Dropbox's AI Dash Traction and Cost Cuts Might Change The Case For Investing In DBX

- Dropbox reported second quarter 2025 results that exceeded analyst expectations for both revenue and profitability, alongside the completion of buybacks totaling 23,942,239 shares for US$657.15 million announced in December 2024.

- An important insight is that improved operating margins were driven by significant cost reductions and early traction in Dropbox's AI-powered Dash product despite declines in revenue and paying users.

- We'll explore how Dropbox's ongoing cost efficiency efforts and early momentum with Dash could reshape its investment narrative moving forward.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Dropbox Investment Narrative Recap

To be a Dropbox shareholder today, you would need confidence that operational efficiency and AI-powered innovation, particularly via Dash, can outweigh near-term revenue and user attrition. The recent buyback completion is directionally positive for per-share metrics, but it does not fundamentally alter the biggest risk, ongoing churn and downsell pressure from Teams customers, or the top catalyst, execution and adoption of Dash as a growth driver.

Among the recent announcements, Dropbox’s Q2 2025 earnings beat stands out as most relevant. Margin improvement was achieved largely through cost reductions and initial Dash traction, underlining the company’s emphasis on driving profitability during a period of lower sales and declining paying users, a key short-term test for the growth narrative.

In contrast, investors should be aware of the impact that continued paying user declines and churn could have on long-term revenue stability, especially if...

Read the full narrative on Dropbox (it's free!)

Dropbox's narrative projects $2.4 billion revenue and $499.8 million earnings by 2028. This requires a 1.2% annual revenue decline and a $29.5 million earnings increase from $470.3 million today.

Uncover how Dropbox's forecasts yield a $28.12 fair value, a 3% upside to its current price.

Exploring Other Perspectives

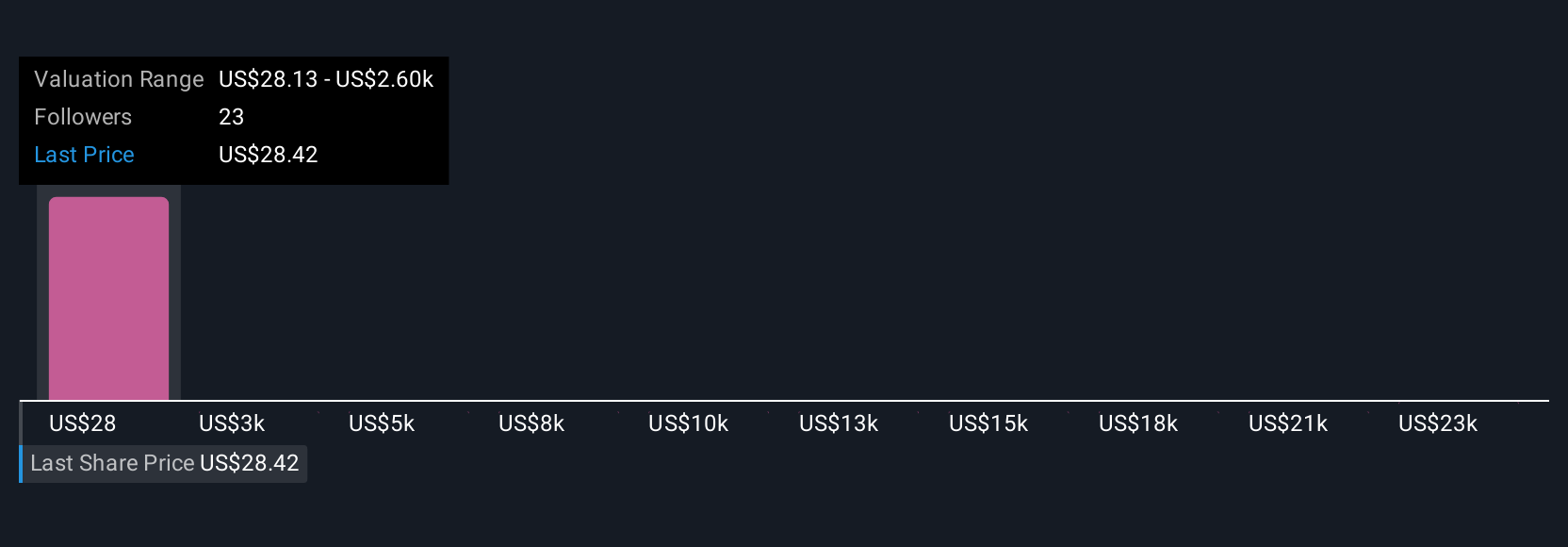

The Simply Wall St Community submitted four independent fair value estimates for Dropbox, ranging from US$28.13 up to an outlier at US$25,709.96. Your strongest conviction on AI-led growth must be balanced with the reality of persistent churn and price sensitivity among Teams customers.

Explore 4 other fair value estimates on Dropbox - why the stock might be worth just $28.12!

Build Your Own Dropbox Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dropbox research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dropbox research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dropbox's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal