Integral Ad Science (IAS) Is Up 11.8% After Raising 2025 Revenue Guidance and Posting Strong Q2 Results

- Integral Ad Science Holding Corp. recently raised its full-year 2025 revenue guidance to a range of US$597 million to US$605 million, following a second-quarter report showing sales of US$149.2 million and net income of US$16.41 million, both up from the previous year.

- This upward revision, together with analyst optimism and increased earnings estimates, signals heightened confidence in the company’s future growth trajectory within the digital advertising verification industry.

- We'll explore how the raised earnings guidance and robust quarterly results impact Integral Ad Science's investment narrative and outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

Integral Ad Science Holding Investment Narrative Recap

To believe in Integral Ad Science Holding Corp., investors need to see ongoing demand for independent ad verification across expanding digital channels, trusting that IAS can capture this growth despite rapid industry shifts. The recently raised 2025 revenue outlook highlights management’s confidence and brings potential to reinforce short-term momentum, yet the biggest risk remains the company’s reliance on key partnerships, any changes with major platforms like Meta or Amazon could quickly impact earnings. For now, this guidance revision looks material to near-term catalysts, but doesn't remove longer-term concentration risks.

Among recent announcements, the updated third-quarter revenue guidance stands out as particularly relevant. IAS expects between US$148 million and US$150 million in Q3 sales, essentially reflecting consistency with the strong Q2 results and adding visibility for investors tracking revenue acceleration across product segments like social and CTV. The company’s repeated confirmations and upward revisions reinforce the focus on business execution and customer adoption as critical short-term drivers.

However, despite increased forward guidance and promising financials, investors should also be mindful of the concentration risk from heavy dependence on a handful of digital ad platforms if...

Read the full narrative on Integral Ad Science Holding (it's free!)

Integral Ad Science Holding's narrative projects $787.0 million in revenue and $104.9 million in earnings by 2028. This requires 11.4% yearly revenue growth and a $49.1 million earnings increase from current earnings of $55.8 million.

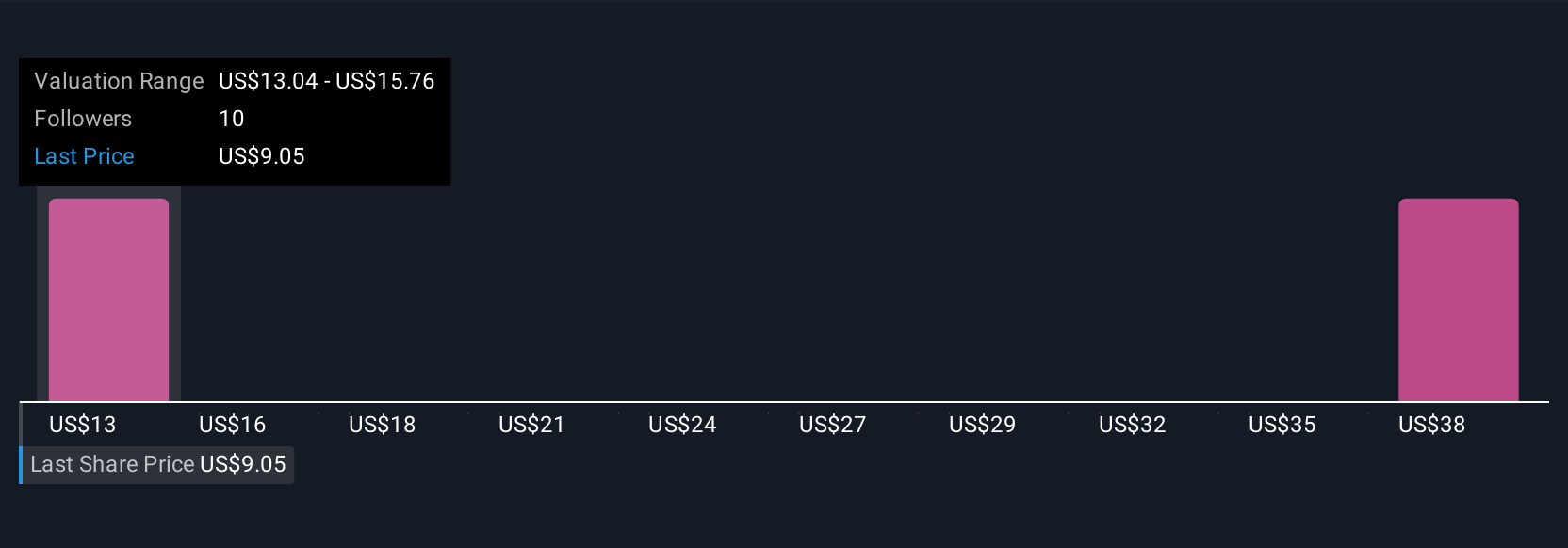

Uncover how Integral Ad Science Holding's forecasts yield a $13.04 fair value, a 45% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for IAS range from US$13.04 to US$40.32, sourced from 2 Simply Wall St Community members. While these diverging views offer a broad spectrum, the recurrent concern over partnership risk shows why expectations for future revenue stability can vary widely.

Explore 2 other fair value estimates on Integral Ad Science Holding - why the stock might be worth over 4x more than the current price!

Build Your Own Integral Ad Science Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Integral Ad Science Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Integral Ad Science Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Integral Ad Science Holding's overall financial health at a glance.

No Opportunity In Integral Ad Science Holding?

Our top stock finds are flying under the radar-for now. Get in early:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal