Did Universal Health Services' (UHS) Earnings Beat and Buybacks Just Shift Its Long-Term Growth Narrative?

- Universal Health Services recently reported strong second quarter results, delivering US$4.28 billion in sales and US$353.22 million in net income, and completed a share repurchase program totaling 41.81 million shares for US$5.61 billion since 2014.

- Insider ownership remains significant at 14%, highlighting continued management alignment with shareholders as the company raises its annual revenue guidance, reflecting confidence in ongoing operational performance.

- We'll now examine how Universal Health Services' robust earnings growth and upward guidance revision could impact its longer-term growth outlook.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Universal Health Services Investment Narrative Recap

To invest in Universal Health Services, you need to trust in the company’s ability to capitalize on sustained demand for healthcare services, balanced by proactive capital management and operational efficiency. The recent upward revision in full-year revenue guidance is a positive signal but does not materially change the key short-term catalyst: ongoing behavioral health expansion. Meanwhile, the risk from looming reductions in Medicaid supplemental payments remains significant, and the latest news does little to offset this fundamental challenge.

The most relevant announcement here is the completion of a major share repurchase program, Universal Health Services has now bought back more than half its outstanding shares since 2014. While this underscores management’s confidence and commitment to shareholder returns, the real focus for investors remains the company’s operational growth initiatives amid a changing reimbursement climate.

However, investors should be aware that despite these positives, the potential for sharp cuts to Medicaid supplement payments could still weigh heavily on future earnings if...

Read the full narrative on Universal Health Services (it's free!)

Universal Health Services is projected to reach $19.0 billion in revenue and $1.5 billion in earnings by 2028. This outlook assumes a 5.0% annual revenue growth rate and a $0.2 billion increase in earnings from the current $1.3 billion.

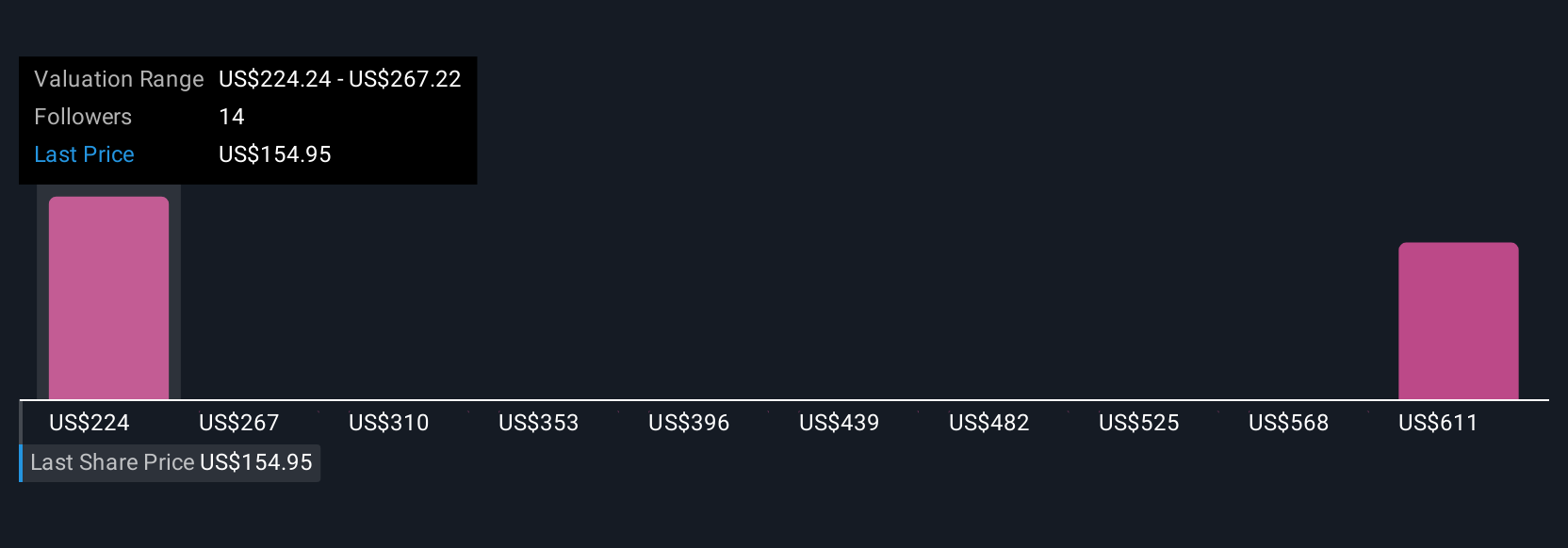

Uncover how Universal Health Services' forecasts yield a $221.44 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range widely, from US$221.44 to US$712.50 per share. While some expect strong healthcare demand to propel the business forward, you should consider how future government reimbursement changes could impact these outlooks and explore several alternative viewpoints.

Explore 3 other fair value estimates on Universal Health Services - why the stock might be worth over 4x more than the current price!

Build Your Own Universal Health Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Universal Health Services research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Universal Health Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Universal Health Services' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal