Will Wynn’s (WYNN) Dividend and Eurobond Moves Reveal a New Capital Allocation Playbook?

- In August 2025, Wynn Resorts reported second-quarter earnings with nearly flat revenue at US$1.74 billion and announced a US$0.25 per share cash dividend, while Wynn Macau disclosed a new senior Eurobond fixed-income offering and continued share repurchases totaling over 2 million shares in the quarter.

- This combination of stable topline performance, ongoing shareholder returns, and new debt issuance highlights Wynn's multi-pronged approach to capital management and financing in a fast-evolving hospitality sector.

- We will examine how Wynn Macau’s new fixed-income offering could impact the company’s investment narrative amid recent earnings and buyback activity.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Wynn Resorts Investment Narrative Recap

To be a shareholder in Wynn Resorts today, you need to believe in the company’s vision for premium hospitality growth amid intense market competition, especially in Macau, and its ability to adapt financial strategies to shifting economic pressures. The recent senior Eurobond offering by Wynn Macau is not likely to materially impact the strongest near-term catalyst, potential revenue growth from new property openings, but could have implications for financial flexibility if market or regulatory risks increase.

The company’s ongoing share buybacks, with over 2 million shares repurchased in the recent quarter, remain highly relevant, these actions not only provide direct returns to investors but also reinforce management’s confidence in long-term value despite modest recent earnings. In contrast, investors should be aware of the potential for changing tariff rates or other external risks to delay future development projects or impact profitability…

Read the full narrative on Wynn Resorts (it's free!)

Wynn Resorts' outlook anticipates $7.7 billion in revenue and $551.7 million in earnings by 2028. This implies a 3.4% annual revenue growth rate and a $122.1 million increase in earnings from the current $429.6 million.

Uncover how Wynn Resorts' forecasts yield a $119.24 fair value, a 10% upside to its current price.

Exploring Other Perspectives

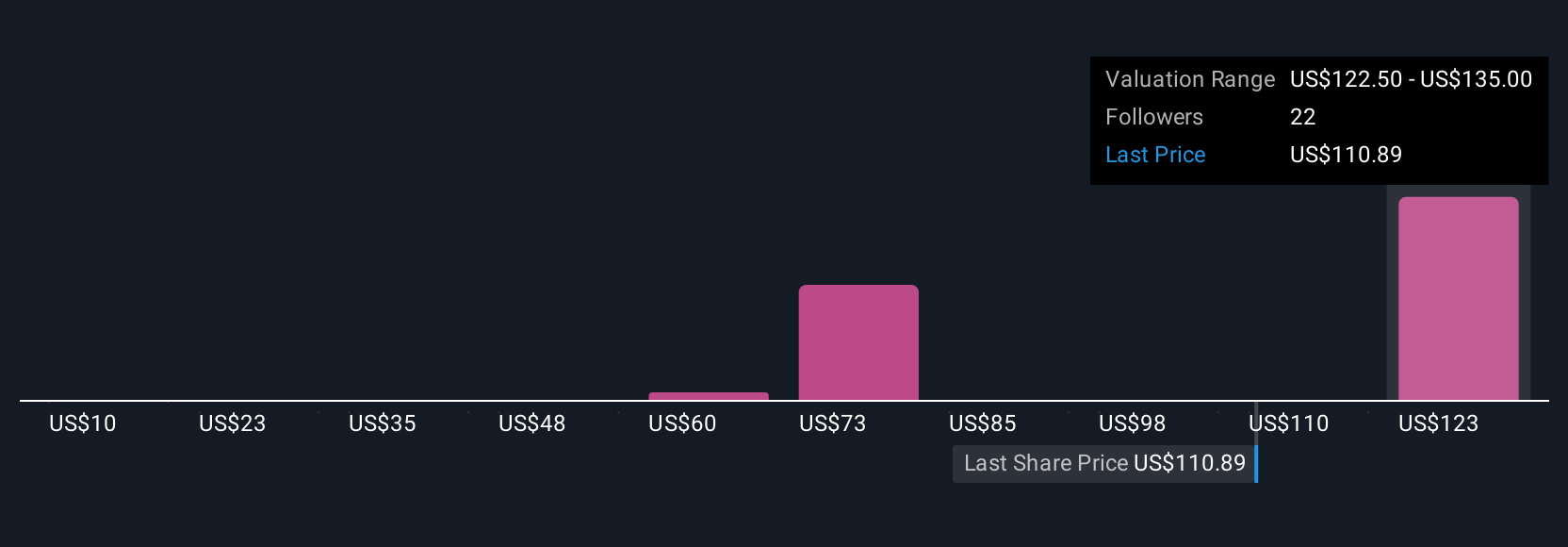

Eight fair value estimates from the Simply Wall St Community span from US$10 to US$1,406, reflecting significant differences in expectations. With competition increasing in the Macau premium market, many market participants are weighing these risks as they form opinions, so be sure to review several views before acting.

Explore 8 other fair value estimates on Wynn Resorts - why the stock might be a potential multi-bagger!

Build Your Own Wynn Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wynn Resorts research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Wynn Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wynn Resorts' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal