Why Novanta (NOVT) Is Up 9.8% After Accelerating Acquisitions and Updating 2025 Revenue Outlook

- On August 5, 2025, Novanta Inc. reported second-quarter financial results showing higher sales but lower net income year-over-year, issued updated revenue guidance for the third quarter and full year 2025, and outlined plans to accelerate acquisitions leveraging a strong balance sheet and an active pipeline of targets.

- Management emphasized that attractive acquisition valuations, shifting customer demand, and favorable financial positioning present an opportunity to execute more impactful transactions in high-growth medical and intelligent systems sectors by year-end.

- We’ll consider how Novanta’s enhanced acquisition focus could influence its outlook for recurring revenue and long-term portfolio evolution.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Novanta Investment Narrative Recap

To be a Novanta shareholder today, you need confidence in the company’s ability to accelerate inorganic growth and unlock higher recurring revenue, even as organic sales remain almost flat. The recent commitment to ramp up acquisitions, supported by a strong balance sheet and attractive target valuations, is a positive for the short-term outlook. However, unless acquisition execution meaningfully outpaces integration risks, the largest immediate challenge, reliance on acquisitions for growth, remains largely unchanged by this news.

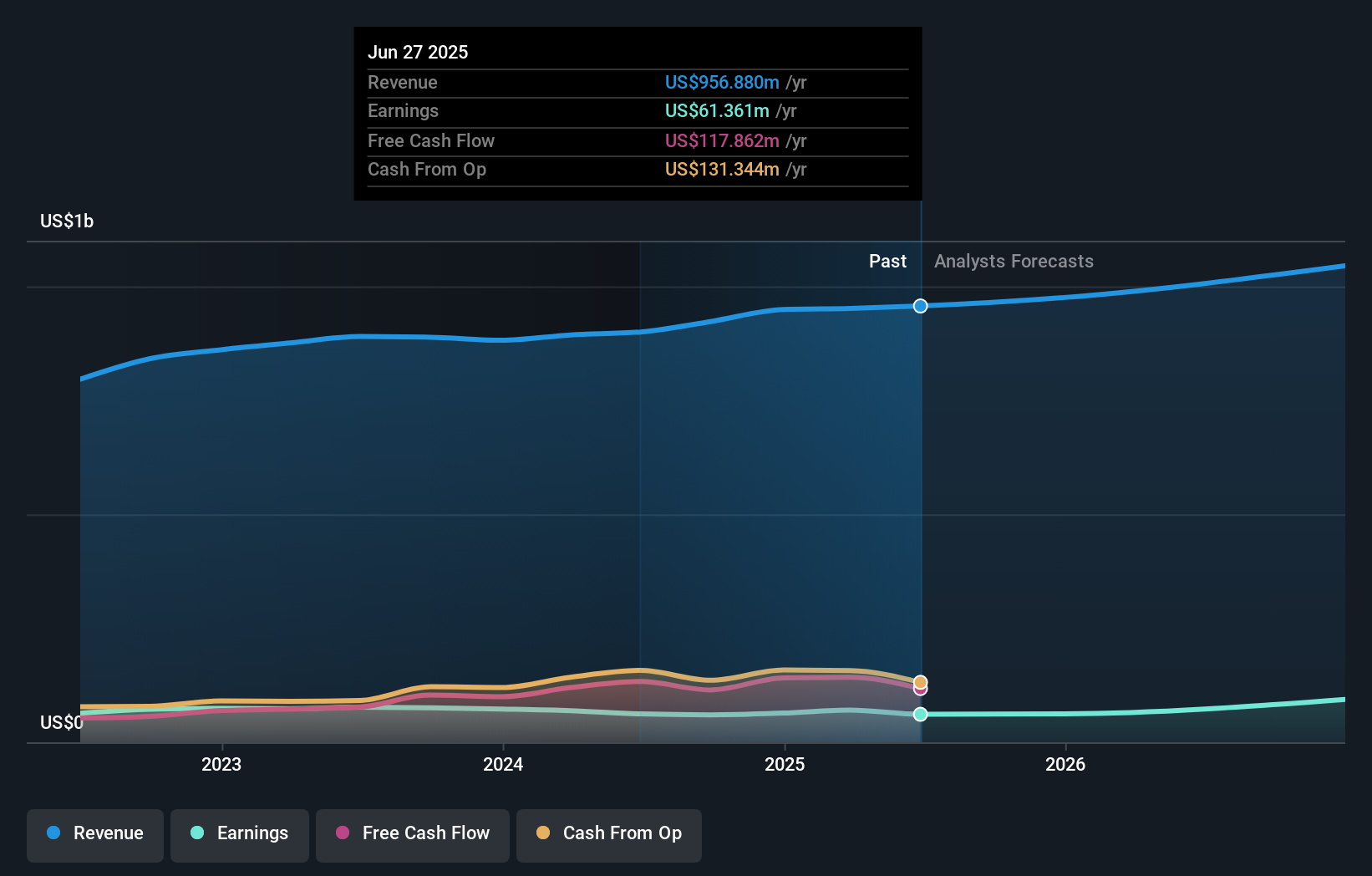

The company’s updated full-year 2025 revenue guidance, now projected at US$970 million to US$985 million, reinforces management’s expectation for incremental growth. This guidance reflects the importance of external growth drivers and provides context for the increased acquisition focus, as organic expansion appears limited in the near term.

Still, against management’s optimism, investors should be aware that if the pace or integration of acquisitions stumbles, especially with organic growth stalled...

Read the full narrative on Novanta (it's free!)

Novanta's narrative projects $1.1 billion revenue and $135.3 million earnings by 2028. This requires 5.8% yearly revenue growth and a $73.9 million earnings increase from $61.4 million currently.

Uncover how Novanta's forecasts yield a $141.50 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered just 2 fair value estimates for Novanta, ranging from US$37.82 to US$141.50. With community views varying this widely, keep in mind that ongoing dependence on acquisitions for growth could impact future outcomes and remains central to debates on the company’s path forward.

Explore 2 other fair value estimates on Novanta - why the stock might be worth less than half the current price!

Build Your Own Novanta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novanta research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Novanta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novanta's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal