What Hilton Grand Vacations (HGV)'s Share Buyback and Profit Rise Mean for Shareholder Value

- Hilton Grand Vacations recently reported second-quarter earnings, showing revenue of US$1.27 billion and net income of US$25 million, alongside announcing a new US$600 million share repurchase program and completing the retirement of over 10% of its shares.

- The move to repurchase and retire a significant amount of shares, combined with improved profitability, suggests a focus on enhancing shareholder returns and balance sheet strength.

- We'll explore how Hilton Grand Vacations' improved net income and new buyback program may influence its investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Hilton Grand Vacations Investment Narrative Recap

To be a Hilton Grand Vacations shareholder today, you need to believe in the company's ability to sustain demand for timeshare ownership while driving membership and upgrade activity amid evolving travel trends. The recent earnings report and buyback plan underscore management's emphasis on supporting earnings per share, but do not materially change the most pressing short-term catalyst: accelerating new owner acquisitions. At the same time, risks from elevated default rates on receivables due to potential consumer stress remain in focus.

Among the recent announcements, the completion of repurchasing over 10% of outstanding shares stands out. This move significantly shrinks the share count, directly supporting future EPS figures and may help offset pressure from narrower profit margins or slower revenue growth, linking back to shareholder value as a catalyst for near-term sentiment.

However, it is important for investors to also recognize that persistently high bad debt allowances could still undermine...

Read the full narrative on Hilton Grand Vacations (it's free!)

Hilton Grand Vacations' outlook anticipates $6.4 billion in revenue and $819.4 million in earnings by 2028. This scenario depends on a 12.7% annual revenue growth rate and an earnings increase of $762.4 million from the current $57.0 million.

Uncover how Hilton Grand Vacations' forecasts yield a $53.56 fair value, a 19% upside to its current price.

Exploring Other Perspectives

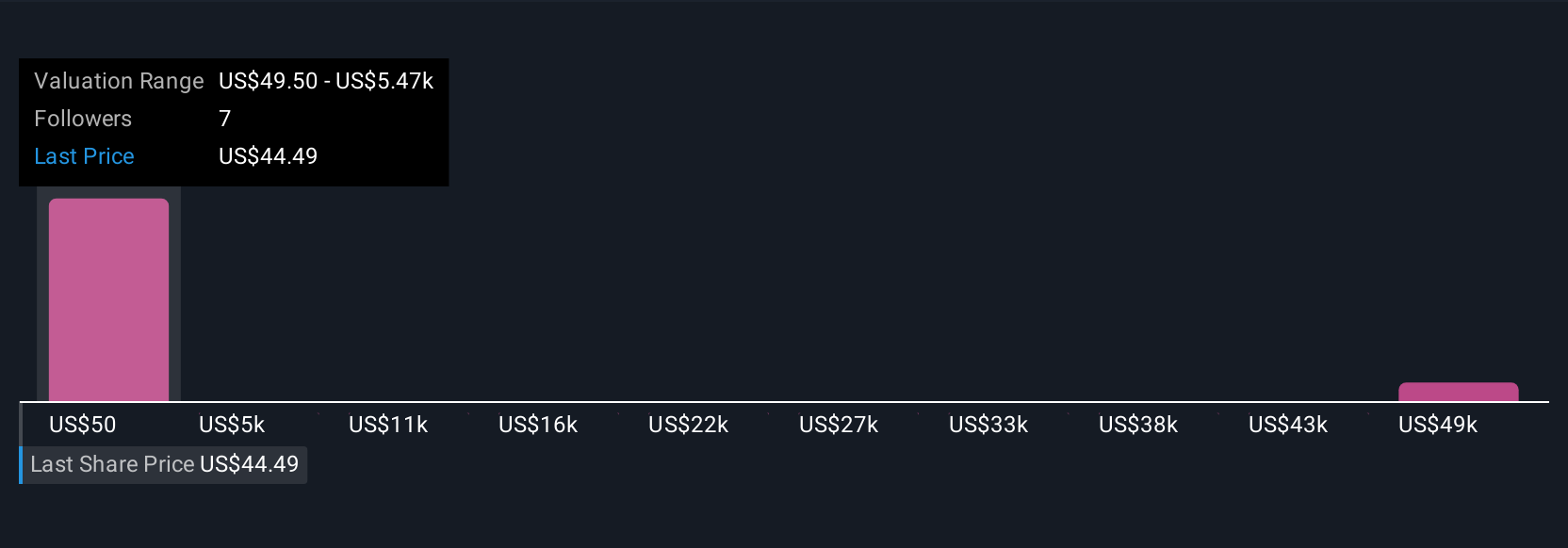

Four community investors on Simply Wall St estimate Hilton Grand Vacations' fair value between US$53.56 and an outlier high of US$54,269.95. While management's buybacks could support the share price, ongoing high customer default rates could limit upside; take a look at other community perspectives on the company's financial resilience.

Explore 4 other fair value estimates on Hilton Grand Vacations - why the stock might be worth just $53.56!

Build Your Own Hilton Grand Vacations Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilton Grand Vacations research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hilton Grand Vacations research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilton Grand Vacations' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal