Middleby (MIDD) Reveals Lower Q2 Earnings and Major Buyback Is the Capital Strategy Shifting?

- Middleby recently reported its second quarter 2025 earnings, showing year-over-year declines in both sales and net income, and issued updated revenue guidance for the upcoming quarter and year, alongside disclosing a significant share buyback completion totaling 6.48 million shares for US$903.43 million.

- While earnings and revenue softened compared to last year, the recently completed share buyback reduces outstanding shares and may influence future earnings per share calculations.

- With management providing new full-year guidance and completing a major buyback, we'll examine how these actions affect Middleby's investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

Middleby Investment Narrative Recap

To be a Middleby shareholder, you need to believe in the long-term adoption of smart kitchen and automation solutions, areas that management continues to prioritize. The recent Q2 earnings miss and full-year revenue guidance update do not materially affect the most important short-term catalyst, which remains capturing delayed replacement cycles as customer capital spending resumes. However, the biggest risk, reliance on large QSR customers facing industry headwinds, remains unchanged and is worth monitoring closely. The just-completed buyback of over 6.48 million shares for US$903.43 million stands out, especially as it reduces share count and could impact future per-share metrics. While this action might support near-term valuations, the underlying earnings softness highlights the continued challenge of driving organic growth as end-market demand remains muted. But investors should not ignore the ongoing risk of dependence on large QSRs facing reduced traffic and inflationary pressures…

Read the full narrative on Middleby (it's free!)

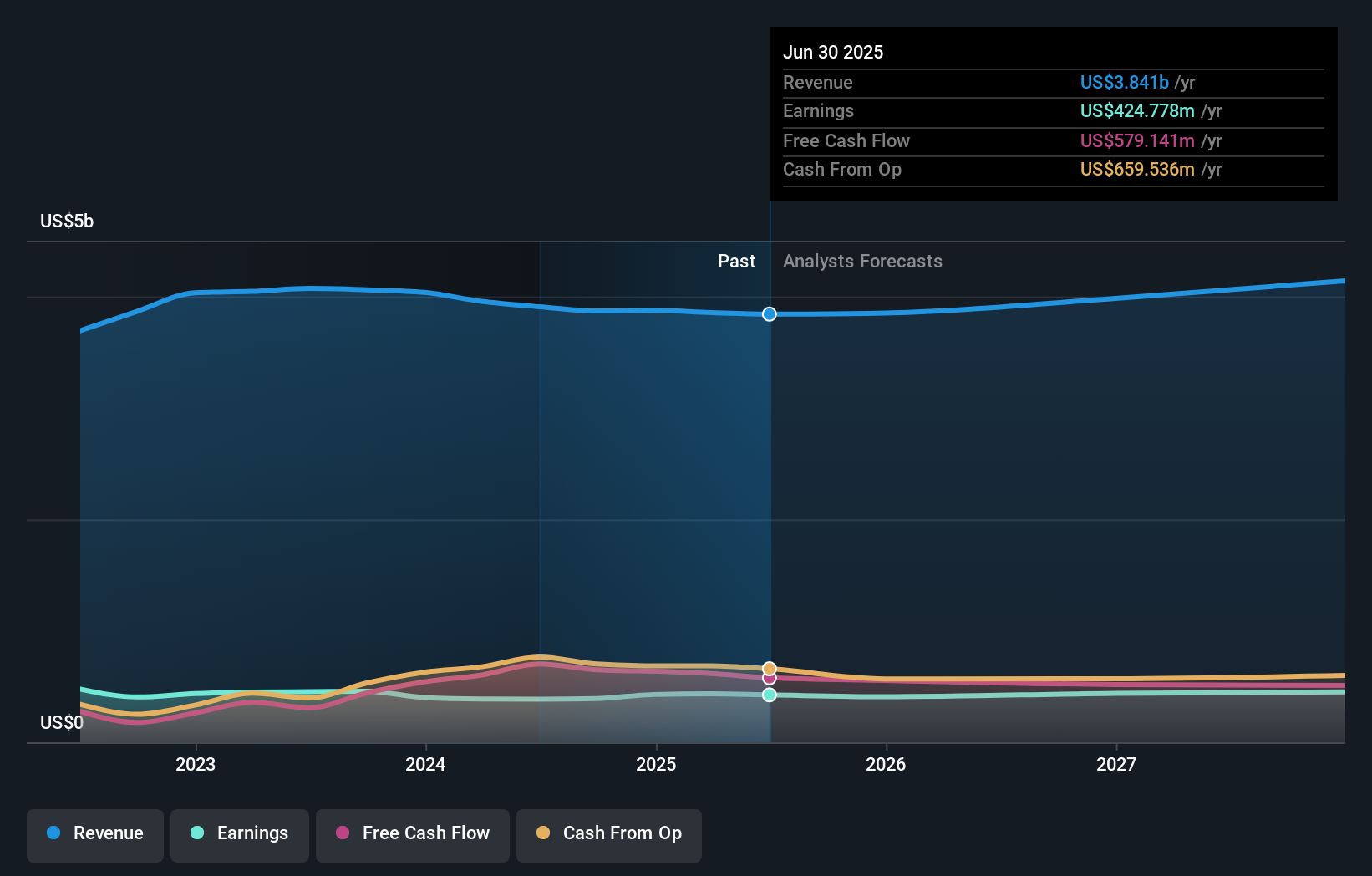

Middleby's narrative projects $4.2 billion revenue and $539.0 million earnings by 2028. This requires 3.3% yearly revenue growth and a $114.2 million earnings increase from $424.8 million currently.

Uncover how Middleby's forecasts yield a $153.00 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$110 to US$153 across two participant views. With exposure to cost inflation among key QSR customers, these varied opinions underscore the importance of assessing multiple angles on Middleby’s growth potential.

Explore 2 other fair value estimates on Middleby - why the stock might be worth as much as 17% more than the current price!

Build Your Own Middleby Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Middleby research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Middleby research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Middleby's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal