Will Hyatt's (H) Q2 Revenue Growth and Loyalty Expansion Shift Its Investment Story?

- Hyatt Hotels Corporation recently announced its second quarter 2025 earnings, highlighting revenue growth to US$1.81 billion and net loss of US$3 million, alongside a revised full-year net income forecast between US$135 million and US$165 million.

- The company also expanded its loyalty program through participation with Bunkhouse Hotels and maintained its quarterly dividend, underscoring a continued focus on brand and guest experience enhancement despite recent margin pressures.

- We'll examine how Hyatt's higher-than-expected revenue growth and business model transition could influence its investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Hyatt Hotels Investment Narrative Recap

To own Hyatt Hotels shares, you need confidence in its asset-light transformation, loyalty program expansion, and continued appeal to higher-tier travelers. The company’s Q2 2025 results, which featured higher revenue but a swing to a net loss, do not appear to materially alter the short-term catalyst of anticipated revenue growth tied to increased management fees, though margin contraction and softness in some U.S. properties remain the biggest near-term risk.

Of the recent developments, Hyatt's revised 2025 earnings guidance, now projecting net income between US$135 million and US$165 million, most clearly connects to investor expectations for ongoing operational gains, even as margin pressure has moderated prior optimism. Investors might view this guidance shift as a measured response to near-term headwinds, reinforcing the focus on stabilizing returns rather than immediate growth acceleration.

Yet, with margins facing pressure, investors should keep in mind that if expense trends persist or leisure demand weakens, the risk to...

Read the full narrative on Hyatt Hotels (it's free!)

Hyatt Hotels' outlook projects $8.0 billion in revenue and $440.7 million in earnings by 2028. This assumes a 35.6% annual revenue growth rate, but a decrease in earnings of $353.3 million from the current $794.0 million.

Uncover how Hyatt Hotels' forecasts yield a $154.42 fair value, a 10% upside to its current price.

Exploring Other Perspectives

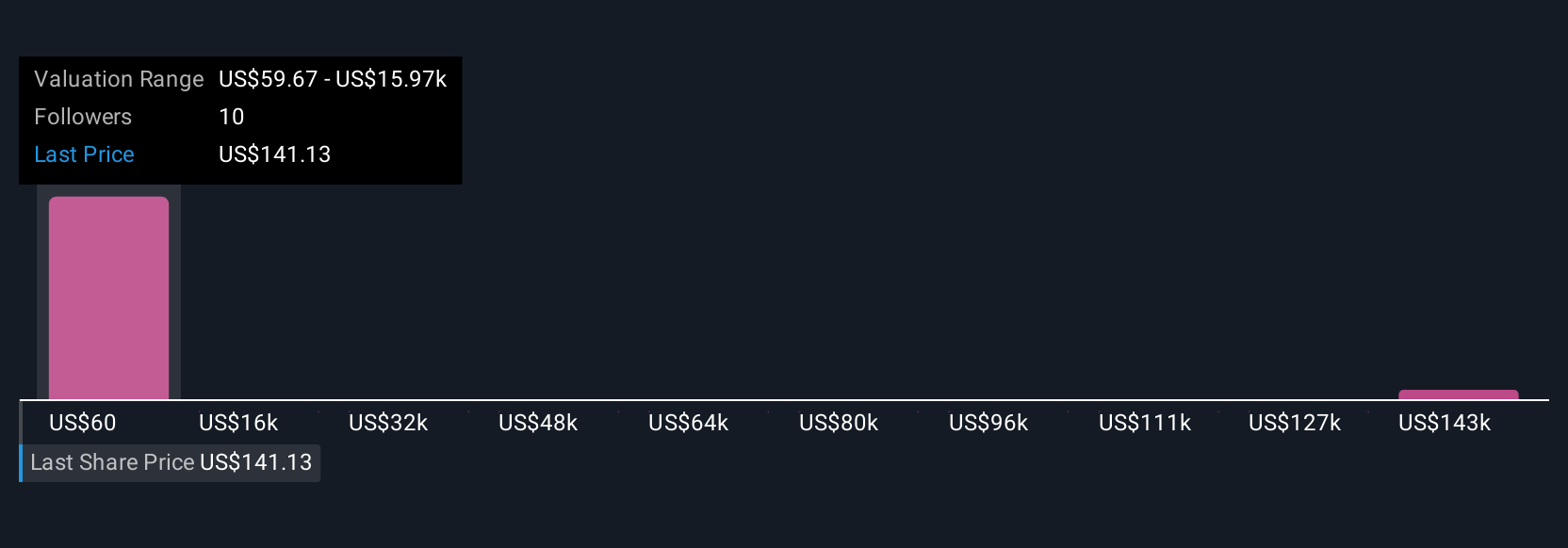

Six members of the Simply Wall St Community offered fair values for Hyatt that ranged from US$73 to over US$159,128 per share. With changing margin trends impacting guidance, opinions continue to vary on Hyatt’s performance outlook and it’s worth exploring how different views may inform your own expectations.

Explore 6 other fair value estimates on Hyatt Hotels - why the stock might be a potential multi-bagger!

Build Your Own Hyatt Hotels Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hyatt Hotels research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Hyatt Hotels research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hyatt Hotels' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal