Does LCII’s Recent Buyback Reflect Enduring Confidence or a Shift in Long-Term Capital Priorities?

- In recent months, LCI Industries completed the repurchase of 1,057,667 shares for US$100.58 million and reported increased sales for July 2025, along with higher six-month net income compared to the prior year.

- The alignment of capital allocation via buybacks and continued sales growth highlights management’s confidence in the company’s long-term positioning within the RV and adjacent markets.

- We'll examine how the completed share repurchase, reflecting capital discipline, influences the outlook for LCI Industries’ investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

LCI Industries Investment Narrative Recap

To hold LCI Industries stock, an investor needs confidence in a recovery and ongoing normalization in the cyclical North American RV market, supported by consumer lifestyle trends and expanded aftermarket opportunities. The recent share repurchase underlines management’s capital discipline, but it is unlikely to directly change the short-term catalyst, continued demand stability in core OEM RV production, nor does it resolve the risk of prolonged weakness in RV retail demand or dealer restocking, which is still the most important challenge for earnings momentum.

Among recent updates, LCI’s July 2025 sales growth of 5% stands out, as it was primarily driven by contributions from acquired businesses and pricing, partially offset by lower RV production volumes. This result highlights how headline revenue increases may mask ongoing pressures in the organic RV OEM business, keeping the focus on how underlying demand volatility could shape performance over the next several quarters.

But, even with disciplined capital returns, the exposure to ongoing weakness in RV retail demand means investors should be aware of...

Read the full narrative on LCI Industries (it's free!)

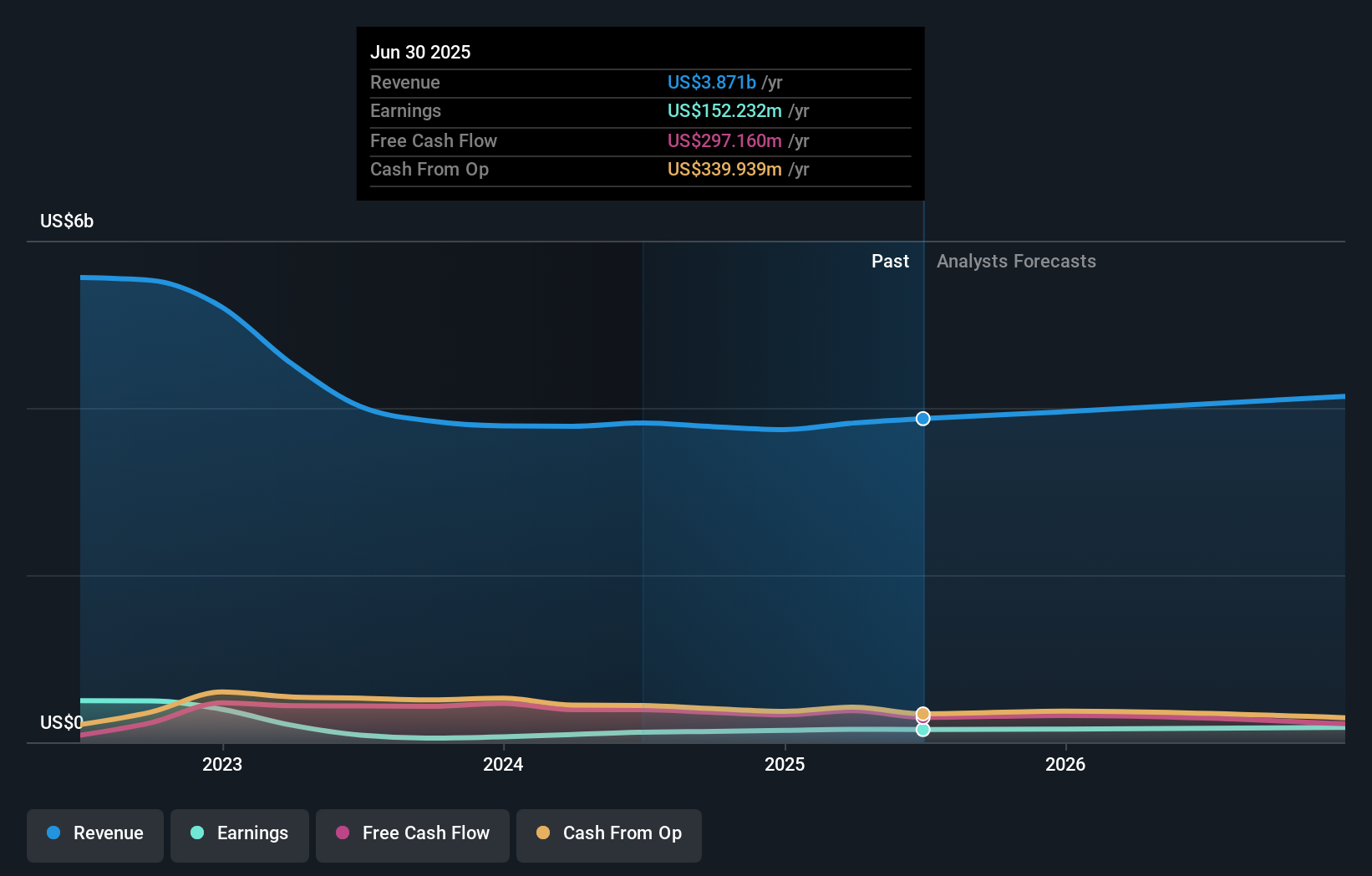

LCI Industries' narrative projects $4.3 billion in revenue and $183.1 million in earnings by 2028. This requires 4.3% yearly revenue growth and a $27.3 million earnings increase from the current $155.8 million.

Uncover how LCI Industries' forecasts yield a $103.00 fair value, in line with its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community range from US$89.04 to US$103 per share. While some see upside, the group’s outlook varies and continued softness in RV production volumes remains a key factor to watch. Consider the range of views as you weigh your own expectations.

Explore 2 other fair value estimates on LCI Industries - why the stock might be worth 12% less than the current price!

Build Your Own LCI Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LCI Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LCI Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LCI Industries' overall financial health at a glance.

No Opportunity In LCI Industries?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal