Cushman & Wakefield (CWK) Is Up 9.6% After Debt Reduction and Profit Jump - Has The Bull Case Changed?

- Cushman & Wakefield reported second-quarter 2025 earnings with sales rising to US$2.48 billion and net income reaching US$57.3 million, significantly up from the prior year.

- An important highlight from the announcement was the company's decision to pay down US$150 million in debt while raising its full-year earnings outlook, reflecting improved financial flexibility.

- We’ll explore how stronger Capital Markets growth and reduced debt could reshape Cushman & Wakefield’s investment narrative going forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cushman & Wakefield Investment Narrative Recap

To invest in Cushman & Wakefield, you need to be confident in a cyclical recovery for commercial real estate and the company's ability to translate operational efficiency and capital markets momentum into sustained earnings growth. The recent earnings beat and debt repayment improve short-term financial flexibility, but they do not fully eliminate sensitivity to shifts in leasing demand, so the key catalyst remains ongoing strength in capital markets activity, while the biggest risk is any sustained downturn in transaction volumes. The Q2 debt paydown is relevant here, as it responds directly to past concerns over leverage and interest costs, helping strengthen the balance sheet at a critical juncture, but recurring revenue resilience is still developing. However, against this measured progress, investors should also remember that if leasing volumes stall or remote work trends accelerate further, then...

Read the full narrative on Cushman & Wakefield (it's free!)

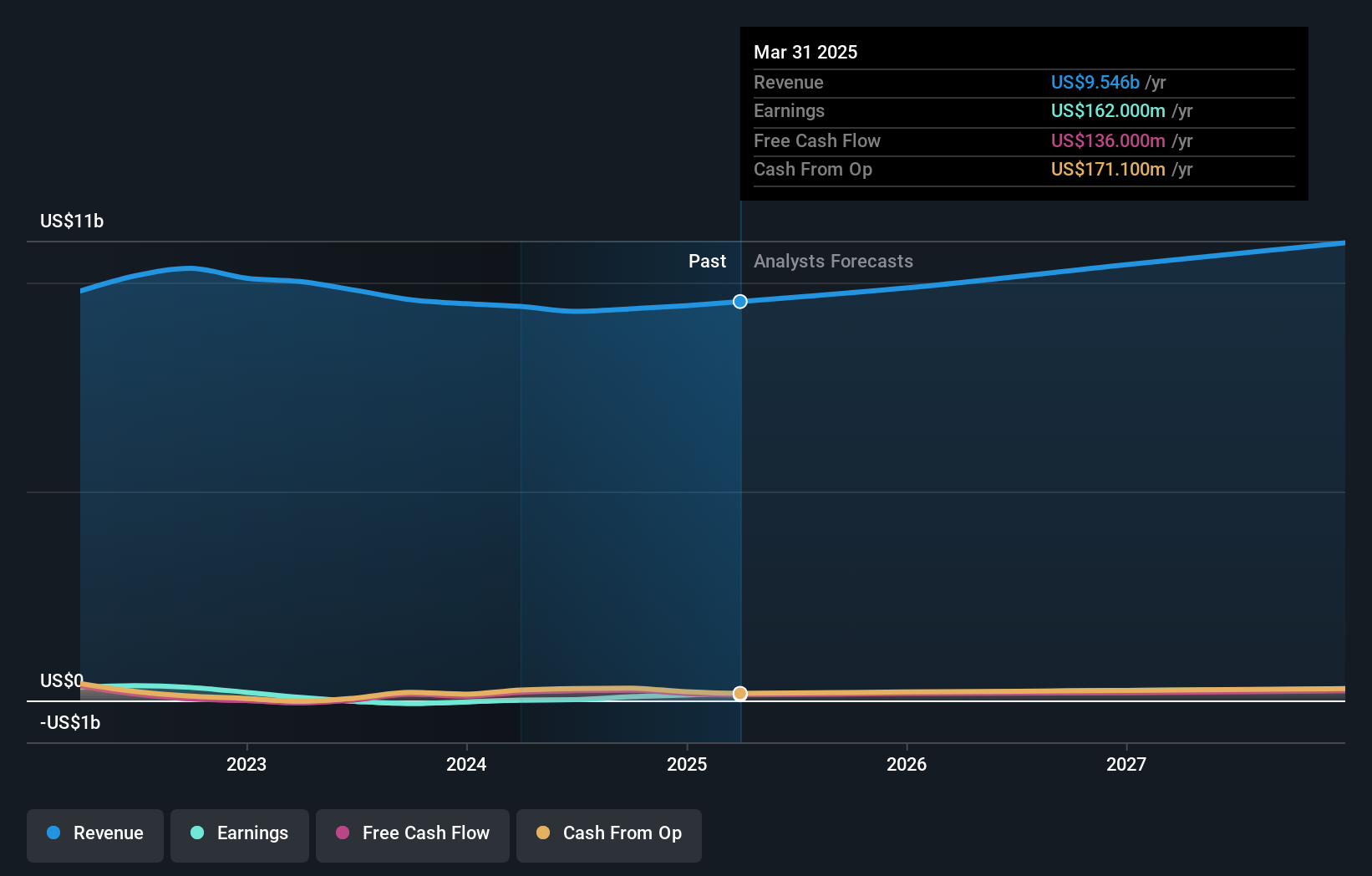

Cushman & Wakefield is forecast to reach $11.4 billion in revenue and $325.3 million in earnings by 2028. This projection is based on an expected annual revenue growth rate of 5.4% and a $119.5 million increase in earnings from the current level of $205.8 million.

Uncover how Cushman & Wakefield's forecasts yield a $15.00 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from US$4.64 to US$18.06, based on three different analyses. While some see potential undervaluation, keep in mind that Cushman & Wakefield is still exposed to risks from economic slowdowns impacting cyclical revenues, highlighting why views on its future may differ so widely.

Explore 3 other fair value estimates on Cushman & Wakefield - why the stock might be worth as much as 21% more than the current price!

Build Your Own Cushman & Wakefield Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cushman & Wakefield research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cushman & Wakefield research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cushman & Wakefield's overall financial health at a glance.

No Opportunity In Cushman & Wakefield?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal