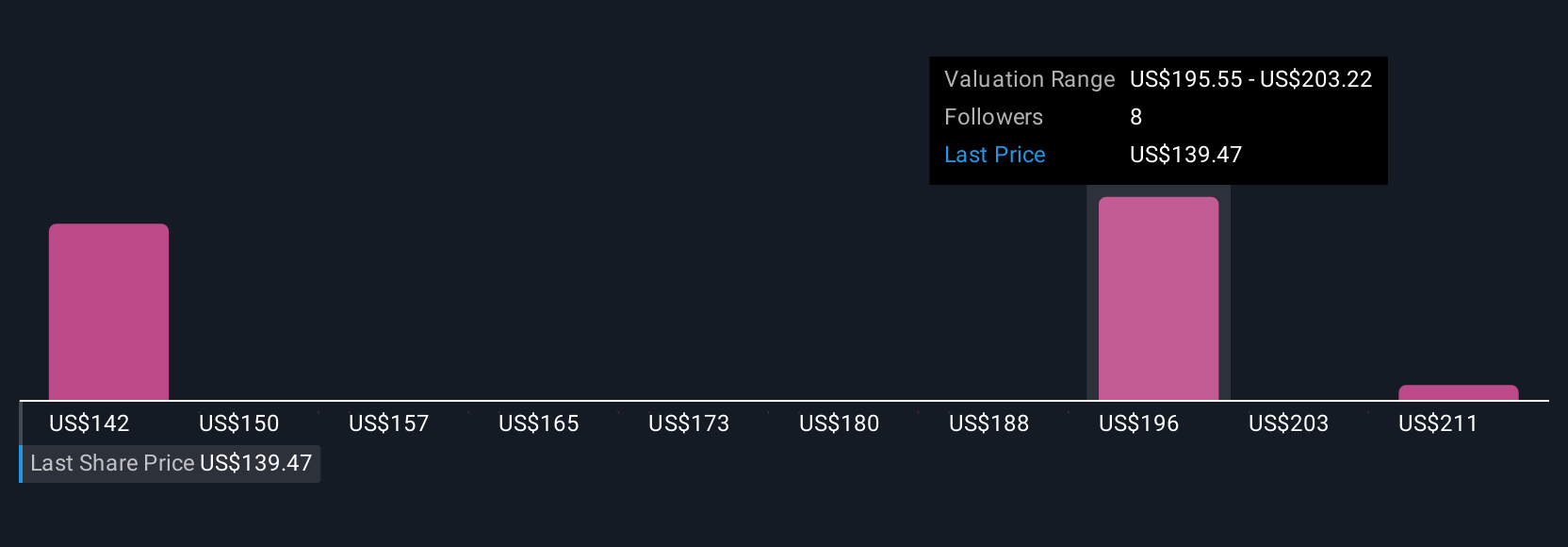

Three fair value estimates from the Simply Wall St Community range from US$161.54 to US$218.54, illustrating significant variation in investor viewpoints. Several market participants are watching whether CBRE’s focus on earnings growth through resilient segments will be enough to offset risks tied to capital market slowdowns.

Explore 3 other fair value estimates on CBRE Group - why the stock might be worth as much as 37% more than the current price!

Build Your Own CBRE Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CBRE Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CBRE Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CBRE Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal