How Will Cyber Risks and Catastrophe Losses Shape Erie Indemnity’s (ERIE) Long-Term Strategy?

- Erie Indemnity Company recently reported its second quarter 2025 financial results, with revenue reaching US$1.06 billion and net income at US$174.69 million, showing gains over the prior year but coming in below analyst forecasts.

- The quarter was marked by elevated catastrophe losses and a cybersecurity incident that temporarily disrupted operations, highlighting the pressures of rising costs and digital risk management even amid positive long-term industry trends.

- We’ll explore how Erie Indemnity’s operational challenges and investments in cybersecurity are shaping its overall investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Erie Indemnity's Investment Narrative?

Being an Erie Indemnity shareholder means buying into a business with a long track record of profit growth, high return on equity, and consistent dividends. The company's core value proposition has historically centered on stable policy management fees and robust customer retention. That said, this past quarter's financial results, which came in just under forecasts, signal that near-term catalysts are under pressure from rising catastrophe losses and higher expenses, underscored by a temporary but real disruption from a cybersecurity incident. While the stock took a mild hit right after the results, and recent price moves show limited long-term damage, these operational setbacks now move digital risk and cost control to the top of the watchlist for shareholders. In my view, the most immediate risks have shifted, making resilience against cyber and catastrophe events more critical to the investment case than before.

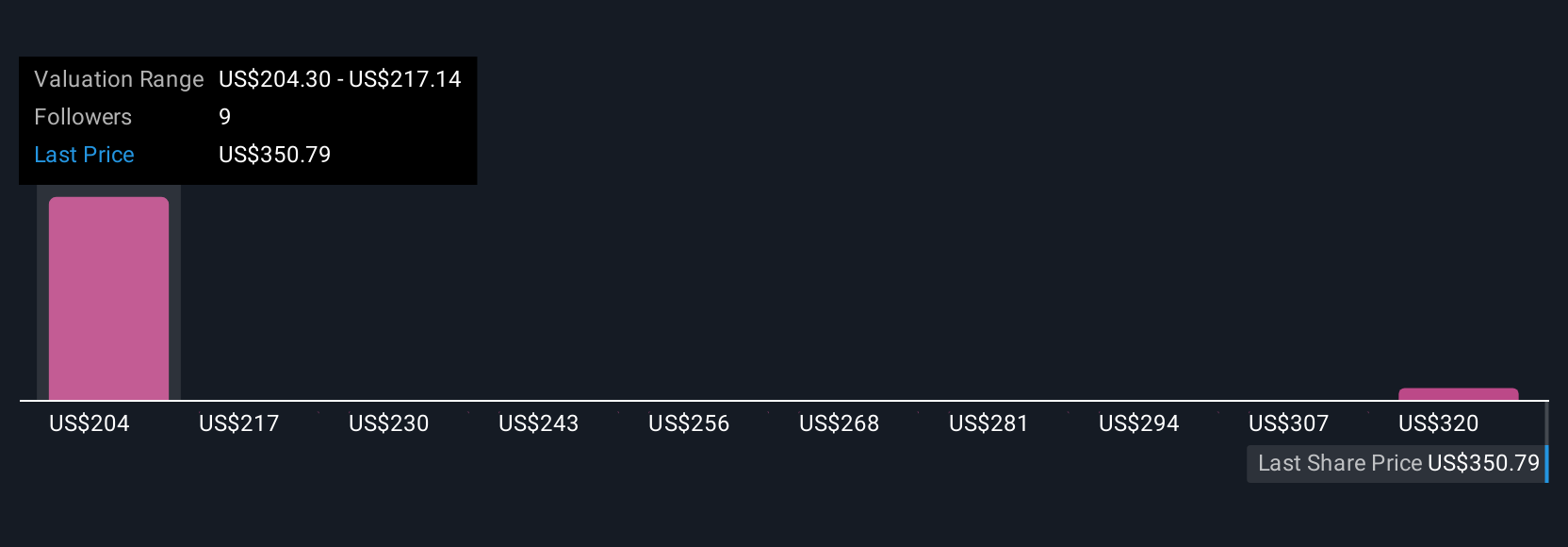

Otherwise, strong historical growth may matter less than investors think with digital risk now so prominent. Erie Indemnity's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Erie Indemnity - why the stock might be worth as much as $332.66!

Build Your Own Erie Indemnity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Erie Indemnity research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Erie Indemnity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Erie Indemnity's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal