Why SSR Mining (TSX:SSRM) Is Up 7.4% After Reaffirming 2025 Output Targets and Strong Quarterly Results

- SSR Mining recently reported strong quarterly financial results and reaffirmed its full-year 2025 production guidance, indicating continued output from its Marigold, CC&V, Seabee, and Puna assets with projected gold equivalent production of 410,000 to 480,000 ounces at an all-in sustaining cost between US$2,090 and US$2,150 per ounce.

- The company also delivered significant year-over-year growth in gold and silver production, alongside marked improvements in revenue and earnings, reflecting robust operational recovery following earlier disruptions at its Çöpler Mine in Türkiye.

- We'll explore how SSR Mining's reaffirmed production guidance and operational improvements may shape its investment narrative going forward.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

SSR Mining Investment Narrative Recap

To own SSR Mining, you need to believe the company can deliver stable production and strong margins from Marigold, CC&V, Seabee, and Puna while managing regulatory risk and operational costs, especially as Çöpler's future remains uncertain. The recent reaffirmation of 2025 guidance is encouraging for the short-term production outlook, but ongoing regulatory and permitting challenges at Çöpler continue to be the most important variable that could affect earnings and future growth; the latest news does not materially change this short-term risk profile.

Among recent announcements, the company's second-quarter operating results, highlighting year-over-year gains in gold and silver output, revenue, and earnings, are most relevant. This operational recovery underpins the near-term catalyst of restored production momentum, but ultimate investor confidence may still hinge on clarity around Çöpler's legal and environmental status and future contributions to overall performance.

However, before getting too comfortable with the operational recovery story, investors should be aware that regulatory and permitting uncertainty at Çöpler means...

Read the full narrative on SSR Mining (it's free!)

SSR Mining's outlook projects $2.3 billion in revenue and $790.5 million in earnings by 2028. This requires 20.1% annual revenue growth and an earnings increase of $625.5 million from the current earnings of $165.0 million.

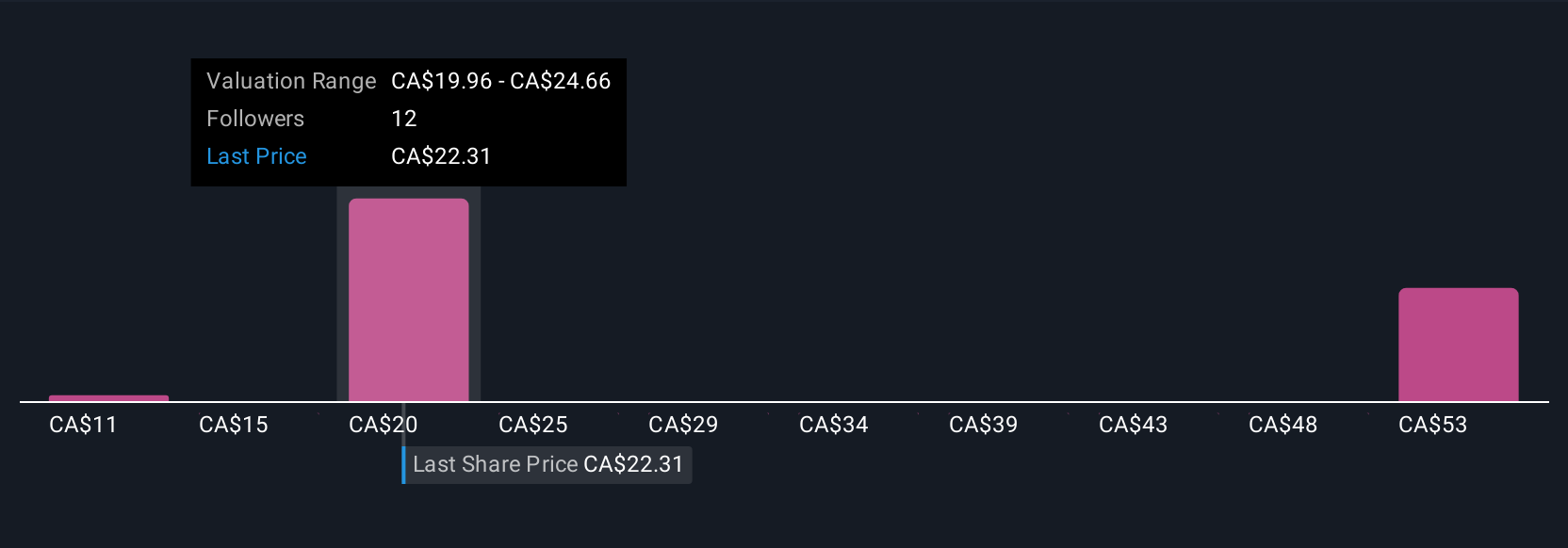

Uncover how SSR Mining's forecasts yield a CA$22.06 fair value, in line with its current price.

Exploring Other Perspectives

Four Simply Wall St Community fair value estimates for SSR Mining range from US$10.56 to US$57.10 per share, revealing a broad spread of opinion. While many see upside in operational improvements and reaffirmed guidance, key risks around Çöpler’s regulatory status remain top of mind for future returns, consider these differences and explore several viewpoints before deciding where you stand.

Explore 4 other fair value estimates on SSR Mining - why the stock might be worth less than half the current price!

Build Your Own SSR Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SSR Mining research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SSR Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SSR Mining's overall financial health at a glance.

No Opportunity In SSR Mining?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal