Can Delek Logistics (DKL) Unlock Sustainable Profit Growth Amid Lower Revenues and Major Expansion Moves?

- Delek Logistics Partners, LP recently announced financial results for the second quarter of 2025, reporting net income of US$44.57 million on revenues of US$246.35 million, compared to net income of US$41.06 million and revenues of US$264.63 million for the same period last year.

- Despite a decrease in sales, the company achieved higher net income while also bringing a new gas processing facility online and completing a US$700 million debt issuance to support further growth initiatives.

- We’ll look at how improved profitability amid lower revenues, highlighted by the new gas facility, could influence Delek Logistics Partners' investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Delek Logistics Partners Investment Narrative Recap

For Delek Logistics Partners, the core investment narrative hinges on confidence in US energy infrastructure demand and ongoing high utilization of Permian Basin assets. The recent earnings report, with improved profitability despite lower sales, supports the short-term catalyst of operational ramp-up at the new gas processing facility; however, it does not materially change the biggest risk right now, which remains elevated leverage due to recent debt financing.

Among the latest announcements, the closure of a US$700 million senior notes offering stands out, directly tying into the company's ongoing liquidity and growth strategy. With expanded capital, Delek Logistics underscores its intent to support new projects and acquisitions as the newly commissioned Libby 2 gas facility comes online, key to management’s focus on expanding gathering and processing capacity.

In contrast, investors should be aware that higher debt levels may increase pressure on earnings and dividends if forecast cash flows disappoint…

Read the full narrative on Delek Logistics Partners (it's free!)

Delek Logistics Partners is projected to reach $1.2 billion in revenue and $292.8 million in earnings by 2028. This outlook is based on analysts' assumptions of 9.1% annual revenue growth and an earnings increase of $141 million from the current $151.8 million.

Uncover how Delek Logistics Partners' forecasts yield a $43.50 fair value, in line with its current price.

Exploring Other Perspectives

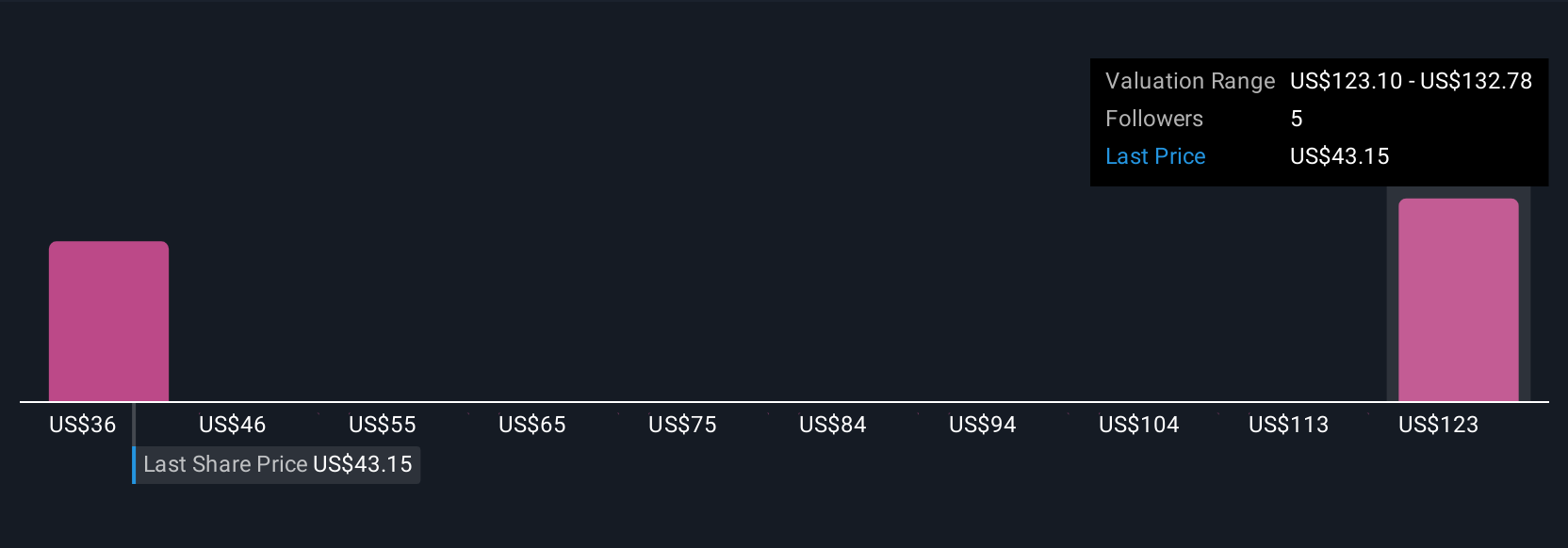

Fair value estimates from three Simply Wall St Community members range widely, from US$36 up to US$131.65 per share. While some see outsized upside, others may be weighing the company's increased leverage and the need for strong cash flow to service new debt, highlighting how views on risk and growth can vary.

Explore 3 other fair value estimates on Delek Logistics Partners - why the stock might be worth over 3x more than the current price!

Build Your Own Delek Logistics Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delek Logistics Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Delek Logistics Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delek Logistics Partners' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal