Why Bitmine Immersion Technologies (BMNR) Is Up 62.3% After Launching a $1B Buyback and Building a Massive Ethereum Treasury

- Bitmine Immersion Technologies recently announced a share repurchase program of up to US$1 billion and filed a US$1.80 billion shelf registration, while simultaneously building one of the world’s largest corporate Ethereum treasuries with over 833,000 ETH acquired in just over a month.

- This rapid crypto treasury expansion has attracted high-profile institutional interest, including from Bill Miller and Cathie Wood's Ark Invest, highlighting increasing mainstream involvement in digital asset strategies.

- We'll explore how Bitmine’s Ethereum accumulation and growing institutional interest are reshaping the company's investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Bitmine Immersion Technologies' Investment Narrative?

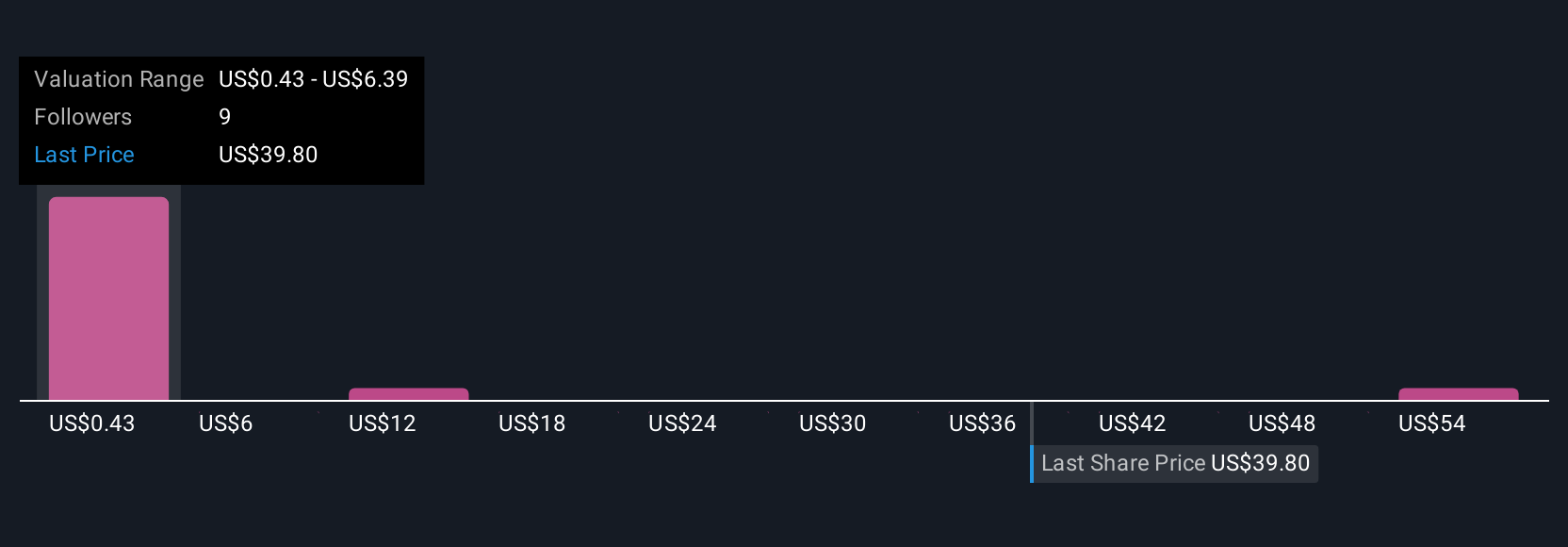

To be a shareholder in Bitmine Immersion Technologies right now, you’d need to believe in the transformational upside of digital assets on corporate balance sheets, particularly Ethereum, and the idea that rapid treasury expansion can create lasting value. Bitmine’s recent moves, a US$1 billion buyback, massive shelf registration, and its rise to the world’s largest listed corporate Ethereum holder, are pushing the stock into the spotlight and drawing interest from major institutions. These are material events, likely to boost the company’s profile and short-term liquidity, and may shift near-term catalysts to headlines and momentum surrounding ETH exposure. Yet, the company is still unprofitable, highly volatile, and valued far above most peers, with significant dilution risk from ongoing capital raises. The new Ethereum treasury focus could amplify both the upside and the risks, calling for careful attention to volatility and the evolving regulatory environment.

But the company’s sharp valuation disconnect, especially after these moves, is crucial for investors to watch.

Exploring Other Perspectives

Explore 11 other fair value estimates on Bitmine Immersion Technologies - why the stock might be worth as much as 17% more than the current price!

Build Your Own Bitmine Immersion Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Bitmine Immersion Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitmine Immersion Technologies' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal