Cardinal Health (CAH) Is Down 5.4% After Net Income Doubles Despite Lower Sales – Has Profitability Turned the Tide?

- On August 12, 2025, Cardinal Health reported full-year results showing sales of US$222.58 billion and net income of US$1.56 billion, up from US$852 million the previous year.

- The company’s net income and earnings per share more than doubled year-over-year, indicating a substantial improvement in profitability despite a slight sales decline.

- To assess how this significant jump in annual profitability may shift Cardinal Health’s long-term outlook, we’ll explore its updated investment narrative.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Cardinal Health Investment Narrative Recap

To own shares in Cardinal Health, I believe an investor needs confidence in the company's ability to grow earnings and margins by leveraging operational efficiencies, managing costs, and sustaining demand for healthcare products as the population ages. The latest results, reporting a substantial jump in annual profitability despite a slight dip in sales, may strengthen conviction in Cardinal's ability to improve margins, but upcoming regulatory and pricing pressures remain the biggest risk to short-term and long-term performance. Based on these results, the most important near-term catalyst continues to be the company's capacity to protect margins, while regulatory and reimbursement headwinds are likely to limit upside and represent the most material risk right now; the impact of these results on that risk is not yet material. Of the recent company announcements, Cardinal Health’s August 2025 earnings report stands out as a key development, with net income and earnings per share more than doubling year-over-year. This improvement underpins the case that operational efficiencies and cost management efforts have started to yield returns, providing support for management’s profitability targets. It also reinforces the focus on sustaining margin gains amid ongoing competitive and regulatory challenges. Yet, in contrast to the positive momentum in profitability, investors should be aware that even a strong earnings year may not offset the impact if government reimbursement changes or competitive bidding programs return in force...

Read the full narrative on Cardinal Health (it's free!)

Cardinal Health's outlook projects $287.0 billion in revenue and $2.2 billion in earnings by 2028. This implies an annual revenue growth rate of 8.8% and a $0.6 billion increase in earnings from the current $1.6 billion.

Uncover how Cardinal Health's forecasts yield a $180.46 fair value, a 22% upside to its current price.

Exploring Other Perspectives

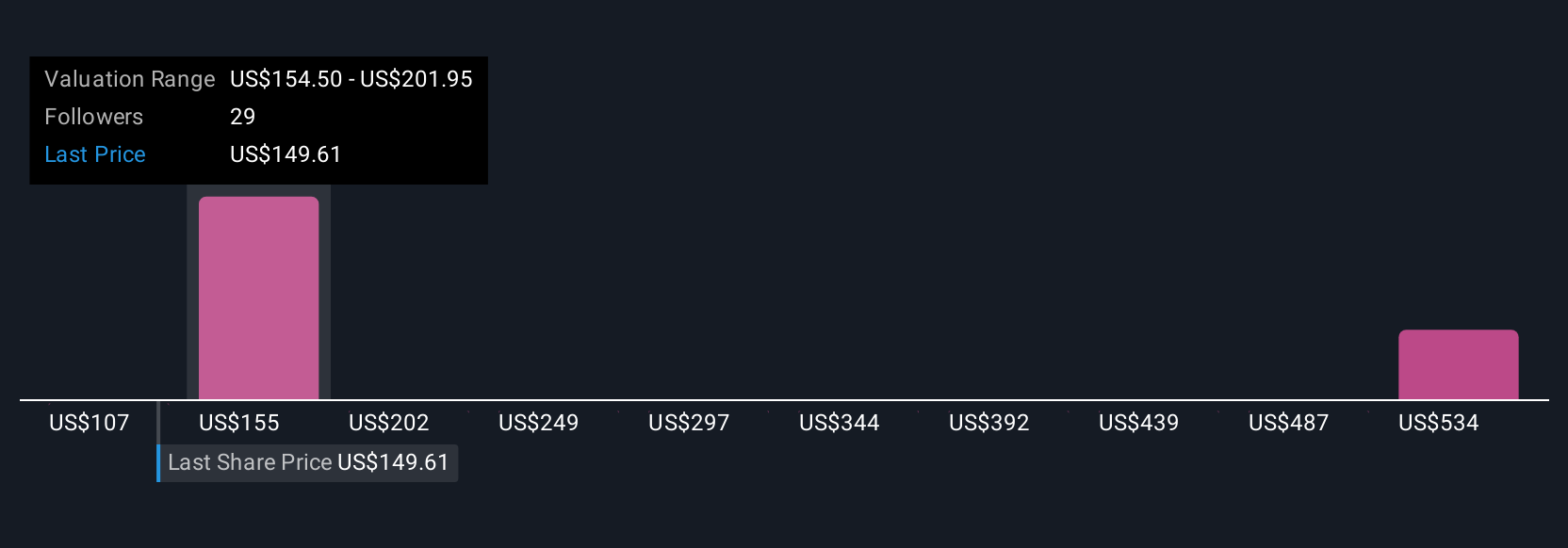

Four community fair value estimates for Cardinal Health range from US$107.06 to US$459.34, with some private investors seeing room for substantial upside. While many anticipate stable profit growth, continued regulatory scrutiny may create uncertainty for returns ahead.

Explore 4 other fair value estimates on Cardinal Health - why the stock might be worth 28% less than the current price!

Build Your Own Cardinal Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cardinal Health research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cardinal Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cardinal Health's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal