Will Strong Q2 Results and New Club Expansion Plans Change Planet Fitness' (PLNT) Growth Narrative?

- Planet Fitness, Inc. recently reported its second quarter 2025 results, with sales rising to US$138.99 million and net income increasing to US$58.02 million compared to the prior year, alongside announcing plans for 130 to 140 new equipment placements and 160 to 170 new franchisee-owned club openings.

- This combination of strong financial results and ambitious expansion plans points to confidence in business momentum and ongoing growth across the Planet Fitness system.

- We'll explore how Planet Fitness's robust plan for new club openings could influence its longer-term investment outlook and growth narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

Planet Fitness Investment Narrative Recap

To own Planet Fitness stock, you need to believe in the company’s ability to drive earnings by scaling its club network, attracting a broad member base, and maintaining steady franchisee expansion. The latest results and ambitious plans for 160 to 170 new club openings bolster confidence in membership growth, but do not yet appear to materially resolve concerns tied to rising member churn rates following the rollout of online cancellation features. The prospect of elevated attrition, and whether it proves temporary or entrenched, remains the key near-term risk for the business.

Among the recent announcements, Planet Fitness’s guidance for 130 to 140 new equipment placements in franchisee-owned locations is especially relevant for evaluating near-term catalysts. This investment directly supports the company’s expansion efforts, reinforcing its commitment to increasing club count and, by extension, total membership, a critical variable underpinning both recurring revenues and the platform’s longer-term growth narrative.

Yet, against these positive signals, the risk of persistent member attrition following the nationwide online cancellation rollout should remain top of mind for investors, especially since...

Read the full narrative on Planet Fitness (it's free!)

Planet Fitness is projected to reach $1.6 billion in revenue and $312.8 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 11.6% and a $123.8 million increase in earnings from the current $189.0 million level.

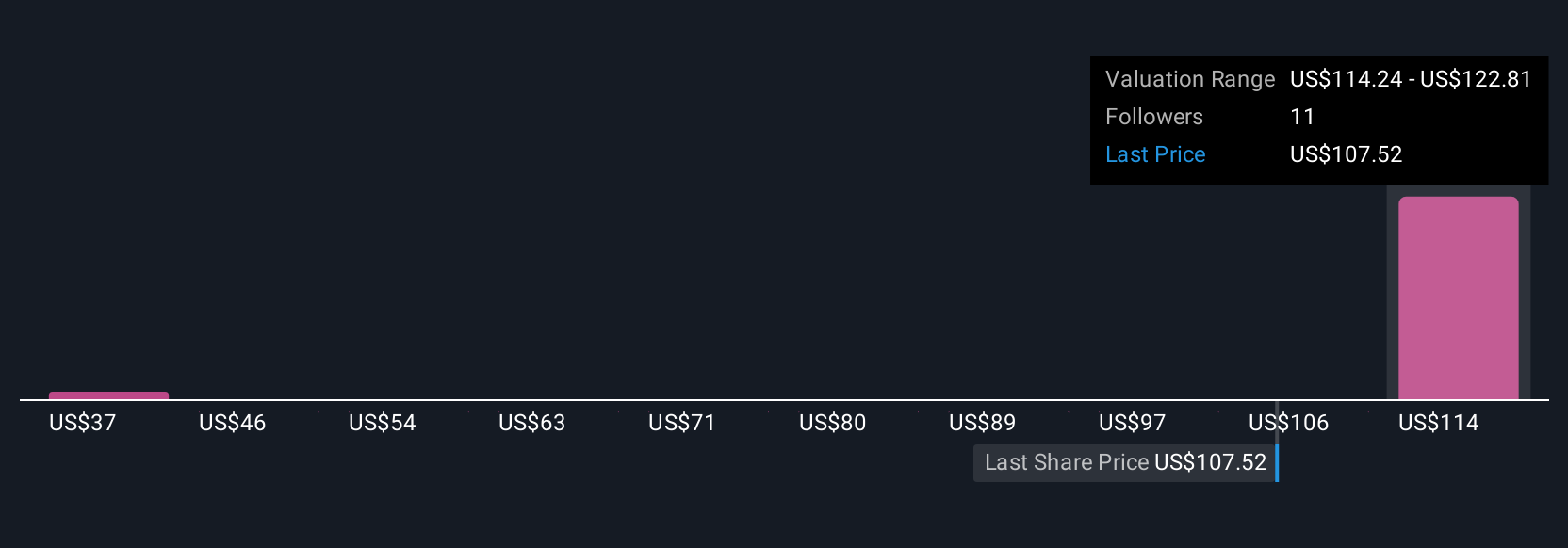

Uncover how Planet Fitness' forecasts yield a $122.81 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range from US$37.05 to US$122.81 per share. While many focus on strong expansion as an upside catalyst, your view should also weigh risks like sustaining long-term membership growth.

Explore 3 other fair value estimates on Planet Fitness - why the stock might be worth less than half the current price!

Build Your Own Planet Fitness Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Planet Fitness research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Planet Fitness research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Planet Fitness' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal