How Jones Lang LaSalle's (JLL) Enhanced Share Buybacks Could Shape Its Investment Narrative

- In the past week, Jones Lang LaSalle reported second quarter 2025 earnings with sales of US$6,250.1 million and net income of US$112.3 million, while also announcing an increase in planned share repurchases through the end of the year.

- Management reaffirmed a focus on returning capital to shareholders and exploring selective acquisitions, highlighting a disciplined capital allocation approach amid ongoing operational growth.

- We'll explore how management's increased commitment to share buybacks could influence the company's investment narrative and long-term outlook.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Jones Lang LaSalle Investment Narrative Recap

To be a shareholder in Jones Lang LaSalle, one must believe in the company's ability to generate consistent long-term growth by expanding recurring revenue streams, maintaining disciplined capital allocation, and capitalizing on trends in global real estate markets. The recently announced increase in share repurchases could bolster near-term earnings per share, but does not materially change the central risk for JLL, continued sensitivity of transaction-driven revenues to global economic uncertainty and volatility in capital markets.

Among the recent company developments, JLL’s announcement of a US$255 million refinancing arrangement for a major multifamily property reflects the firm's continued activity in debt advisory, which aligns closely with a key revenue catalyst: improved performance in Capital Markets as broader market conditions stabilize. Sustaining momentum in these transactional businesses remains connected to how effectively JLL can offset cyclical risks with earnings from more stable service lines.

However, it's important to remember that if geopolitical issues or macroeconomic headwinds persist, particularly in major markets...

Read the full narrative on Jones Lang LaSalle (it's free!)

Jones Lang LaSalle's outlook projects $27.7 billion in revenue and $1.0 billion in earnings by 2028. This calls for a 3.9% annual revenue growth rate and a $436 million increase in earnings from the current $563.9 million.

Uncover how Jones Lang LaSalle's forecasts yield a $306.56 fair value, a 10% upside to its current price.

Exploring Other Perspectives

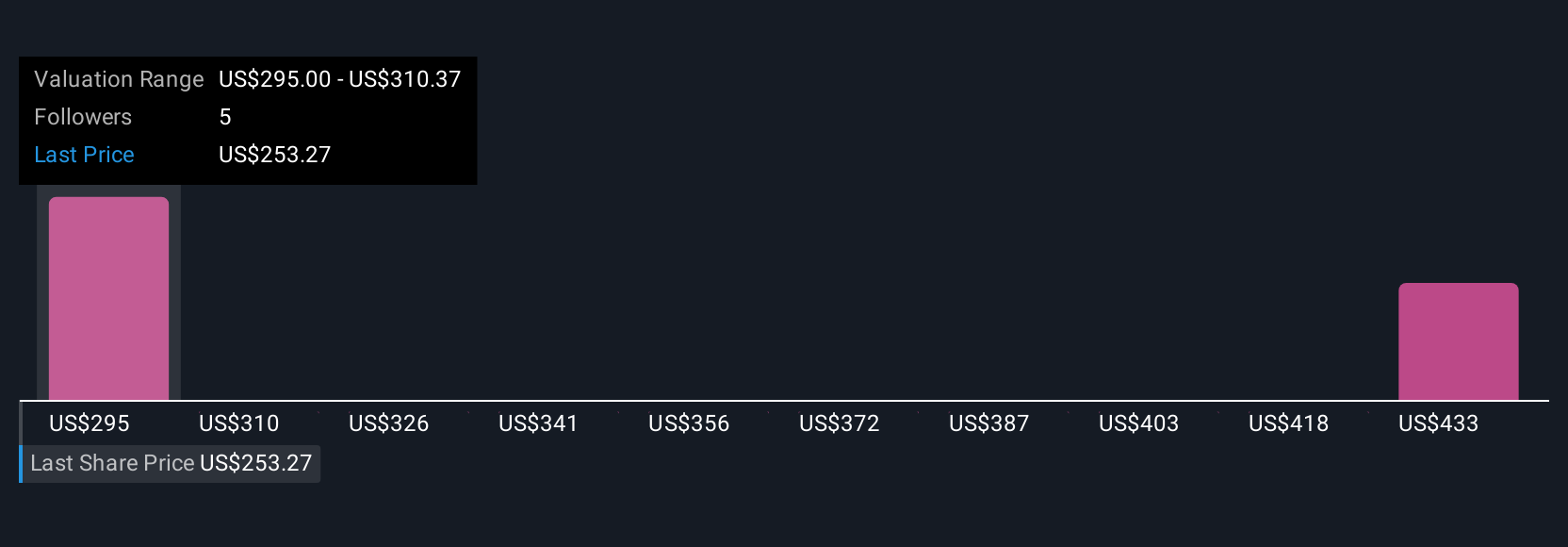

Fair value estimates from two Simply Wall St Community contributors for JLL range from US$306.56 to US$419.04 per share. With improved capital allocation and share buybacks standing out as a key catalyst, exploring these differing opinions can offer broader insights into potential outcomes for JLL’s future performance.

Explore 2 other fair value estimates on Jones Lang LaSalle - why the stock might be worth just $306.56!

Build Your Own Jones Lang LaSalle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jones Lang LaSalle research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Jones Lang LaSalle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jones Lang LaSalle's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal