Will SPB’s Acquisition Strategy Balance Growth and Discipline Amidst Soft Sales and Ongoing Capital Returns?

- In August 2025, Spectrum Brands Holdings reported a decline in sales for its third quarter but saw improved net income, affirmed a quarterly dividend of US$0.47 per share, completed a significant share repurchase, and signaled an active search for acquisitions in its Pet and Home & Garden businesses.

- An interesting takeaway is the company's intent to fill product gaps within its pet platform using acquisitions, while maintaining a disciplined approach supported by what management describes as a strong, liquid balance sheet.

- We'll explore how Spectrum Brands Holdings' pursuit of value-accretive acquisitions could influence its investment narrative and long-term growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Spectrum Brands Holdings Investment Narrative Recap

To be a long-term shareholder in Spectrum Brands Holdings, you need faith in its ability to grow earnings through portfolio expansion and operational improvements, especially in Pet and Home & Garden. The company’s continued interest in acquisitions might stir optimism, but short-term risks around tariff exposure and execution still loom large, with no material change to these factors in the most recent update.

Among recent developments, the aggressive share repurchase program stands out, with 17.3% of shares bought back for US$384.45 million, highlighting the company's emphasis on returning capital to shareholders. The buyback helps support earnings per share and may offer a buffer if operational challenges persist.

Yet, while Spectrum’s management points to a strong balance sheet, investors should closely watch for the operational and cost risks of relocating production out of China if tariffs remain a headwind as...

Read the full narrative on Spectrum Brands Holdings (it's free!)

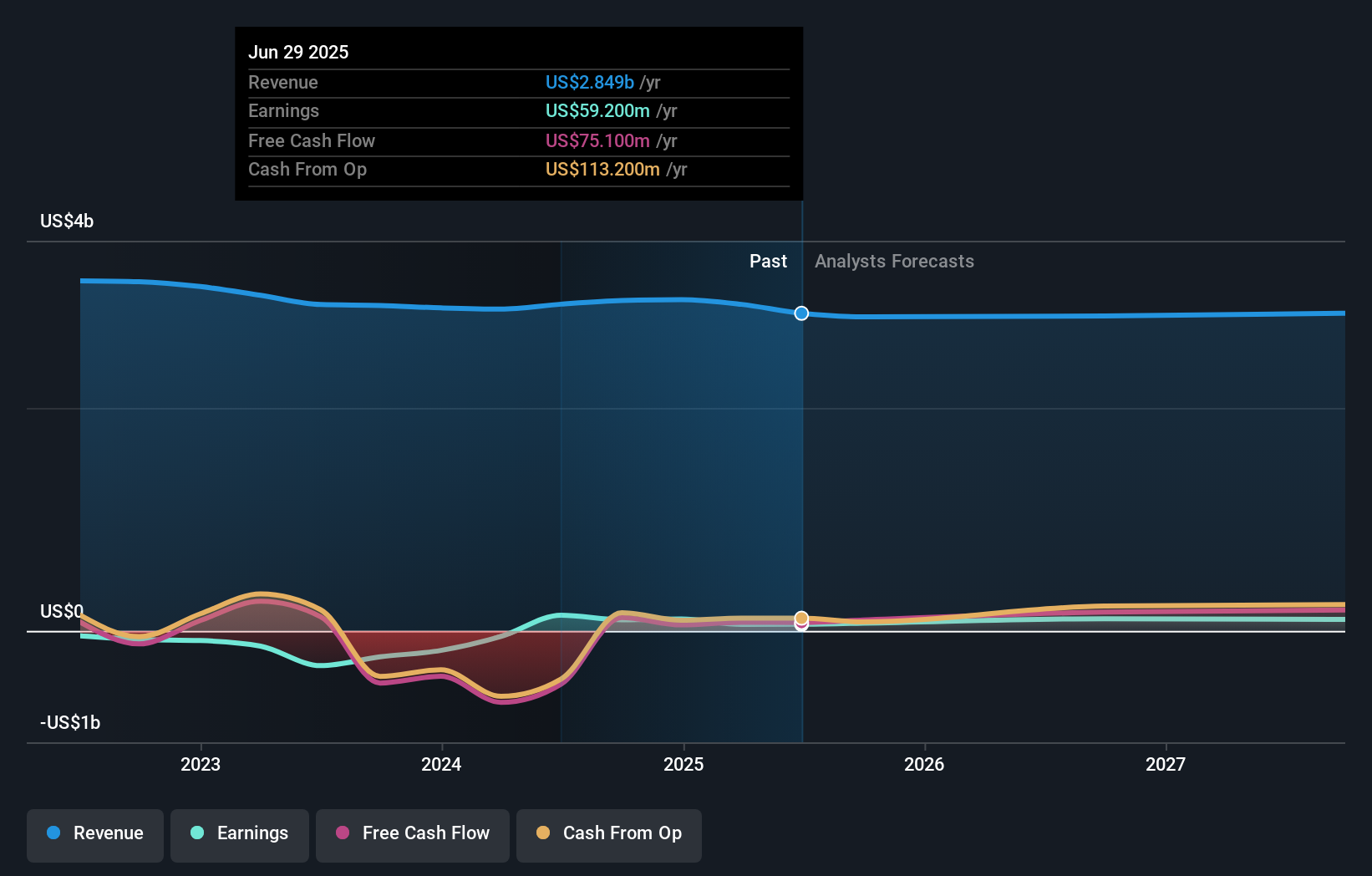

Spectrum Brands Holdings' outlook anticipates $2.9 billion in revenue and $124.8 million in earnings by 2028. This scenario is based on a 0.4% annual revenue decline and a $67.2 million earnings increase from the current earnings of $57.6 million.

Uncover how Spectrum Brands Holdings' forecasts yield a $81.29 fair value, a 43% upside to its current price.

Exploring Other Perspectives

Community members’ fair value estimates for Spectrum Brands Holdings range widely, from US$81.29 up to US$235.12, based on 2 independent analyses. While many see substantial upside, ongoing tariff and supply chain uncertainties add further complexity to these divergent outlooks.

Explore 2 other fair value estimates on Spectrum Brands Holdings - why the stock might be worth over 4x more than the current price!

Build Your Own Spectrum Brands Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spectrum Brands Holdings research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Spectrum Brands Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spectrum Brands Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal