WEBTOON Stock Explodes 40% After Hours After Disney Partnership Bombshell

WEBTOON Entertainment Inc. (NASDAQ:WBTN) shares surged 40.17%, to $13.12 in after-hours trading on Tuesday, following second-quarter results that exceeded guidance and a strategic partnership with The Walt Disney Co. (NYSE:DIS).

Check out the current price of WBTN stock here.

What Happened: The digital comics platform operator reported second-quarter revenue of $348.3 million, up 8.5% year-over-year and above the top end of its guidance range. On a constant currency basis, revenue grew 5.5% to $338.7 million, driven by increases across all three revenue streams: Paid Content, Advertising, and IP Adaptations.

The company posted adjusted earnings per share of $0.07, significantly beating analyst consensus estimates and improving from diluted loss per share of $0.70 in the prior year. Net loss narrowed dramatically to $3.9 million from $76.6 million in the second quarter of 2024, primarily due to lower general and administrative expenses related to the company’s initial public offering costs incurred in the prior year.

WEBTOON separately announced a multiyear partnership with Disney to bring approximately 100 titles featuring characters from Marvel, Star Wars, Disney Studios, and 20th Century Studios to its vertical-scroll format platform. The collaboration will include classic comic series, graphic novels, and all-new original webcomic series for the first time in vertical-scroll format.

“We are pleased to report strong second quarter results, with both revenue and adjusted EBITDA coming in above the top end of our guidance range,” said Founder and CEO Junkoo Kim.

Why It Matters: Adjusted earnings before interest, taxes, depreciation, and amortisation (EBITDA) of the California-based company reached $9.7 million with a 2.8% margin, compared to $20.4 million and a 6.3% margin in the prior year. The company also maintained a strong balance sheet with approximately $581.5 million in cash and cash equivalents and no debt.

For the third quarter, WEBTOON projects revenue growth of 9.4%-12.2% on a constant currency basis, representing $380-390 million based on current foreign exchange rates. The company expects adjusted EBITDA of $2.0-7.0 million, representing a margin of 0.5%-1.8%.

Price Action: According to Benzinga Pro data, Webtoon's stock closed at $9.36, up 2.41% on Tuesday. It has traded between $6.76 and $14.69 over the past year, with a market capitalization of $1.22 billion. On average, about 229,630 shares change hands daily.

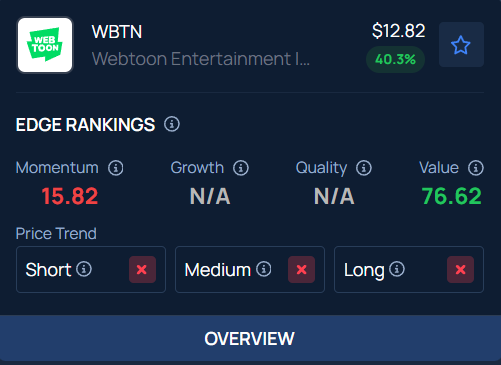

Benzinga's Edge Stock Rankings indicate that WBTN has a negative price trend across all time frames. Here is how the stock fares on other parameters.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: Kanyapak Lim on Shutterstock.com

Wall Street Journal

Wall Street Journal