How Does HCA Healthcare's (HCA) Analyst Optimism Reflect Its Operational Scale and Talent Investment Strategy?

- In recent days, HCA Healthcare highlighted its operational scale as the largest non-governmental acute care hospital operator in the US, while also receiving positive attention from analysts amid upward earnings revisions and strong performance metrics.

- The company also reaffirmed its commitment to employee family support, with the HCA Healthcare Foundation awarding over US$15 million in scholarships, emphasizing a culture of philanthropy and staff development.

- We'll explore how renewed analyst optimism around HCA Healthcare's earnings momentum may influence its investment outlook and growth assumptions.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

HCA Healthcare Investment Narrative Recap

HCA Healthcare's investment narrative centers on sustained volume growth in patient admissions and outpatient services, supported by improved operational efficiencies and disciplined capital allocation. While the recent scholarship program and analyst optimism shine a positive light on HCA’s culture and performance, they do not materially affect the current primary catalyst, earnings momentum from volume and margin gains, or the main risk, ongoing federal policy and regulatory uncertainty impacting revenues and expenses.

The company’s recent raised corporate guidance, forecasting higher revenues and earnings for 2025, is particularly relevant. This announcement reinforces short-term optimism around HCA’s ability to translate operational strength into tangible financial results, reflecting the same momentum highlighted by analysts and possibly addressing market expectations tied to growth and profitability.

However, investors should also consider that while recent achievements suggest resilience, potential regulatory changes to Medicaid reimbursement could still present significant risks to revenue stability...

Read the full narrative on HCA Healthcare (it's free!)

HCA Healthcare's narrative projects $85.7 billion revenue and $6.9 billion earnings by 2028. This requires 5.6% yearly revenue growth and a $0.9 billion earnings increase from $6.0 billion today.

Uncover how HCA Healthcare's forecasts yield a $394.10 fair value, in line with its current price.

Exploring Other Perspectives

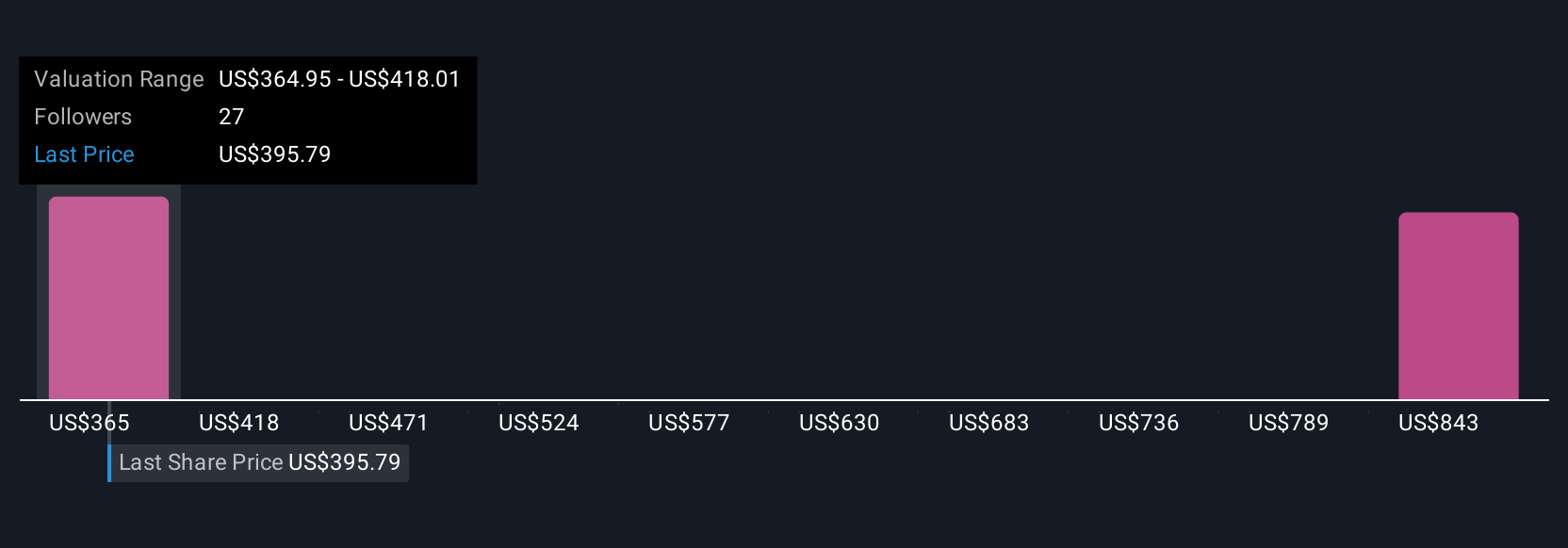

Fair value estimates from seven Simply Wall St Community members range from US$364.95 to US$895.64 per share. These varied views come as HCA’s guidance increases but regulatory uncertainty remains a critical consideration for you and other market participants, explore multiple opinions for a balanced view.

Explore 7 other fair value estimates on HCA Healthcare - why the stock might be worth over 2x more than the current price!

Build Your Own HCA Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HCA Healthcare research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free HCA Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HCA Healthcare's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal