Atmos Energy (ATO) Raises 2025 Guidance and Dividend—Is Management Signaling Enduring Confidence?

- In August 2025, Atmos Energy reported third quarter earnings showing year-over-year growth, raised its full-year 2025 earnings guidance to US$7.35–US$7.45 per diluted share, and announced a quarterly dividend of US$0.87 per share payable in September.

- The company’s ability to increase guidance and deliver consistent dividend payments for 167 consecutive quarters hints at stable operations and management confidence in future performance.

- We’ll examine how Atmos Energy’s raised earnings outlook could influence its long-term investment case amid Texas pipeline expansion and regulatory shifts.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Atmos Energy Investment Narrative Recap

To be a shareholder in Atmos Energy, you need to believe in steady demand growth for natural gas infrastructure, dependable regulatory support in key markets, and the company's ability to convert ongoing expansion into rising earnings and stable dividends. While the recent raised earnings guidance for 2025 reinforces management’s confidence and supports near-term optimism, it does not materially change the most immediate business catalyst, capital recovery tied to Texas pipeline expansion, or offset the key risk of rising capital and operating expenses putting pressure on margins and free cash flow.

Among recent announcements, the affirmation of Atmos Energy’s 167th consecutive quarterly dividend stands out as a marker of both resilience and predictability, especially in the utility sector. For investors, this history of uninterrupted dividends aligns closely with the narrative catalysts of predictable cash flows and favorable regulation, but should be weighed against the increasing cost base and debt-funded investments needed to sustain long-term network modernization.

However, investors should also be aware of the potential downside if expanding capital expenditures...

Read the full narrative on Atmos Energy (it's free!)

Atmos Energy's outlook anticipates $6.3 billion in revenue and $1.6 billion in earnings by 2028. This is based on an annual revenue growth rate of 10.9% and an earnings increase of $0.4 billion from current earnings of $1.2 billion.

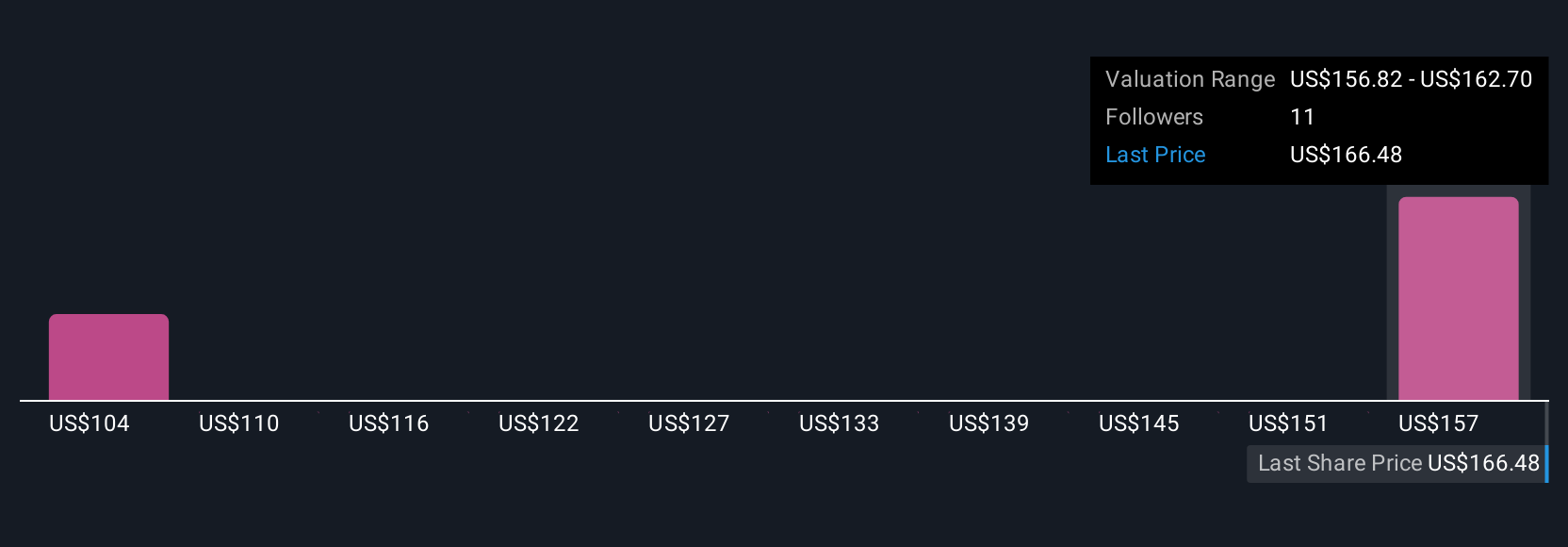

Uncover how Atmos Energy's forecasts yield a $162.00 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair value for Atmos Energy between US$104.47 and US$162, based on two widely varying forecasts. As you consider this spread, remember the company’s rising capital expenditures and how external financing needs can influence future returns and risk overall performance.

Explore 2 other fair value estimates on Atmos Energy - why the stock might be worth as much as $162.00!

Build Your Own Atmos Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atmos Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Atmos Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atmos Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal