How SolarEdge's Revenue Beat and Strategic Partnerships Could Shape the SEDG Investment Narrative

- SolarEdge Technologies recently reported second quarter 2025 results, posting revenues of US$289.43 million and a narrower net loss compared to a year prior, while also issuing revenue guidance for the third quarter in the range of US$315 million to US$355 million.

- Alongside these financial updates, the company announced new collaborations in commercial rooftop solar and EV charging infrastructure, reinforcing its focus on product innovation and market expansion.

- We'll examine how SolarEdge's revenue beat and forward-looking guidance signal potential shifts in its investment narrative.

Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

SolarEdge Technologies Investment Narrative Recap

To be a shareholder in SolarEdge Technologies, you need confidence in the company’s ability to execute a turnaround, by restoring revenue growth, improving margins, and capitalizing on shifts in solar and EV charging demand. The recent revenue beat and improved quarter-over-quarter financials address immediate growth catalysts, but do not materially reduce the biggest risk: uncertain demand trends, particularly in the U.S. and Europe, which may still weigh on a full financial recovery in the near term.

Of the recent announcements, the partnership with Solar Landscape stands out as most pertinent, given its potential to expand SolarEdge’s commercial presence in the U.S. rooftop market right as the company seeks to ramp up domestic content and supply chain efficiencies. This aligns directly with the key short-term catalyst of strengthening revenue through new commercial channels, though execution and uptake remain central to watch.

However, investors should not overlook the impact that a prolonged period of weak demand in core markets could have on SolarEdge’s...

Read the full narrative on SolarEdge Technologies (it's free!)

SolarEdge Technologies' outlook anticipates $1.7 billion in revenue and $228.6 million in earnings by 2028. This scenario is based on annual revenue growth of 21.9% and a $1.9 billion increase in earnings from the current level of -$1.7 billion.

Uncover how SolarEdge Technologies' forecasts yield a $19.19 fair value, a 23% downside to its current price.

Exploring Other Perspectives

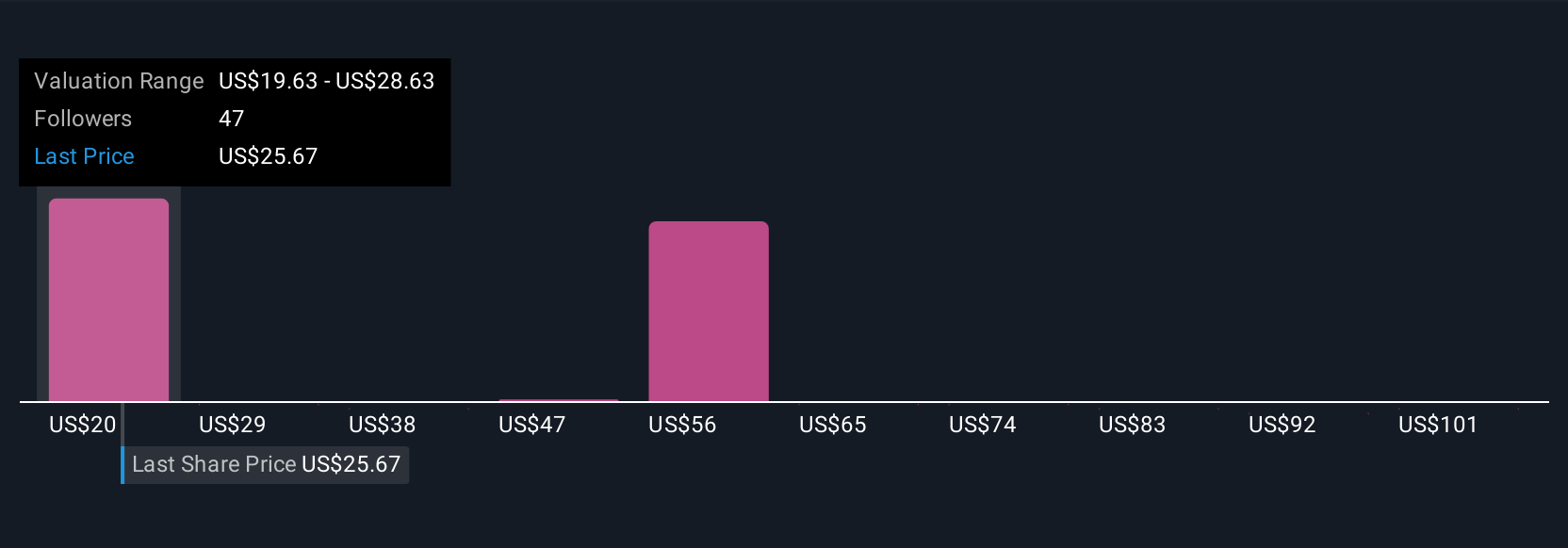

Simply Wall St Community members provided 18 fair value estimates for SolarEdge Technologies, ranging from US$19.19 to US$90.47 per share. While revenue growth ambitions are in focus, the broad spread in valuations highlights just how much opinions differ regarding SolarEdge's path to recovery.

Explore 18 other fair value estimates on SolarEdge Technologies - why the stock might be worth 23% less than the current price!

Build Your Own SolarEdge Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SolarEdge Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SolarEdge Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SolarEdge Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal