Dividend Hike and Buyback Expansion Might Change the Case For Investing In Chemed (CHE)

- On August 1, 2025, Chemed Corporation announced a 20% increase in its quarterly cash dividend to US$0.60 per share and expanded its equity buyback authorization by US$300 million, raising the total to US$2.75 billion.

- While these shareholder return initiatives signal management's confidence, they come just after the company reported softer quarterly earnings in the face of persistent margin and reimbursement pressures affecting the broader industry.

- We'll assess how expanding the buyback program shapes Chemed's investment narrative amid operational and sector headwinds.

Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

Chemed Investment Narrative Recap

To be a Chemed shareholder, you need to believe in the long-term demand for both hospice care and essential home services, even in the face of industry reimbursement pressures and operational cost challenges. The recent buyback expansion and dividend increase reinforce management’s shareholder focus, but given recent earnings softness and revised guidance, these moves do not appear to meaningfully shift the primary near-term catalyst: Chemed’s continued ramp-up of new VITAS locations and the anticipated normalization of margins as cap management strategies are fully implemented. The most important risk remains persistent margin compression from changing patient mix and ongoing Medicare cap limitations, especially in key markets like Florida.

Among the recent corporate announcements, the July 29 guidance cut, which lowered expected 2025 earnings, directly connects to the outlook on margin recovery in both VITAS and Roto-Rooter. As management continues investing in operational improvements and adjusting to industry headwinds, progress toward stabilizing margins and restoring earnings momentum stands out as a pivotal factor alongside any incremental shareholder return actions.

But while these shareholder returns may offer reassurance, investors should be aware that margin pressure in VITAS due to cap limitations remains a risk that could…

Read the full narrative on Chemed (it's free!)

Chemed's outlook anticipates $2.9 billion in revenue and $347.9 million in earnings by 2028. This implies 5.0% annual revenue growth and a $57.6 million increase in earnings from the current $290.3 million.

Uncover how Chemed's forecasts yield a $567.25 fair value, a 28% upside to its current price.

Exploring Other Perspectives

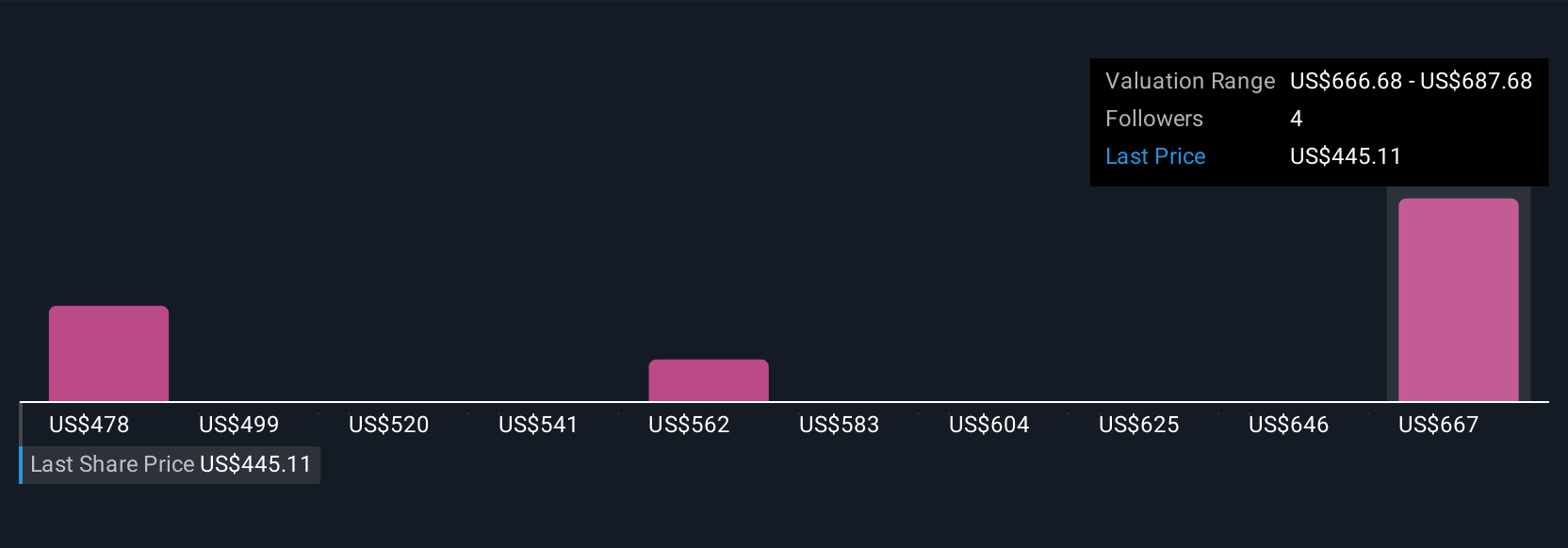

Four Simply Wall St Community members shared fair value estimates for Chemed spanning US$477.66 to US$687.68. Yet persistent margin pressure from reimbursement changes continues to weigh on performance, reminding you to compare a range of viewpoints.

Explore 4 other fair value estimates on Chemed - why the stock might be worth as much as 55% more than the current price!

Build Your Own Chemed Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chemed research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Chemed research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chemed's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal