Rising Margins and Share Buybacks Could Be a Game Changer for CorVel (CRVL)

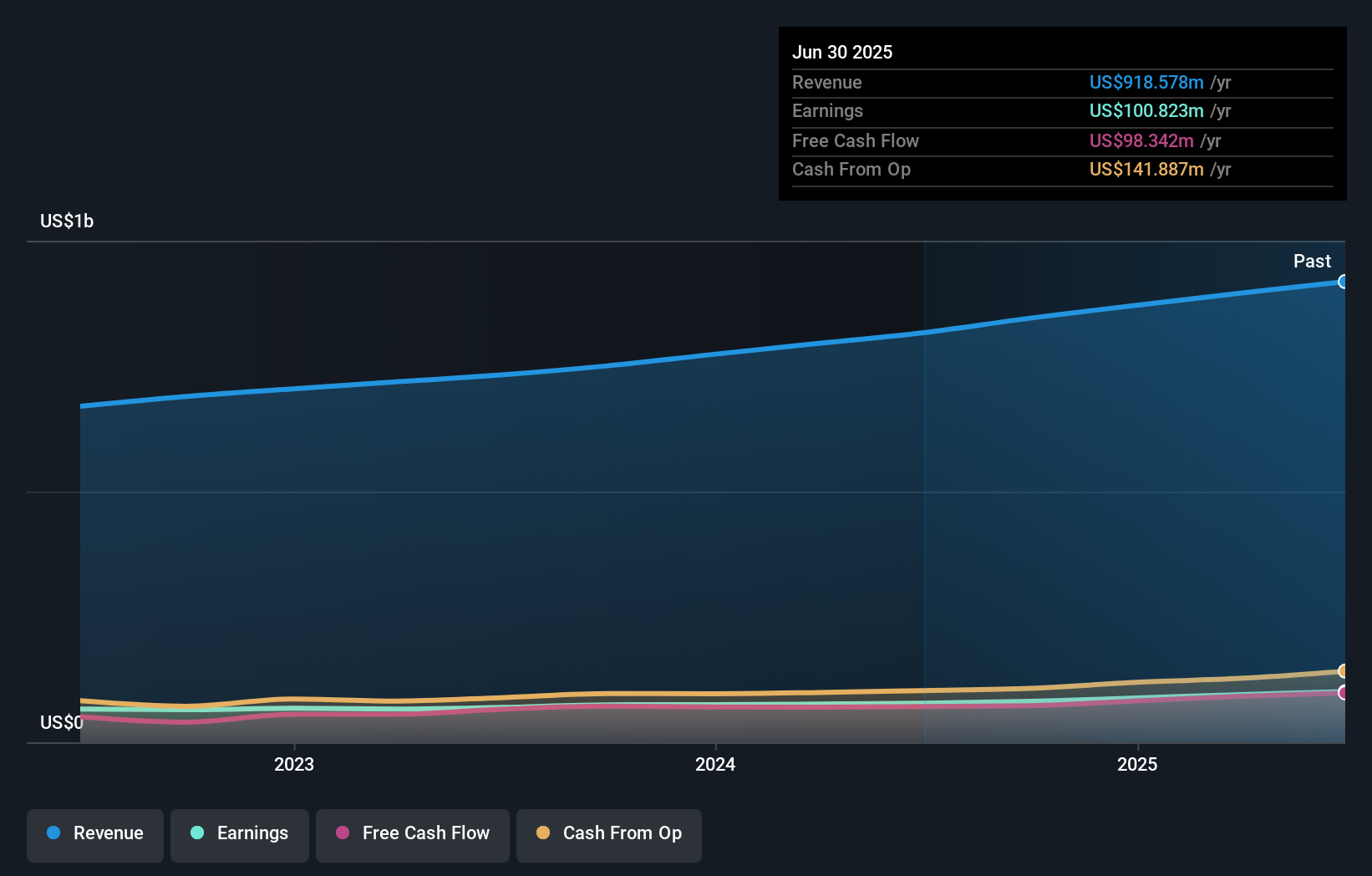

- CorVel Corporation recently reported its first quarter 2025 earnings, revealing an increase in sales to US$234.71 million and net income rising to US$27.24 million compared to the prior year period.

- An additional highlight is the continued execution of CorVel's share repurchase program, with the company buying back 87,141 shares for US$9.6 million during the quarter.

- We'll explore how CorVel's improved profit margins combined with active share buybacks influence its investment narrative going forward.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is CorVel's Investment Narrative?

CorVel’s first quarter 2025 results give investors plenty to think about. The headline figures, a strong lift in both sales and profits, speak to effective cost management and persistent revenue momentum, keeping the company’s recent streak of progress intact. The active share buyback program may appeal to those focused on shareholder returns and possible EPS support in the near term. These updates could influence short-term market sentiment, but the fundamentals around valuation and industry outlook remain critical. The company still trades at a higher price-to-earnings ratio than the sector, while recent price weakness raises questions about how much of the good news is already priced in. For now, improving profit margins appear to temper some downside risk, but further insider selling or broader healthcare sector shifts could quickly change the narrative.

But keep in mind, significant insider selling is something investors should pay close attention to. CorVel's shares have been on the rise but are still potentially undervalued by 8%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on CorVel - why the stock might be worth just $95.17!

Build Your Own CorVel Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CorVel research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CorVel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CorVel's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal