IES Holdings And 2 More Value Stocks Trading At An Estimated Discount

As the U.S. market continues its upward trajectory, with the S&P 500 and Nasdaq reaching new all-time highs, investors are keenly observing opportunities that may arise from this rally. In such an environment, identifying undervalued stocks can be crucial for those looking to capitalize on potential discounts amidst a bullish market trend.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Willdan Group (WLDN) | $118.63 | $232.57 | 49% |

| UMB Financial (UMBF) | $114.55 | $225.65 | 49.2% |

| Udemy (UDMY) | $6.86 | $13.24 | 48.2% |

| Shoals Technologies Group (SHLS) | $4.62 | $8.99 | 48.6% |

| Royal Gold (RGLD) | $172.34 | $331.91 | 48.1% |

| First Commonwealth Financial (FCF) | $16.82 | $32.97 | 49% |

| First Busey (BUSE) | $23.25 | $45.40 | 48.8% |

| Excelerate Energy (EE) | $23.98 | $46.38 | 48.3% |

| e.l.f. Beauty (ELF) | $116.75 | $224.59 | 48% |

| Dime Community Bancshares (DCOM) | $29.01 | $56.20 | 48.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

IES Holdings (IESC)

Overview: IES Holdings, Inc. designs and installs integrated electrical and technology systems while providing infrastructure products and services in the United States, with a market cap of approximately $6.70 billion.

Operations: The company generates revenue from several segments: Residential ($1.34 billion), Communications ($1.03 billion), Commercial & Industrial ($418.64 million), and Infrastructure Solutions ($465.63 million).

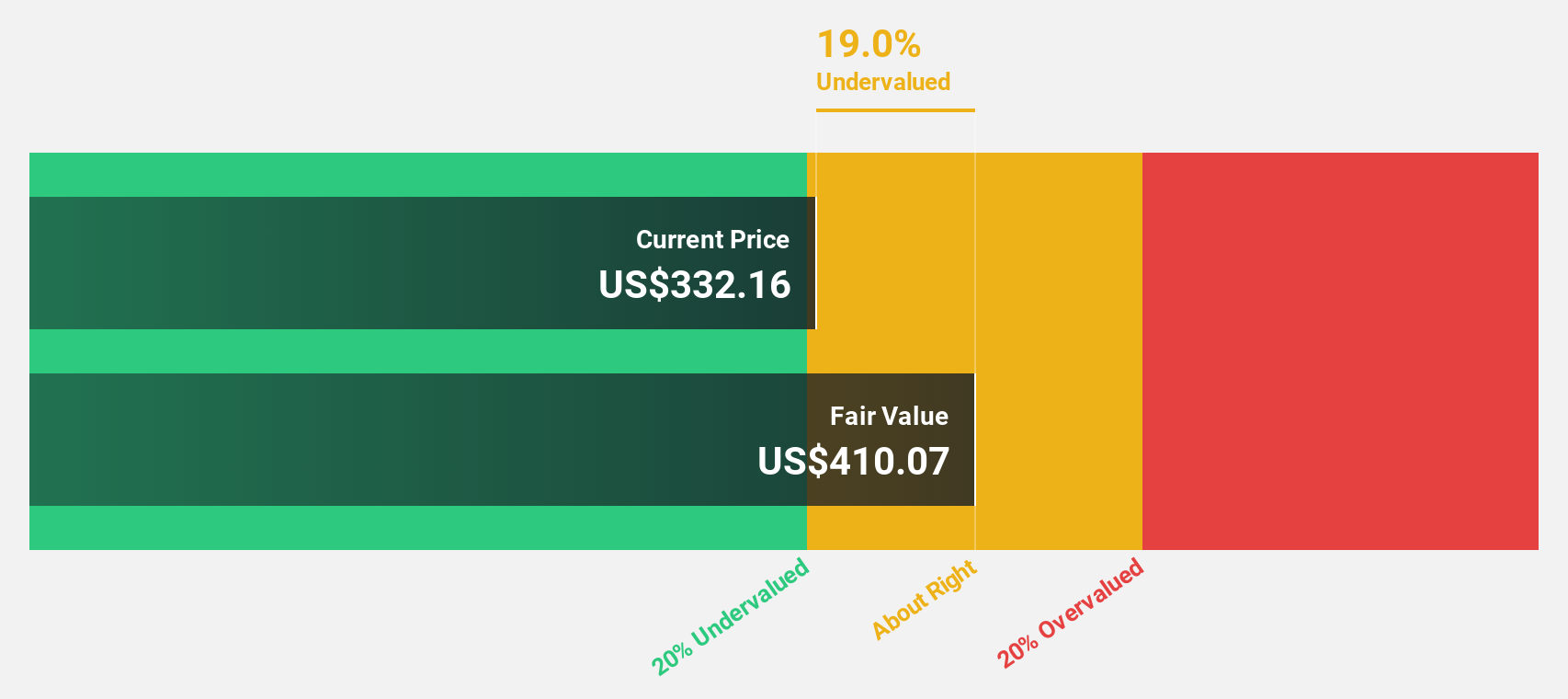

Estimated Discount To Fair Value: 13.7%

IES Holdings appears undervalued based on cash flows, trading at US$353.71, below its estimated fair value of US$409.94. The company reported strong earnings growth for Q3 2025 with sales reaching US$890.16 million and net income of US$77.23 million, up from the previous year. Despite significant insider selling recently, IES is forecast to grow earnings at 19.4% annually, outpacing the broader market's growth rate of 15%.

- Our expertly prepared growth report on IES Holdings implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in IES Holdings' balance sheet health report.

Willdan Group (WLDN)

Overview: Willdan Group, Inc. offers professional, technical, and consulting services mainly in the United States, with a market cap of approximately $1.65 billion.

Operations: The company generates revenue through its Energy segment, contributing $527.71 million, and its Engineering & Consulting segment, which adds $100.46 million.

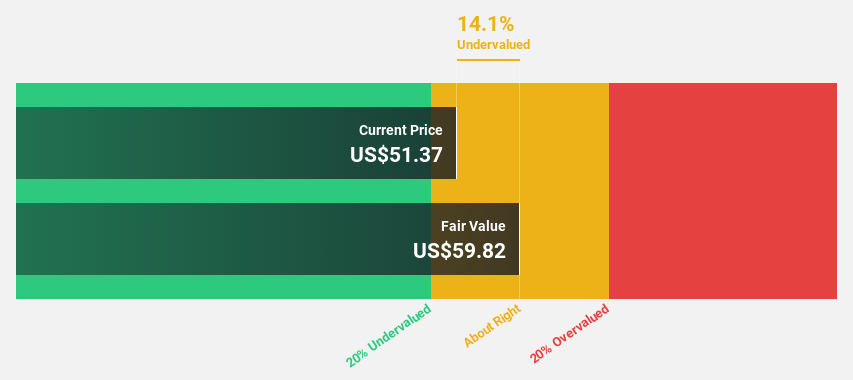

Estimated Discount To Fair Value: 49%

Willdan Group is trading at US$118.63, significantly below its estimated fair value of US$232.57, highlighting its undervaluation based on cash flows. The company reported robust earnings for Q2 2025, with sales of US$173.47 million and net income of US$15.44 million, up from the previous year. With earnings forecasted to grow at 29.5% annually, surpassing the broader market's growth rate, Willdan has raised its revenue guidance for 2025 to between $340 million and $350 million.

- The growth report we've compiled suggests that Willdan Group's future prospects could be on the up.

- Navigate through the intricacies of Willdan Group with our comprehensive financial health report here.

Life Time Group Holdings (LTH)

Overview: Life Time Group Holdings, Inc. operates health, fitness, and wellness centers for individual members across the United States and Canada, with a market cap of approximately $6.12 billion.

Operations: The company generates revenue of $2.82 billion from personal services and other related offerings in the United States and Canada.

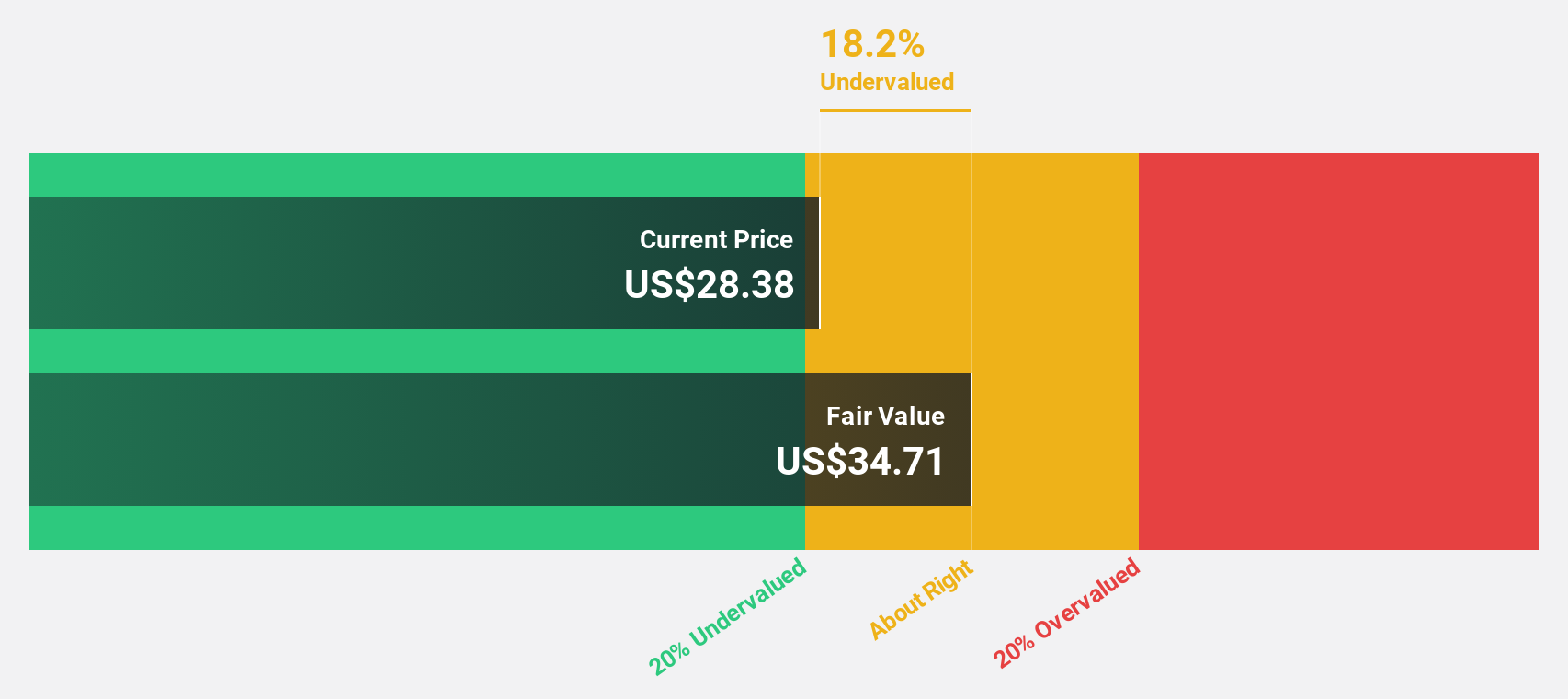

Estimated Discount To Fair Value: 20%

Life Time Group Holdings is trading at US$27.6, below its estimated fair value of US$34.48, indicating potential undervaluation based on cash flows. The company reported strong Q2 2025 results with revenue of US$761.47 million and net income of US$72.1 million, both up from the previous year. Life Time has raised its full-year revenue guidance to between $2.955 billion and $2.985 billion, amidst ongoing business expansions in key markets like Atlanta and Sacramento.

- Our growth report here indicates Life Time Group Holdings may be poised for an improving outlook.

- Dive into the specifics of Life Time Group Holdings here with our thorough financial health report.

Make It Happen

- Dive into all 182 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal