The Bull Case For Ensign Group (ENSG) Could Change Following Major Skilled Nursing Facility Expansion

- Earlier this month, The Ensign Group announced the acquisition of Pine Crest Health and Memory Care in Wisconsin, Crystal Heights Care Center in Iowa, and a substantial portfolio of skilled nursing and assisted living facilities across California, adding over 1,200 beds and units to its operational footprint.

- This expansion significantly grows Ensign’s capacity and presence in key regions, reinforcing its role as a major provider in the skilled nursing sector.

- Let’s consider how this large-scale facility acquisition may influence Ensign Group’s long-term growth outlook and operational efficiency assumptions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Ensign Group Investment Narrative Recap

To be a shareholder in Ensign Group, you need confidence in the company’s ability to capitalize on an aging U.S. population and efficiently integrate new acquisitions for continuing expansion. The latest multi-state facility additions further boost capacity and regional influence, but do not materially change that one of the biggest catalysts remains Ensign's operational integration and cost management, while risks tied to changing government reimbursement policies are still front of mind for the business today.

Of particular relevance, Ensign’s recent Q2 2025 earnings announcement stood out, with notable year-over-year revenue and net income growth and a raised outlook for both earnings and revenue guidance. This momentum reinforces the underlying catalyst of scalable acquisition-driven growth, but the sustainability of these results continues to depend heavily on how effectively new facilities are assimilated and the company’s exposure to evolving healthcare regulations and funding frameworks.

However, it’s important to consider that if federal or state reimbursement policies change unfavorably, even a highly efficient operator like Ensign could see margins pressured...

Read the full narrative on Ensign Group (it's free!)

Ensign Group's narrative projects $6.5 billion revenue and $483.4 million earnings by 2028. This requires 12.0% yearly revenue growth and a $160.6 million earnings increase from $322.8 million.

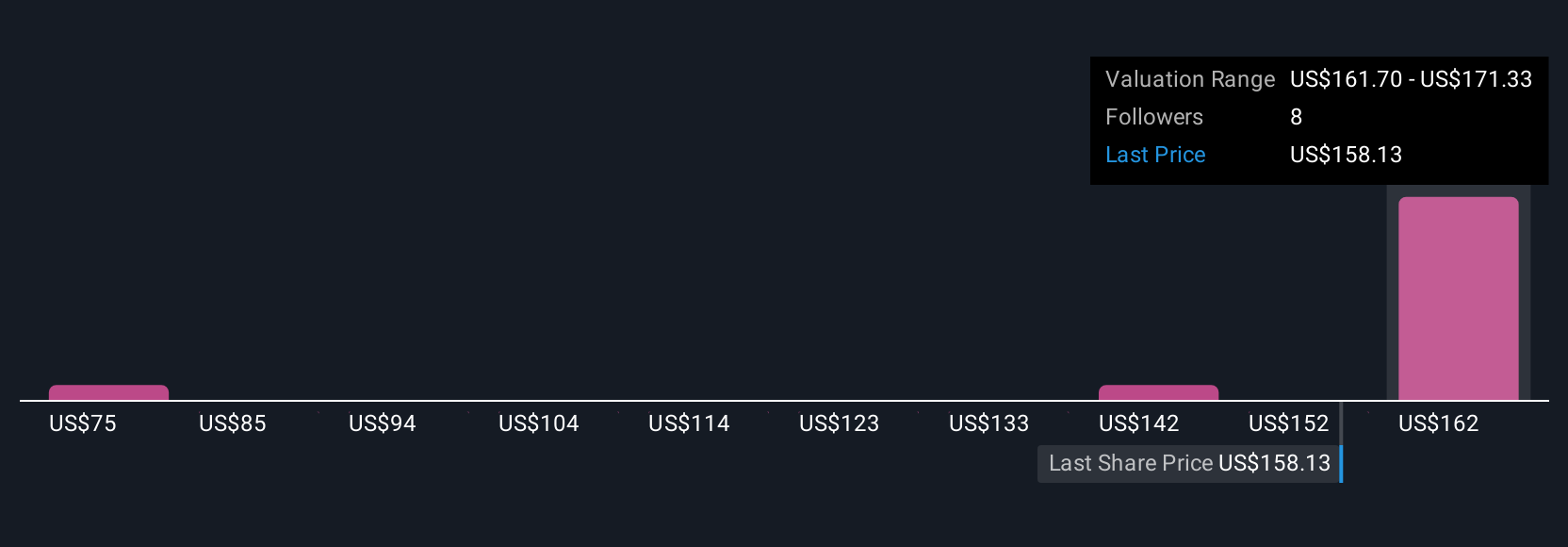

Uncover how Ensign Group's forecasts yield a $171.33 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have posted four independent fair value estimates for Ensign Group, ranging from as low as US$75 up to US$171.33. While views differ, many are closely watching government funding trends, given the outsize impact any policy shifts could have on future profitability, see how your outlook compares to these varied positions.

Explore 4 other fair value estimates on Ensign Group - why the stock might be worth less than half the current price!

Build Your Own Ensign Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ensign Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Ensign Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ensign Group's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal