Will EnerSys (ENS) Dividend Growth Shift Investor Focus to Returns Over Earnings Momentum?

- EnerSys recently announced a 9% increase to its quarterly dividend, payable September 26, 2025, alongside its first-quarter fiscal 2026 results reporting revenue of US$893.02 million and net income of US$57.46 million, as well as the completion of a sizable US$228.79 million share buyback program.

- This combination of a rising dividend, ongoing capital returns, and higher sales but lower earnings year-over-year highlights the company's efforts to balance shareholder rewards with operating challenges.

- To understand how these moves affect the long-term outlook, we’ll examine how the strengthened dividend policy influences EnerSys’ investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 27 companies in the world exploring or producing it. Find the list for free.

EnerSys Investment Narrative Recap

To be a shareholder in EnerSys, investors need conviction in the company's ability to accelerate growth in energy storage markets amid a changing digital and industrial landscape. The recent dividend increase and completion of the US$228.79 million buyback are positive, though they do not materially shift the primary short-term catalyst, rising demand for data centers and communications infrastructure, or lessen ongoing risks like uncertainty in global trade policy and organic revenue stagnation.

Among the recent developments, the 9% boost to the quarterly dividend is especially relevant. This payout growth signals management's confidence in long-term cash flow generation, supporting the view that recurring shareholder returns can be maintained even as near-term organic growth challenges persist and input costs fluctuate.

By contrast, investors should stay alert to the potential drag from ongoing tariff uncertainty and...

Read the full narrative on EnerSys (it's free!)

EnerSys' outlook points to $3.9 billion in revenue and $379.1 million in earnings by 2028. This projection is based on a 2.0% annual revenue growth rate and a $28 million increase in earnings from the current $351.1 million.

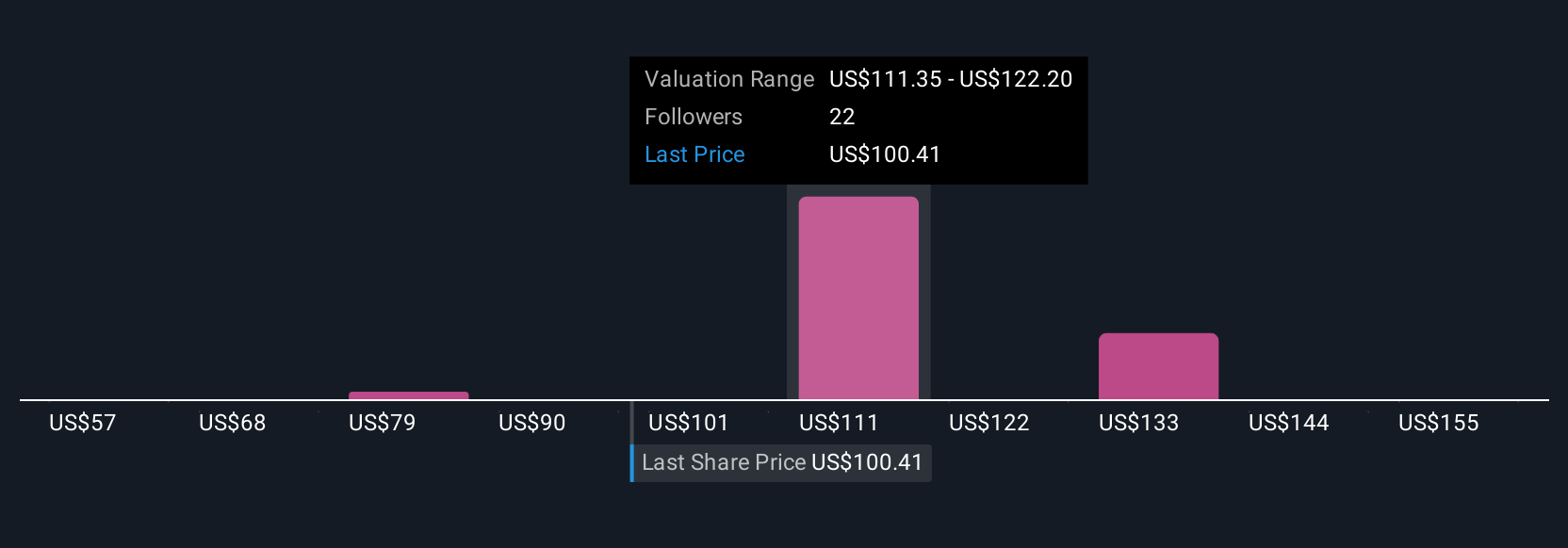

Uncover how EnerSys' forecasts yield a $111.69 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Eight Simply Wall St Community fair value estimates for EnerSys range from US$57.11 to US$165.59 per share, reflecting broad divergence in market assessments. While many see upside on cost-saving and data infrastructure catalysts, persistent concerns over global trade policy and organic growth keep expectations wide apart, review the full spectrum of view points to inform your next steps.

Explore 8 other fair value estimates on EnerSys - why the stock might be worth 43% less than the current price!

Build Your Own EnerSys Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EnerSys research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EnerSys research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EnerSys' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal