How UGI's (UGI) Growing Losses and Stable Dividend Are Shaping Its Investment Story

- UGI Corporation recently reported its third-quarter and nine-month earnings, posting US$1.39 billion in quarterly sales and a widened quarterly net loss of US$163 million, while affirming its quarterly dividend of US$0.375 per share payable in October 2025.

- Despite higher sales, the significant increase in the company's net loss highlights ongoing operational and cost pressures, even as management maintains its dividend commitment.

- We'll examine how the sharp rise in UGI's quarterly net loss may alter its investment narrative and future earnings expectations.

Find companies with promising cash flow potential yet trading below their fair value.

UGI Investment Narrative Recap

To be a shareholder in UGI, you have to believe the company can successfully manage the transition away from fossil fuels while controlling costs enough to preserve stable returns. The recent third-quarter earnings report, which showed a much larger net loss despite higher sales, makes it clear that immediate operational and cost concerns remain the most important short-term focus, though this update does not appear to materially shift the biggest risk: ongoing margin pressure tied to persistent cost increases and structural demand declines in core markets.

Among the latest company actions, UGI's decision to affirm its quarterly dividend of US$0.375 per share stands out. This announcement suggests management remains committed to returning cash to shareholders, even in the face of challenging earnings, reinforcing the dividend as a near-term catalyst while cost control and margin protection efforts continue.

By contrast, investors should also keep an eye on whether ongoing cost pressures could ultimately affect...

Read the full narrative on UGI (it's free!)

UGI's outlook anticipates $9.0 billion in revenue and $794.3 million in earnings by 2028. This is based on a 7.0% yearly revenue growth rate and an increase of $376.3 million in earnings from the current level of $418.0 million.

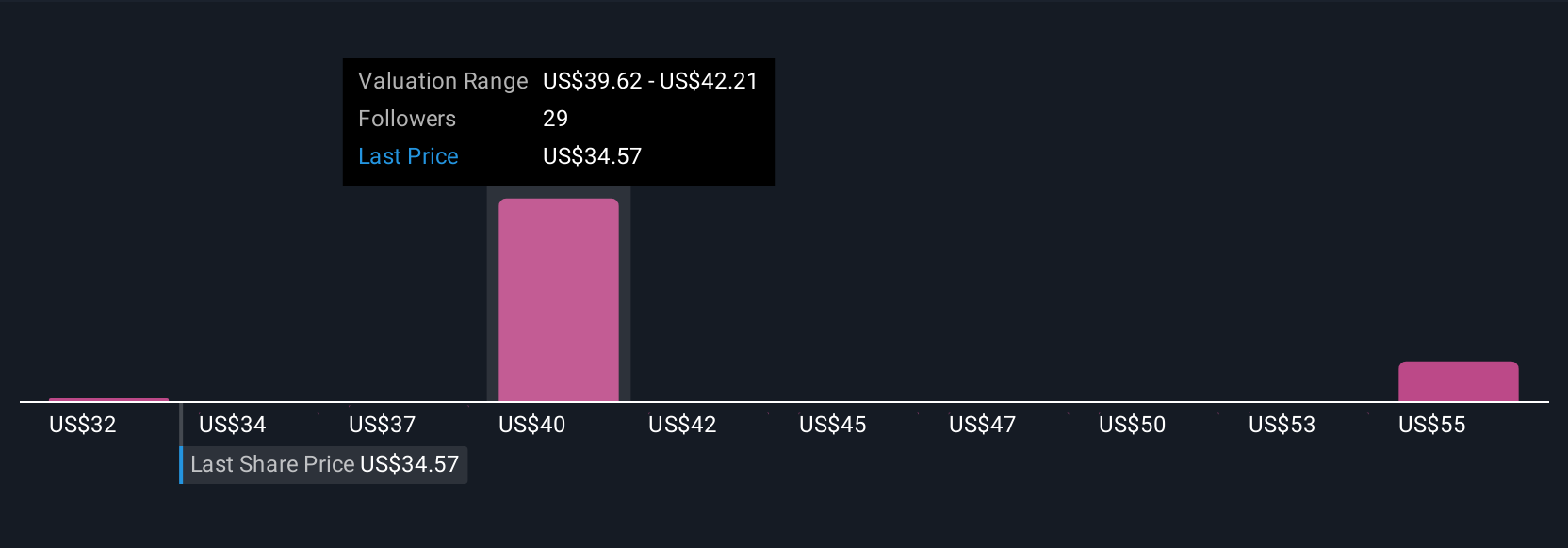

Uncover how UGI's forecasts yield a $41.00 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span US$31.87 to US$58.93. While some see significant upside, the risk of sustained operating expense growth remains a key concern impacting future earnings and cash flow; review the range of community perspectives for broader insight.

Explore 5 other fair value estimates on UGI - why the stock might be worth as much as 64% more than the current price!

Build Your Own UGI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UGI research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free UGI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UGI's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal