Stronger Q2 Results and Raised Capex Could Be a Game Changer for Chesapeake Utilities (CPK)

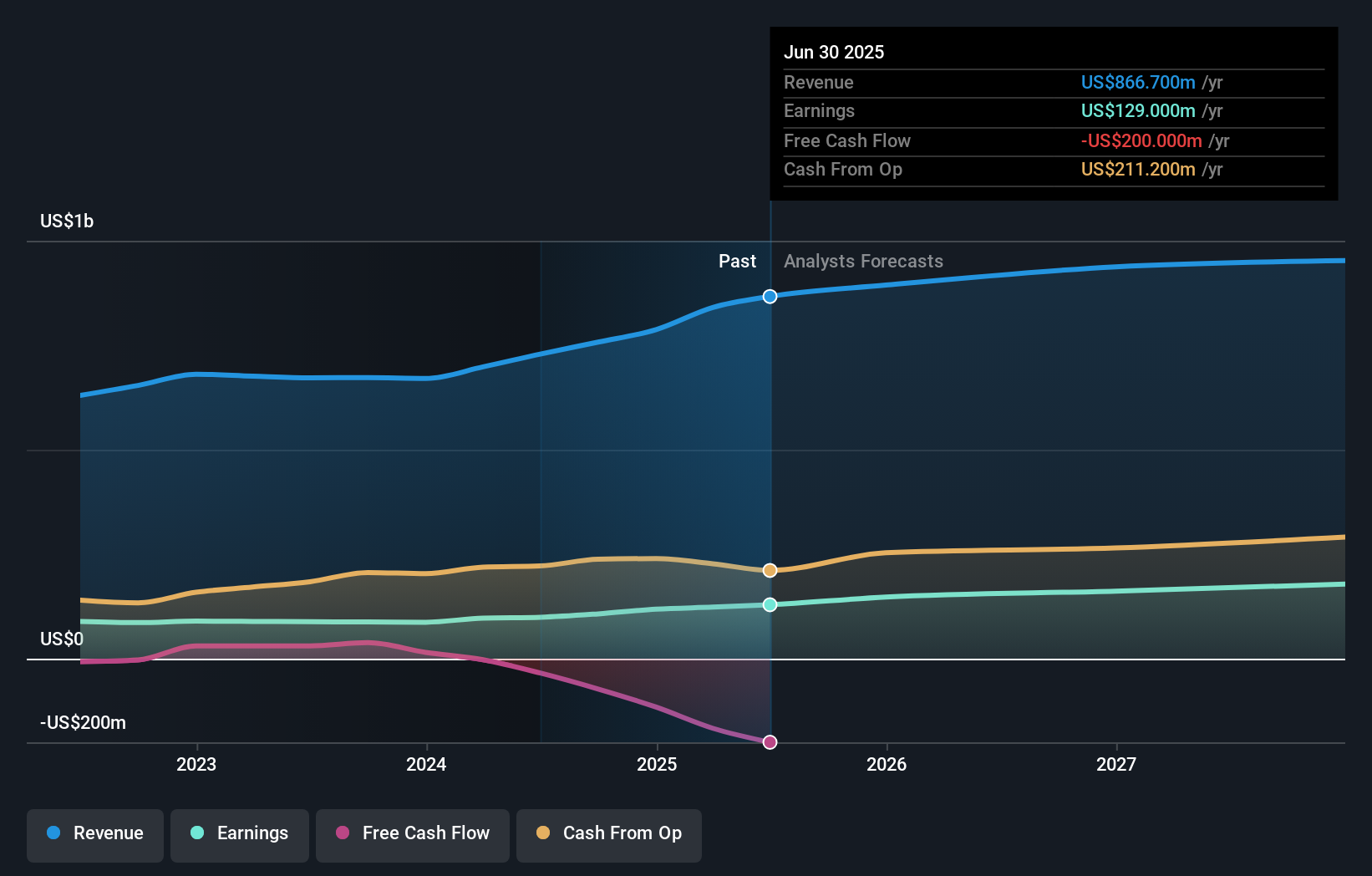

- Chesapeake Utilities Corporation recently reported strong second quarter 2025 results, with revenue and earnings per share from continuing operations both increasing compared to the same period last year, and raised its 2025 capital expenditure guidance by US$50 million to support natural gas infrastructure expansion and customer growth.

- The company reaffirmed its earnings guidance through 2028, secured regulatory approvals across multiple states, and maintained its 64-year unbroken dividend record, reflecting both operational momentum and a focus on shareholder value.

- Next, we'll evaluate how the strengthened earnings outlook and elevated investment plans affect Chesapeake Utilities' investment narrative and assumptions.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Chesapeake Utilities Investment Narrative Recap

For Chesapeake Utilities, the case for being a shareholder centers on the company's ability to balance growth in natural gas infrastructure with disciplined management of expenses and regulatory outcomes. The recent strong earnings and raised capital expenditure guidance support the view that near-term catalysts remain intact, especially customer growth and regulatory approvals, while higher debt levels and interest costs remain the most immediate risks. As a result, these announcements do not materially shift the balance between Chesapeake's growth opportunities and its most pressing challenges right now.

Among the recent developments, the approval and imminent funding of US$200 million in new senior notes stands out. This financing is directly relevant to the expanded capital program, supporting Chesapeake's pipeline upgrades, expansion projects, and customer acquisition goals, the very projects poised to drive future earnings momentum if executed as planned and supported by regulatory success.

However, while earnings growth is holding steady, investors should also be aware that, in contrast, the company’s larger debt load means exposure to ...

Read the full narrative on Chesapeake Utilities (it's free!)

Chesapeake Utilities' outlook anticipates $961.6 million in revenue and $177.5 million in earnings by 2028. This projection is based on a 4.6% annual revenue growth rate and a $54.2 million earnings increase from the current $123.3 million.

Uncover how Chesapeake Utilities' forecasts yield a $136.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community median fair value estimate is US$87.26, well below recent price levels, with one perspective included. While catalytic projects underpin growth, increased financial leverage is a double-edged sword. See what other investors think and compare your view.

Explore another fair value estimate on Chesapeake Utilities - why the stock might be worth as much as $87.26!

Build Your Own Chesapeake Utilities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chesapeake Utilities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Chesapeake Utilities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chesapeake Utilities' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal