Does PROG Holdings' (PRG) Dividend Payout Reflect Enduring Stability or Strategic Conservatism?

- On August 7, 2025, PROG Holdings, Inc. announced that its Board of Directors had declared a quarterly cash dividend of US$0.13 per share, payable on September 4, 2025, to shareholders of record as of August 19, 2025.

- This dividend declaration indicates the Board's view of the company's financial stability and may be interpreted by investors as a reflection of management’s confidence in ongoing cash flows.

- We’ll explore how this dividend announcement could affect PROG Holdings’ investment narrative, especially its signaling of the company’s financial health.

Find companies with promising cash flow potential yet trading below their fair value.

PROG Holdings Investment Narrative Recap

To be a shareholder in PROG Holdings, investors generally need to believe in the continued adoption of flexible payment and lease-to-own solutions, as well as the company’s ongoing shift toward digital channels and new verticals. The recent dividend announcement may reinforce confidence in the stability of earnings and cash flows, but it does not materially change the most important short term catalyst, growth and profitability in the Buy Now, Pay Later (BNPL) segment, nor does it address the primary risk: sustained weak demand in core leasing categories. Among recent announcements, the July earnings report stands out as most relevant. It showed higher net income and improved basic earnings per share, alongside updated guidance for increased full-year revenue and earnings. These operating results provide practical context for the dividend declaration and support ongoing interest in whether PROG Holdings can maintain profitability as it faces revenue headwinds and competitive pressures. In contrast, investors should be aware that despite the dividend and improved earnings, concentration among key retail partners remains a significant risk if partnerships shift unexpectedly...

Read the full narrative on PROG Holdings (it's free!)

PROG Holdings' narrative projects $2.7 billion revenue and $141.4 million earnings by 2028. This requires 2.5% yearly revenue growth and a $73.3 million decrease in earnings from $214.7 million.

Uncover how PROG Holdings' forecasts yield a $38.57 fair value, a 20% upside to its current price.

Exploring Other Perspectives

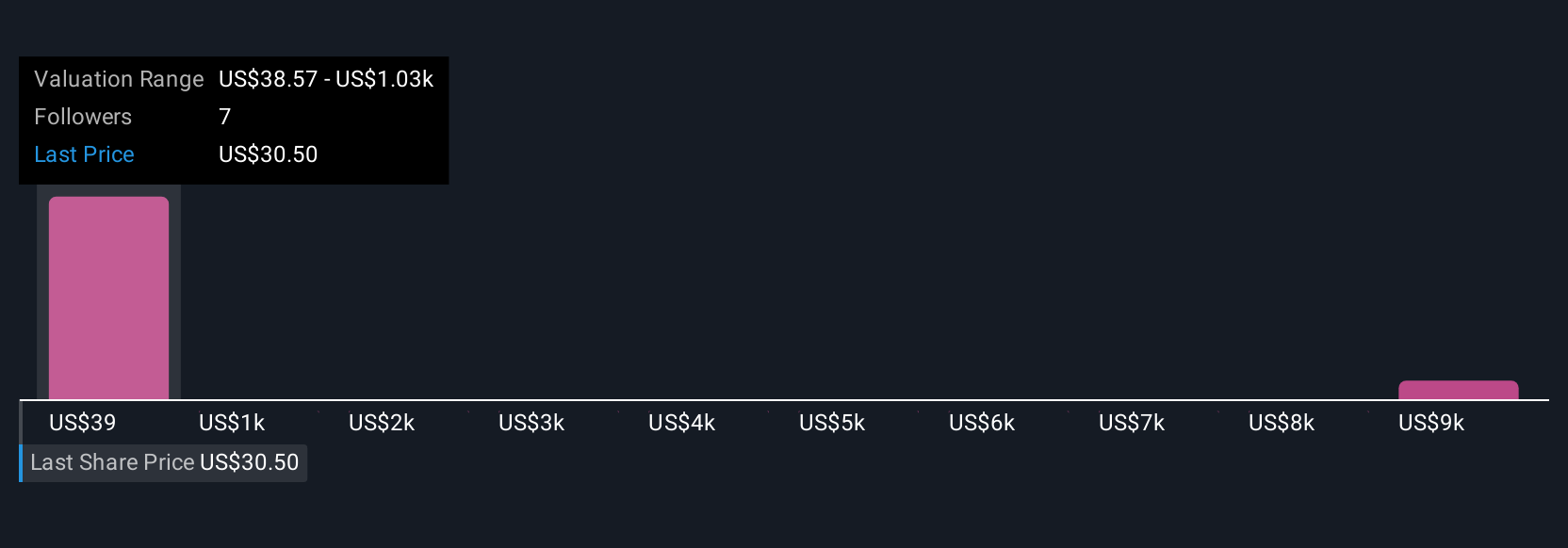

Retail investors in the Simply Wall St Community produced a wide range of fair value estimates for PROG Holdings, from US$38.57 to US$9,999, based on three distinct forecasts. While some see strong upside, ongoing pressure in core leasing demand is a clear risk for revenue and valuation outcomes, so compare these varied outlooks with your own expectations.

Explore 3 other fair value estimates on PROG Holdings - why the stock might be worth just $38.57!

Build Your Own PROG Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PROG Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free PROG Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PROG Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal