Is Markel Group’s (MKL) Retreat From Reinsurance Reshaping Its Profitability and Investment Appeal?

- Earlier this month, Markel Group Inc. closed a shelf registration offering of 10,000 common shares worth $17.10 million, tied to its Employee Stock Ownership Plan (ESOP), while also reporting second-quarter results that exceeded revenue and profit expectations following a significant operational restructuring.

- A major development was the company's exit from global reinsurance due to persistent losses, sharpening its focus on core specialty insurance lines and the decentralization of profit and loss accountability.

- We'll explore how Markel Group’s exit from underperforming reinsurance operations shapes its investment outlook and profitability trajectory.

Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

Markel Group Investment Narrative Recap

To be a Markel Group shareholder today, you need to believe in the company’s sharpened focus on specialty insurance and its disciplined restructuring effort. The recent ESOP-related offering has no material impact on the short-term catalyst, which remains the successful redeployment of capital into higher-return lines, but a primary risk endures: the pace and effectiveness of freeing up and redeploying capital from reinsurance runoff could be gradual, affecting returns in the near term.

The second-quarter results, released alongside the shelf registration closure, are especially timely, as they reflect progress from the operational restructuring and indicate the first financial impacts of exiting global reinsurance. Encouraging insurance segment results suggest improvement is underway, yet the legacy risks tied to discontinued lines remain a key factor that could influence future earnings, highlighting the importance of ongoing reserve management.

Yet, despite visible progress, investors should keep in mind the possibility of further reserve charges or delayed capital redeployment...

Read the full narrative on Markel Group (it's free!)

Markel Group's outlook anticipates $18.0 billion in revenue and $2.0 billion in earnings by 2028. This scenario is based on a 3.1% annual revenue growth rate and a $0.2 billion decrease in earnings from the current $2.2 billion.

Uncover how Markel Group's forecasts yield a $1917 fair value, in line with its current price.

Exploring Other Perspectives

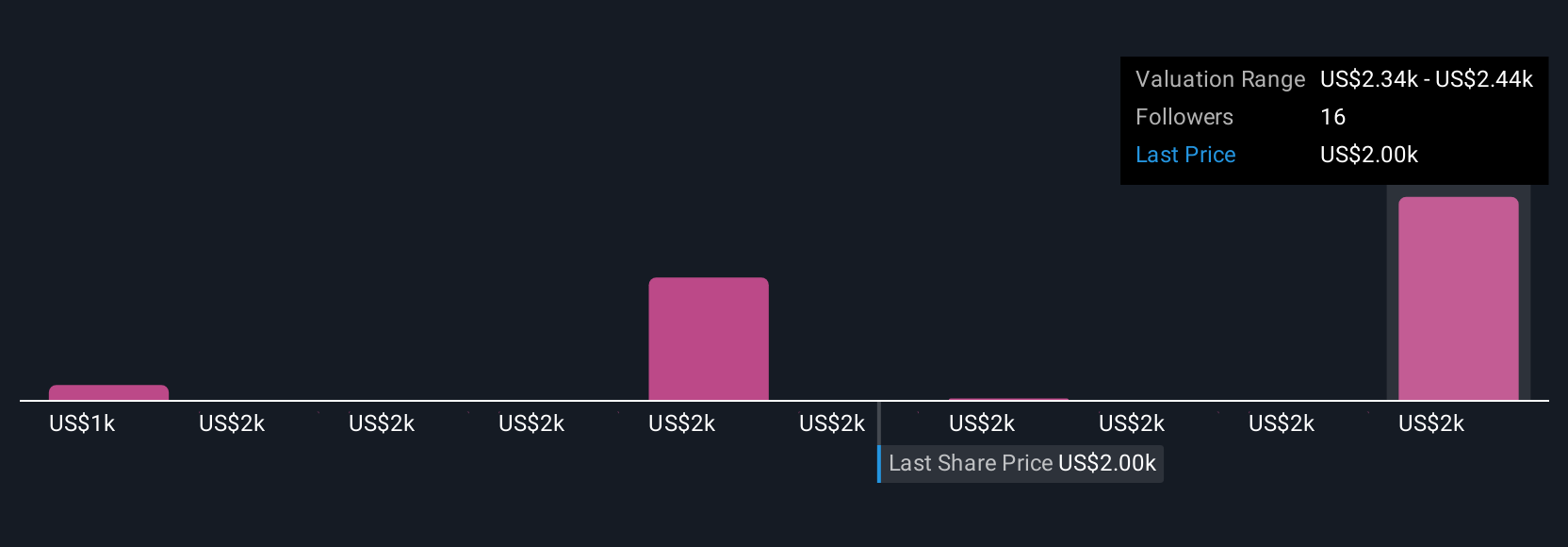

Six different fair value analyses from the Simply Wall St Community range from US$1,449.63 to US$2,403.04 per share, showing substantial diversity in views. With persistent legacy reserve risks and uncertain timing of capital release from runoff segments, you can explore several alternatives and see how widely investor perspectives may differ.

Explore 6 other fair value estimates on Markel Group - why the stock might be worth as much as 22% more than the current price!

Build Your Own Markel Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Markel Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Markel Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Markel Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal