Prestige Consumer Healthcare (PBH) Trims Outlook as Sales Dip—Is the Acquisition Strategy Still on Track?

- Prestige Consumer Healthcare Inc. recently reported first-quarter results, with sales reaching US$249.28 million and net income at US$47.47 million, both lower than the previous year, and the company also reduced its full-year revenue and earnings guidance for fiscal 2026.

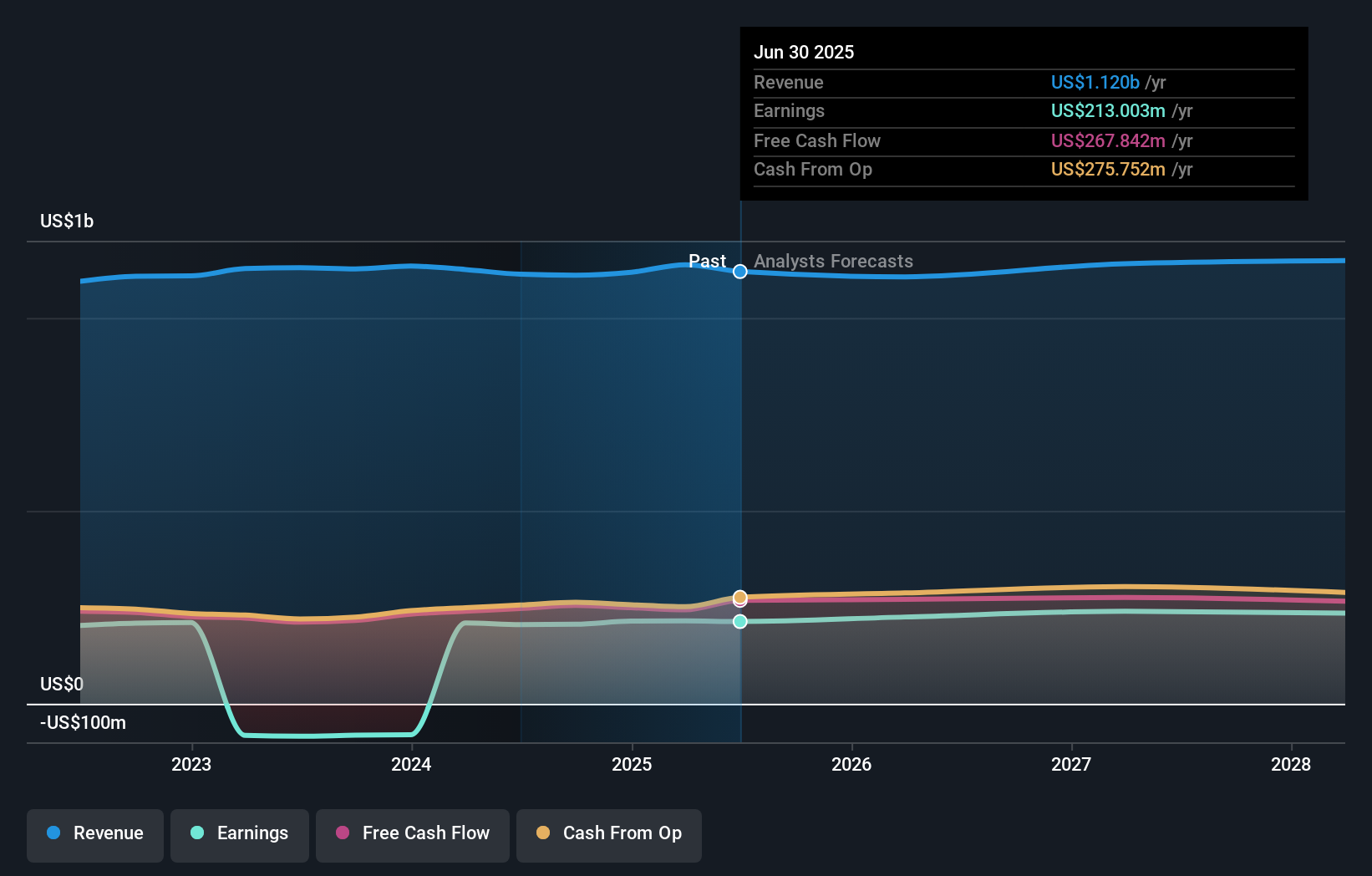

- This announcement followed comments from company leadership highlighting ongoing efforts to pursue acquisitions and investments, supported by an expected US$1 billion in free cash flow over four years.

- We'll examine how Prestige's revised guidance, reflecting near-term operational headwinds, could influence its long-term investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Prestige Consumer Healthcare Investment Narrative Recap

To be a shareholder in Prestige Consumer Healthcare, you need to believe in its ability to sustain growth through portfolio brands and effective capital allocation, even amid recent revenue and earnings pressure. While the lowered fiscal 2026 guidance signals operational headwinds, the most important short-term catalyst remains the company’s disciplined pursuit of acquisitions, which is supported by robust free cash flow. The biggest risk in the near term continues to be potential supply chain disruptions, especially for core brands, but this update does not materially shift that outlook.

Of the latest announcements, Prestige’s reaffirmed focus on mergers and acquisitions stands out, as company leadership highlighted plans to use their expected US$1 billion in free cash flow to explore disciplined investment opportunities. This is especially relevant given that M&A activity could offset earnings weakness and set up new growth levers, tying directly to market expectations about catalysts for future performance.

However, with ongoing supply chain uncertainty potentially affecting both revenue and costs, investors should be mindful that...

Read the full narrative on Prestige Consumer Healthcare (it's free!)

Prestige Consumer Healthcare is projected to reach $1.2 billion in revenue and $253.0 million in earnings by 2028. This outlook assumes annual revenue growth of 1.6% and an earnings increase of $38.4 million from the current earnings of $214.6 million.

Uncover how Prestige Consumer Healthcare's forecasts yield a $82.80 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Only one Simply Wall St Community member has estimated a fair value for Prestige, setting it at US$82.80 per share. Despite this, ongoing supply chain challenges continue to weigh on earnings forecasts, shaping contrasting opinions about the company's future direction.

Explore another fair value estimate on Prestige Consumer Healthcare - why the stock might be worth just $82.80!

Build Your Own Prestige Consumer Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Prestige Consumer Healthcare research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Prestige Consumer Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Prestige Consumer Healthcare's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal