Why Is SEM Reaffirming Guidance Despite Lower Profits and What Does It Signal for Its Capital Strategy?

- On July 30, 2025, Select Medical Holdings Corporation released its second quarter results, Board-approved bylaw amendments enhancing proxy and nomination procedures, declared a US$0.0625 per share dividend, reaffirmed 2025 earnings guidance, and completed a large share repurchase tranche.

- The company highlighted increased sales but reported lower net income versus the prior year, while maintaining confidence in its outlook for the full year.

- We'll explore how Select Medical Holdings' reaffirmed guidance, despite profit declines, impacts its outlook and the broader investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Select Medical Holdings Investment Narrative Recap

To be a shareholder in Select Medical Holdings, you need to believe in the resilience of facility-based acute care and rehabilitation amid industry shifts and regulatory challenges. The latest bylaw amendments and reaffirmed guidance provide a vote of confidence, but do not appear to materially move the needle for the key short-term catalyst, increasing rehab volumes, or the greatest risk, ongoing reimbursement pressures in the critical illness recovery segment.

Among the recent announcements, the reaffirmation of 2025 earnings guidance stands out as especially relevant. Despite softer quarterly profits, the company’s continued commitment to its earnings range may provide some reassurance for those tracking near-term revenue targets, which is central to the ongoing narrative about patient demand trends.

Yet, despite the company's positive outlook, investors should be aware that persistent pressure on Medicare reimbursement rates could still ...

Read the full narrative on Select Medical Holdings (it's free!)

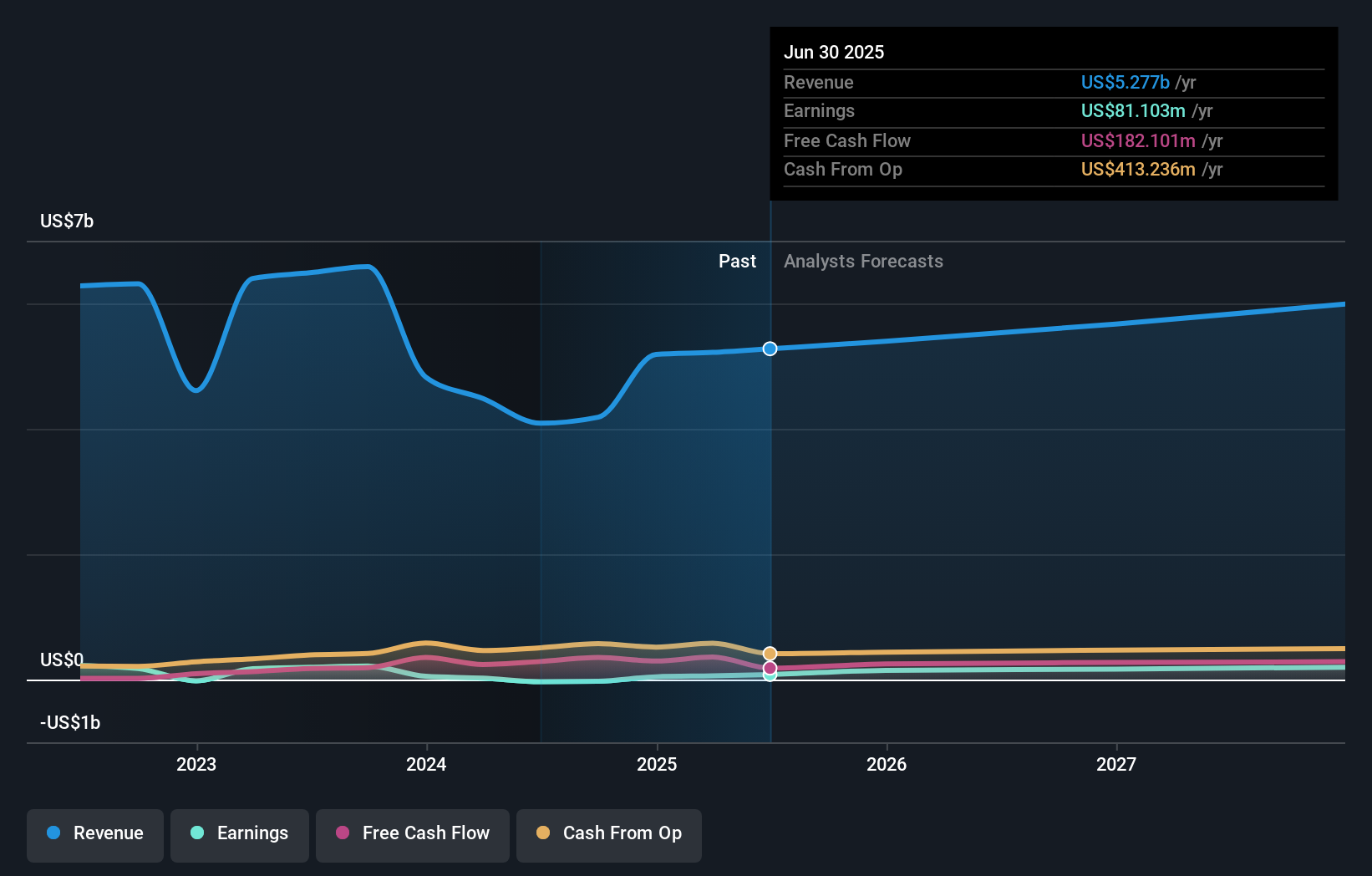

Select Medical Holdings is projected to reach $6.1 billion in revenue and $233.8 million in earnings by 2028. This outlook assumes a 5.1% annual revenue growth rate and expects earnings to rise by $152.7 million from the current $81.1 million.

Uncover how Select Medical Holdings' forecasts yield a $17.83 fair value, a 41% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair value estimates for Select Medical Holdings between US$17.83 and US$43.50 across 2 perspectives. With regulatory pressures continuing to weigh on the critical illness recovery business, it’s clear that opinions can widely differ, explore several alternative viewpoints before you decide.

Explore 2 other fair value estimates on Select Medical Holdings - why the stock might be worth just $17.83!

Build Your Own Select Medical Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Select Medical Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Select Medical Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Select Medical Holdings' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal