Does NJR’s Upgraded Earnings Guidance Signal a Shift in Management Confidence?

- New Jersey Resources reported its third quarter fiscal 2025 results on August 4, showing sales of US$298.95 million and a net loss of US$15.05 million, while also raising the lower end of its full-year earnings guidance range.

- Despite posting a wider quarterly loss, stronger year-to-date net income and increased guidance suggest management is more optimistic about full-year earnings performance compared to prior expectations.

- Following the increase in full-year earnings guidance, we'll explore how this adjustment may affect New Jersey Resources' investment narrative.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

New Jersey Resources Investment Narrative Recap

To be a shareholder in New Jersey Resources, you must believe in the long-term stability of regulated natural gas distribution and management’s ability to adapt to the evolving energy environment. The recent bump in full-year earnings guidance, despite a wider quarterly net loss, suggests that improved year-to-date performance rather than one-off quarterly results is the more important short-term catalyst, while the dominant risk remains exposure to regulatory changes and shifting energy policies. This news does not fundamentally alter the risk that regulatory or policy headwinds could pressure future returns, so the overall investment case is largely unaffected.

Among recent announcements, the decision to raise the lower end of fiscal 2025’s net financial earnings per share guidance directly ties to this quarter’s improved cumulative results and provides added confidence in management’s near-term outlook. This guidance adjustment is particularly meaningful for investors focused on earnings consistency as a key driver of value within a defensive utility sector.

Yet, contrasting with the more optimistic guidance, the potential for accelerated electrification and decarbonization policies remains a risk investors should be aware of if...

Read the full narrative on New Jersey Resources (it's free!)

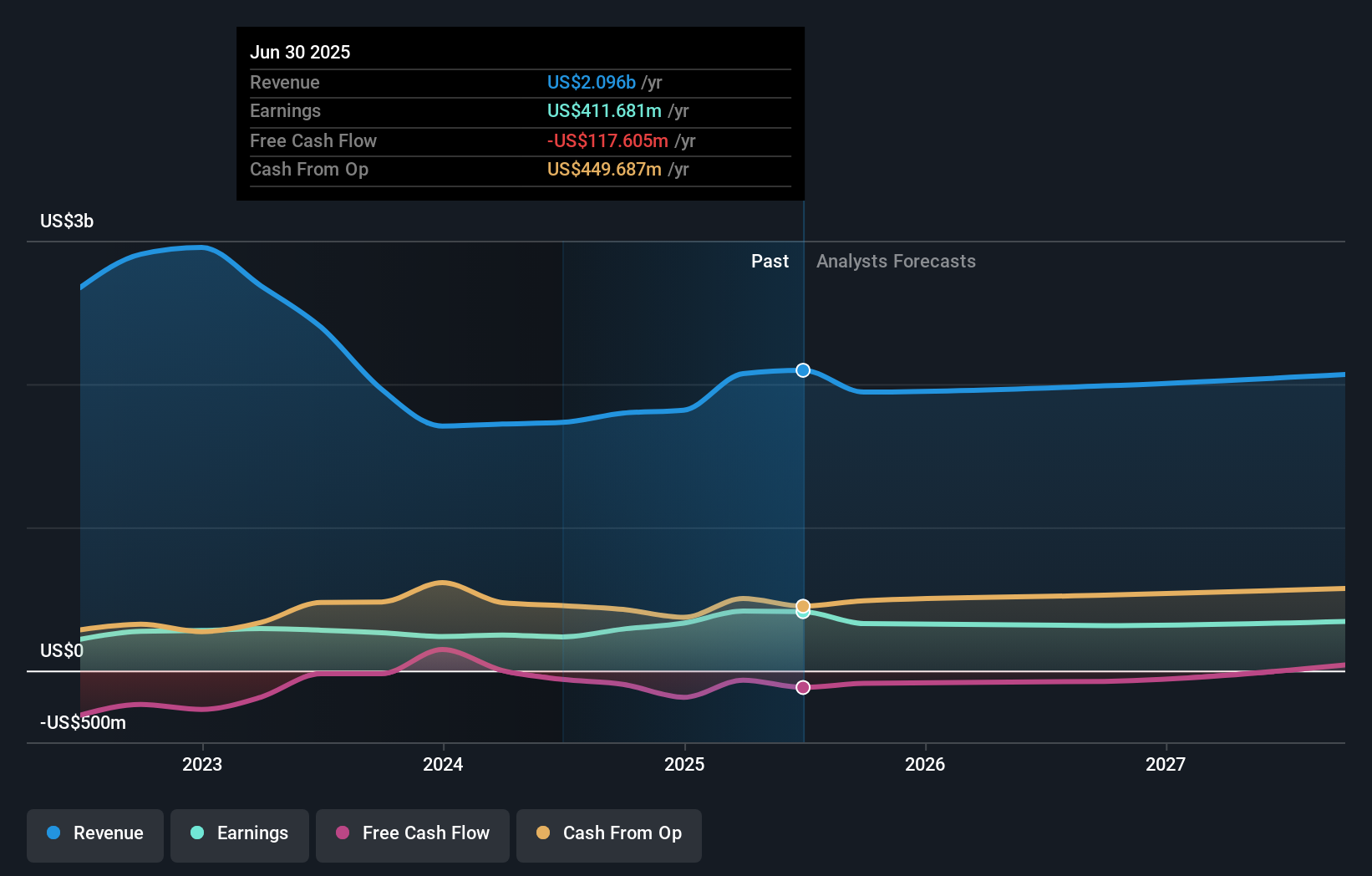

New Jersey Resources is projected to reach $2.1 billion in revenue and $377.6 million in earnings by 2028. This outlook assumes revenues will decline by 0.1% per year, and earnings will decrease by $34.1 million from current earnings of $411.7 million.

Uncover how New Jersey Resources' forecasts yield a $53.38 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community participants set a single fair value estimate of US$53.38, reflecting limited diversity and consensus. While guidance was raised, broad regulatory shifts still create uncertainty for long-term growth, so explore contrasting viewpoints.

Explore another fair value estimate on New Jersey Resources - why the stock might be worth just $53.38!

Build Your Own New Jersey Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Jersey Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free New Jersey Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Jersey Resources' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal